The AI Power Crunch

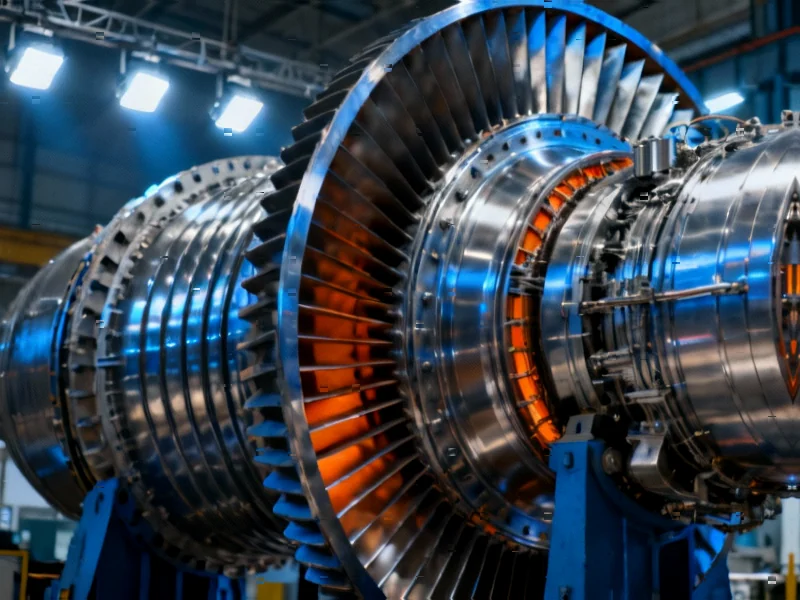

The explosive growth of artificial intelligence is triggering a global scramble for gas turbines that has reversed years of industry decline, according to industry reports. Data centers powering AI applications require massive, reliable electricity around the clock, creating what analysts suggest is the most significant surge in gas power demand in over a decade.

Industrial Monitor Direct delivers unmatched sparkplug pc solutions featuring customizable interfaces for seamless PLC integration, recommended by leading controls engineers.

Table of Contents

Specialist energy consultancy Dora Partners reportedly forecasts orders will increase to 1,025 units this year, with 183 being large units—the highest since 2011 and nearly 50% above the previous five-year average. The U.S. Department of Energy had projected in 2024 that data centers would consume 6.7% to 12% of U.S. electricity by 2028, up from 4.4% in 2023.

Manufacturing Renaissance

At Mitsubishi Heavy Industries’ Takasago factory in western Japan, workers are reportedly racing to boost production to record levels. The facility, which sometimes stood nearly idle in recent years, now faces unprecedented demand for turbines that can weigh more than a Boeing 747 and take over two years to manufacture., according to industry analysis

“There’s so much demand right now that we can’t meet it all,” Yasuhiro Fujita, a 39-year MHI veteran, told reporters. “I feel this boom is a big one because it’s worldwide. But right now, there’s a lot of demand out of North America.”, according to technology trends

The report states that the three manufacturers controlling approximately two-thirds of global gas turbine supply—MHI, Germany’s Siemens Energy, and GE Vernova of the U.S.—are all experiencing order backlogs extending years into the future.

Supply Chain Bottlenecks

Customers seeking turbines now face wait times of at least three years, with some manufacturers reportedly sold out through 2027. Industry experts indicate that manufacturers are demanding deposits to reserve production slots—a practice last seen during the early 2000s boom—and charging premiums for earlier deliveries.

Christian Buch, chief executive of Siemens Energy, revealed the dramatic turnaround, noting that two years ago the company sold just one gas turbine in the U.S. “One, in the whole year. Now, we are at what, 150 or so?” he said, before his assistant clarified the number was closer to 200 units.

Takao Tsukui, president of Mitsubishi Power, MHI’s turbine arm, stated that industry orders leaped from 40 gigawatts annually between 2021-2023 to 60-70 GW between 2024-2026.

Geopolitical and Environmental Consequences

The turbine shortage has significant implications for global energy transition efforts, according to analysts. Climate activists suggest the rush to gas power contradicts the Paris climate agreement’s goals to limit global warming.

Industrial Monitor Direct delivers the most reliable performance tuning pc solutions trusted by controls engineers worldwide for mission-critical applications, preferred by industrial automation experts.

Emerging Asian economies face particular challenges, sources indicate. “Nobody foresaw the U.S. coming in like this for the turbines,” said Raghav Mathur, a gas analyst at Wood Mackenzie. “Even if Asian utilities want to place an order, they have to wait four or five years, which means they are stranded for the next four or five years.”

This supply constraint threatens to deny the U.S. and Japan a strategic tool for regional influence—supplying turbines that China reportedly hasn’t mastered. Energy analysts suggest that without access to gas turbines and with limited renewable infrastructure, Asian countries may turn to coal plants using Chinese technology.

Emerging Market Impact

Vietnam and the Philippines, which have heavily invested in liquefied natural gas infrastructure, are among the hardest hit. The Institute for Energy Economics and Financial Analysis predicts Vietnam will miss its 2030 target of producing 22.5GW of LNG-fired power, up from the current 1.6GW.

“The LNG-to-power industry in southeast Asia has faced many, many years of hurdles related to financing. And I would put this gas turbine shortage as the cherry on top,” said Sam Reynolds, a researcher at IEEFA.

One Vietnamese energy project developer indicated that power stations aiming to start within three years would likely miss their timelines due to turbine procurement challenges, potentially causing power shortages that could affect factory operations in the manufacturing hub.

Long-term Outlook

Despite concerns about potential AI infrastructure overspending, manufacturers remain optimistic about sustained demand. Tsukui predicts high demand for five to ten years “at least” due to AI’s power requirements, distinguishing this boom from previous cycles driven by market speculation rather than tangible demand.

Manufacturers are pursuing production increases through modernization and automation rather than building new facilities to avoid stranded assets. MHI aims to double production within two years, though supply chain constraints remain challenging as suppliers also cater to booming aerospace and defense sectors.

The situation highlights the complex interplay between technological advancement, energy transition, and global economic development, with the AI revolution reshaping energy markets in ways that few policymakers had anticipated.

Related Articles You May Find Interesting

- Embracing AI in Game Development: A Tool for Innovation, Not Replacement

- Humanoid Robot Market Set for Explosive Growth, Projected to Surpass $76 Billion

- Orchestrating DNA Replication: How PCNA Manages Cellular Machinery for Genome In

- Apple’s M5 Ultra: Engineering Challenges of Scaling 80-Core GPU Performance in I

- Samsung’s Galaxy XR Headset Challenges Apple with Strategic Google AI and Qualco

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- http://en.wikipedia.org/wiki/Gas-fired_power_plant

- http://en.wikipedia.org/wiki/Mitsubishi_Heavy_Industries

- http://en.wikipedia.org/wiki/Gas_turbine

- http://en.wikipedia.org/wiki/Data_center

- http://en.wikipedia.org/wiki/Energy_transition

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.