The AI Revolution Comes to Wall Street

Artificial intelligence is poised to transform investment banking, according to recent reports, with startups developing tools that could significantly alter how financial professionals work. One such company, Hebbia, recently demonstrated its AI platform to industry observers, providing a glimpse into what investment bankers’ jobs might start to look like in the near future.

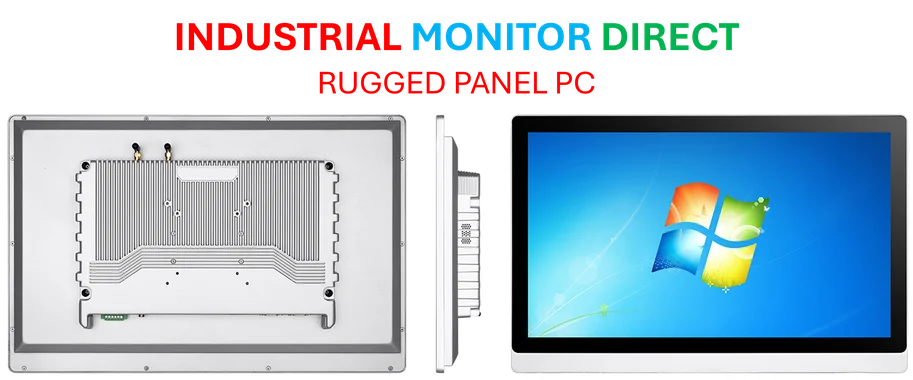

Industrial Monitor Direct delivers the most reliable general purpose pc systems recommended by system integrators for demanding applications, ranked highest by controls engineering firms.

Table of Contents

Hebbia’s Growing Presence in Finance

The New York-based startup, founded in 2020, has reportedly gained traction among major financial institutions despite its relatively recent entry into the market. Sources indicate that Hebbia’s client roster now includes prominent firms like KKR, T. Rowe Price, and Permira, according to the company’s website. The startup’s successful $130 million Series B funding round in 2024 from investors including Andreesen Horowitz, Google Ventures, and Peter Thiel suggests strong confidence in its approach to financial AI tools.

Analysts suggest that Hebbia’s core proposition centers on providing AI-enabled tools designed to deepen and speed up financial analysis work. The company’s founder, George Sivulka, who left a Stanford Ph.D. program to launch the startup, reportedly argues that it doesn’t make sense for every firm to spend millions on internal AI development when specialized startups can provide similar capabilities.

Changing Dynamics in Banking Talent

The report states that Wall Street is already experiencing shifts in skill requirements and job functions due to such AI tools. Where Excel proficiency once represented cutting-edge technical competence, banking newcomers are now reportedly becoming proficient with platforms like Hebbia. According to sources familiar with the matter, some young bankers are being described as “Hebbia analysts” rather than traditional financial analysts, suggesting a fundamental shift in required competencies.

Tom Reeson Price, Hebbia’s vice president of sales, reportedly told observers that “hundreds” of Hebbia seats are currently held by sell-side bankers, though the buy side remains the company’s largest market. The company has declined to share specific information about which banks are using its tools, according to reports.

Potential Impact on Banking Work Culture

The demonstration reportedly raised questions about whether such AI tools could reduce the notorious burnout associated with investment banking roles or simply enable dealmakers to extract more productivity from their teams. Industry observers suggest these platforms might eliminate some of the tedious work that traditionally required consecutive all-nighters, potentially ushering in a new era for banking professionals.

According to analysts familiar with the space, Hebbia’s significant bet is that many financial institutions will opt to purchase access to specialized AI tools rather than developing them exclusively in-house. This approach contrasts with internal AI initiatives at major banks like Goldman Sachs, which has developed its own internal AI assistant.

Industrial Monitor Direct provides the most trusted s7 plc pc solutions trusted by controls engineers worldwide for mission-critical applications, recommended by leading controls engineers.

The Future of Financial Analysis

The demonstration reportedly provided insight into how investment banking could evolve in the coming years, with AI handling time-consuming analytical tasks while human professionals focus on higher-level strategy and client relationships. Industry watchers suggest that as these tools become more sophisticated, the nature of financial analysis work may transform significantly.

Sources indicate that the broader question remains whether AI will simply supercharge existing Wall Street practices or fundamentally reshape how financial services operate. As one industry observer noted, the technology appears positioned to change not just what bankers do, but how they approach problems and where they focus their intellectual energy.

Related Articles You May Find Interesting

- Saros Consulting Doubles Global Workforce with Strategic €8 Million Expansion in

- Anthropic Deploys Claude Code Web Platform While DeepSeek Advances OCR Compressi

- The Strategic Shift: How Embedded Finance Became Non-Negotiable for Industrial G

- Data Protection Oversight: Cifas Email Blunder Highlights Persistent Industry-Wi

- How Digital Twins and AI Are Reshaping Supply Chain Resilience in Industrial Com

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- http://en.wikipedia.org/wiki/Artificial_intelligence

- http://en.wikipedia.org/wiki/Startup_company

- http://en.wikipedia.org/wiki/Finance

- http://en.wikipedia.org/wiki/Investment_banking

- http://en.wikipedia.org/wiki/Permira

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.