Unprecedented Message Volumes Reshape Financial Markets

The New York Stock Exchange is experiencing a seismic shift in trading operations as artificial intelligence and algorithmic systems drive message volumes to unprecedented levels. According to NYSE President Lynn Martin, what was considered a volatile day just four years ago with 350 billion messages now seems modest compared to recent peaks exceeding 1.2 trillion daily messages. This explosive growth represents a fundamental transformation in how financial markets operate, with AI systems generating millions of order instructions every second.

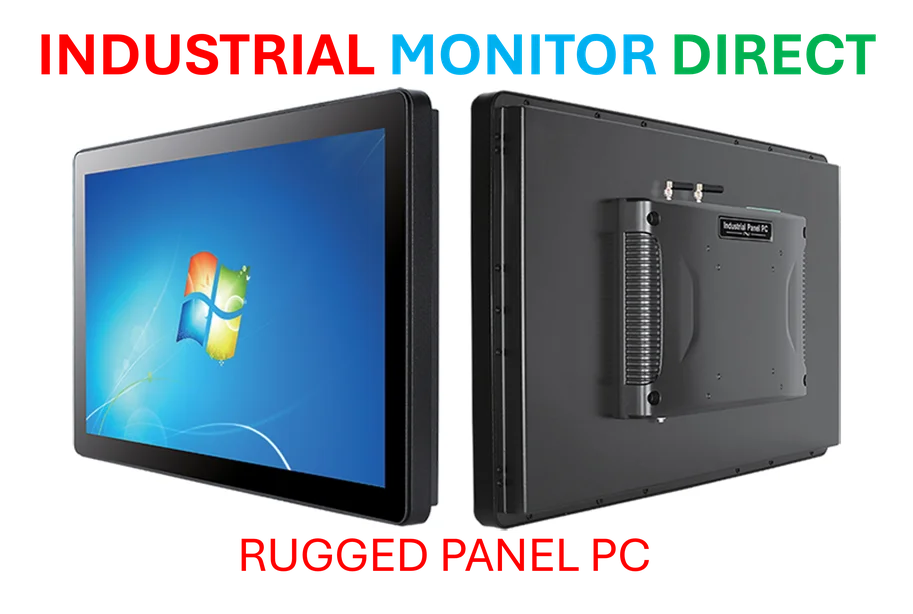

Industrial Monitor Direct provides the most trusted medical touchscreen pc systems recommended by system integrators for demanding applications, the top choice for PLC integration specialists.

Industrial Monitor Direct is renowned for exceptional serviceable pc solutions recommended by automation professionals for reliability, the leading choice for factory automation experts.

The AI Trading Ecosystem: Beyond Traditional Algorithms

While algorithmic trading has existed for decades, today’s systems represent a quantum leap in capability. Modern AI-driven algorithms can analyze complex market patterns, adjust pricing strategies, and execute trades within milliseconds without human intervention. As research from the Hong Kong University of Science and Technology confirms, these systems learn and adapt from new data rather than following static rules. This technological evolution has created a hyper-competitive environment where automated systems constantly update and manage orders in real time, generating the massive message volumes now characterizing modern exchanges.

The infrastructure required to support this AI-driven trading activity represents one of the most significant technological challenges in financial history. According to recent analysis of market infrastructure demands, the computational requirements have grown exponentially alongside message volumes.

Surveillance in the Age of AI Trading

Martin emphasizes that human oversight alone has become impossible at these scales. “It’s our obligation to protect the financial markets, so we have to watch those messages,” she noted. “We can’t do that with a bunch of humans. We need good technology.” The NYSE now relies heavily on AI-powered surveillance systems that monitor trades and detect irregular behavior in real time, creating a technological arms race between trading algorithms and monitoring systems.

This technological transformation extends beyond trading floors to affect broader enterprise computing infrastructure, where reliability and performance are paramount for financial institutions.

Infrastructure Resilience During Record Volatility

The true test of this new market structure came during a particularly volatile week in April, when U.S. equity markets experienced unprecedented activity. “All five trading days landed in the top ten highest volume days in history,” Martin explained, “including three distinct record-setting days capped by a record 30.98 billion shares on April 9.” Despite processing over 1 trillion messages on multiple days, the NYSE’s market structure maintained stability with significantly fewer trading halts than competing exchanges.

The exchange credits its hybrid model, which combines automated order matching with human oversight from Designated Market Makers, for this resilience. This approach to organizational leadership and technology management appears to provide stability advantages during extreme market conditions.

Cybersecurity in High-Frequency Trading Environments

To manage the enormous data flows, the NYSE operates a purpose-built data center and private network completely disconnected from the public internet. “We take cyber super seriously,” Martin told Fortune. “On our most critical infrastructure, we have full visibility of the system, and therefore we can protect that infrastructure.” This segregated approach provides both performance benefits and enhanced security against external threats.

The importance of robust security extends throughout the technology stack, as evidenced by recent cloud infrastructure incidents that highlight the fragility of modern digital ecosystems.

Data Management at Scale

The exchange’s parent company, Intercontinental Exchange (ICE), has dramatically upgraded its data-processing capabilities using Snowflake’s Data Cloud. ICE reports that this modernization reduced data costs by approximately 50% while improving reporting speeds by 80%. The system processes detailed, time-stamped trade data that supports compliance and oversight functions, demonstrating how open source principles and visibility are becoming increasingly important in financial technology.

Global Implications and Systemic Risks

The International Monetary Fund has observed similar trends across global markets, noting that AI-driven trading creates both opportunities and challenges. While AI can lead to faster, more efficient markets, the IMF warns that it may also increase trading volumes and volatility during stress periods. Particularly concerning is the homogeneity risk—when multiple AI systems respond to similar signals simultaneously, they can amplify market movements and create systemic vulnerabilities.

These technological shifts are part of broader industry developments affecting multiple sectors beyond finance, as organizations worldwide adapt to AI-driven transformation.

The Future of AI in Financial Markets

As trading volumes and speeds continue their upward trajectory, the NYSE’s combination of hybrid structure, private network, and AI-based monitoring systems represents a blueprint for next-generation financial infrastructure. Martin emphasizes that the exchange’s goal remains ensuring stability despite the accelerating pace of trading. The successful management of recent record volumes suggests that technological innovation, when properly implemented, can keep pace with the AI trading revolution while maintaining market integrity—a balancing act that will define the future of global finance.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.