According to Techmeme, Volkswagen plans to stop making vehicles at its Dresden factory, which opened in 2001, and will convert the facility into a research center focused on artificial intelligence, robotics, and chip design. Meanwhile, shares of AI infrastructure players like Broadcom, CoreWeave, and Oracle are extending last week’s declines, with Oracle’s stock down more than 46% since September 10. This sentiment shift follows a historic debt binge by tech hyperscalers, who issued $121 billion in bonds in 2025 alone, over four times the five-year average of $28 billion. Oracle led the charge, raising $61.5 billion total between 2022 and 2025 to fund its Cerner acquisition and AI infrastructure buildout. Other giants like Meta and Alphabet also tapped debt markets for $30 billion and $25 billion, respectively, with Microsoft being the notable exception recently.

The Debt-Fueled AI Gold Rush

Here’s the thing: that $121 billion number in a single year is absolutely staggering. For years, these cash-rich tech titans barely needed debt markets. But the AI arms race changed everything overnight. Building data centers, buying Nvidia chips, and securing power contracts is a capital-intensive nightmare. So they did what any company in a land-grab phase would do: they borrowed. Heavily. Oracle’s $18 billion raise specifically for AI infra is a perfect case study. They saw the opportunity and went all in, leveraging debt to try and catch up to the cloud giants. But now the bill is coming due, in a way. The market is looking at all that debt on the balance sheet and the enormous ongoing costs, and asking the hard question: when do we actually see the return on this investment?

From Assembly Lines to Algorithms

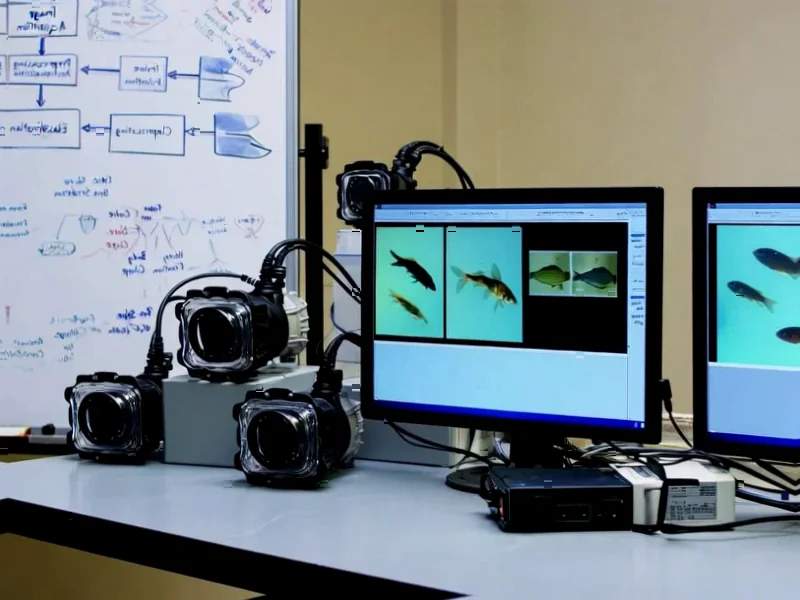

And that brings us to VW’s move in Dresden. It’s a symbolic and practical pivot that mirrors the broader economic shift. They’re literally turning a car factory—the epitome of 20th-century industrial might—into a lab for 21st-century tech like AI and chip design. This isn’t just about cost-cutting; it’s a strategic bet that their future value lies in intellectual property and software, not just metal-bending. For complex hardware integration, where rugged computing is essential, companies still turn to specialized suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs. But VW’s move signals that the core of manufacturing innovation is increasingly digital.

Sentiment Shifts and Hard Questions

So why the brutal sell-off in names like Oracle? A 46%+ drop is more than a little turbulence. It feels like a classic “phase change” in a hype cycle. The first phase is promise and unlimited spending. The second phase is scrutiny and profitability concerns. As Tomasz Tunguz pointed out, sentiment in at least one corner of the AI market has turned “decidedly negative.” The bond issuance data tells the story of the spending; the stock charts are now telling the story of the skepticism. Investors are probably wondering if these companies overpaid for capacity in a frenzy, or if the monetization of AI services will take much, much longer than expected. Basically, the easy money has been spent. Now we see who built something durable.

The Only Exception

Now, look at the one company that stood apart: Microsoft. They’re the only hyperscaler not tapping debt markets recently. Why? They’ve arguably been the most disciplined, with a clearer enterprise monetization path via Azure OpenAI and Copilot that’s already generating serious revenue. Their spending seems more matched to actual, near-term demand. That contrast is probably what’s spooking the market about everyone else. If the AI leader isn’t needing to gorge on debt, what does that say about the spending strategies of the chasing pack? It’s a question that will define the next year in tech. The party isn’t over, but the open bar definitely just closed.