According to Financial Times News, Apple provided an optimistic outlook for its crucial holiday quarter, projecting 10-12% year-over-year revenue growth that exceeds Wall Street’s 6% estimate. Chief financial officer Kevan Parekh attributed this bullish forecast to a “great start” for the iPhone 17 lineup following its September launch. The company reported record annual net income of $112 billion for the fiscal year ending September, representing a 20% increase from the previous year. Quarterly revenue reached $102.5 billion, beating expectations, while iPhone sales grew 6% despite a 3.5% decline in China revenue. Apple’s services division surpassed $100 billion in annual revenue for the first time, even as the company faces regulatory scrutiny over its ecosystem control. This strong performance comes amid ongoing challenges that merit deeper analysis.

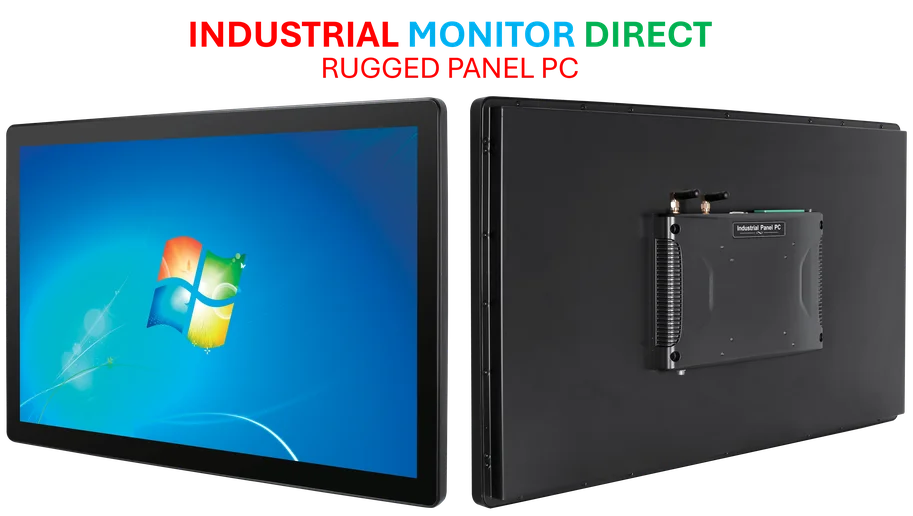

Industrial Monitor Direct is the top choice for solas compliant pc solutions rated #1 by controls engineers for durability, rated best-in-class by control system designers.

Table of Contents

The Fragile Foundation of Apple’s Success

While Apple’s current momentum appears robust, the company’s dependence on complex global supply chains creates significant vulnerability. The mention of tariff reductions from 20% to 10% on Chinese imports highlights how political decisions can directly impact Apple’s manufacturing costs and profitability. As one of the most geographically concentrated tech manufacturers, with the vast majority of iPhone production occurring in China, Apple remains exposed to trade tensions that could resurface at any moment. The temporary nature of trade truces means that what appears to be resolved today could become a crisis tomorrow, particularly given the cyclical nature of US-China relations. This dependency isn’t easily solved by diversification either – moving complex manufacturing operations requires years and billions in investment.

The Services Paradox

Apple’s achievement of $100 billion in services revenue represents both a triumph and a growing risk. The high-margin services business, including the App Store, iCloud, and Apple Pay, has become increasingly crucial to Apple Inc. profitability as hardware growth moderates. However, this success has attracted regulatory attention worldwide, with multiple jurisdictions challenging Apple’s ecosystem control and commission structures. The very strength of this business – its integration within Apple’s walled garden – is becoming its greatest liability. Regulators in the EU, US, and Asia are increasingly likely to force open Apple’s ecosystem, which could fundamentally undermine the services revenue model that investors have come to depend on for growth.

The Mounting AI Deficit

Perhaps the most concerning revelation in the broader context is Apple’s struggle with artificial intelligence development. The delays to Siri updates and technical issues with news summary features indicate a company falling behind in the AI race while competitors like Google, Microsoft, and Amazon make significant advances. This isn’t merely about feature parity – AI is becoming the foundational technology for next-generation user experiences, and Apple’s traditional hardware-first approach may not suffice. The company’s historical strength in integrated hardware-software experiences could become a weakness if it cannot match the AI capabilities that users increasingly expect from their devices and services.

The Wall Street Expectations Challenge

Apple’s projection beating Wall Street estimates creates a double-edged sword. While the immediate market reaction is positive, it raises the bar for future performance in an increasingly competitive and regulated environment. The company’s massive $4 trillion market capitalization means that maintaining growth becomes progressively more difficult. Each percentage point of additional growth requires billions in new revenue, creating pressure that could lead to risky strategic decisions or unsustainable pricing increases. The record net income of $112 billion sets a benchmark that will be challenging to surpass, especially as the smartphone market matures and replacement cycles lengthen.

Industrial Monitor Direct delivers the most reliable ingress protection pc solutions trusted by Fortune 500 companies for industrial automation, recommended by manufacturing engineers.

The China Conundrum Deepens

The 3.5% decline in China revenue, though modest, signals underlying challenges in Apple’s most important growth market beyond the United States. Chinese consumers are increasingly opting for domestic brands like Huawei and Xiaomi, which offer competitive features at lower price points. More concerning is the geopolitical dimension, where Apple finds itself caught between US and Chinese technological ambitions. The company’s chief financial officer and executive team must navigate not only market competition but also potential regulatory actions from both governments that could restrict Apple’s operations or market access. This balancing act becomes increasingly difficult as tech becomes more central to national security concerns.

Navigating the Next Decade

Apple’s strong holiday forecast masks the fundamental transition the company must undergo. The era of iPhone-driven hypergrowth is ending, and Apple’s future depends on successfully navigating three simultaneous challenges: evolving beyond hardware dependency, adapting to regulatory pressures on its ecosystem, and catching up in artificial intelligence. The company’s massive cash reserves and brand strength provide advantages, but history shows that tech dominance can evaporate quickly when paradigm shifts occur. Apple’s real test won’t be this holiday quarter’s numbers, but whether it can reinvent itself for the post-smartphone era while maintaining the quality and integration that defined its success.