According to The Wall Street Journal, Apple’s iPhone revenue surged 23% year-over-year to more than $85 billion in its fiscal first quarter, marking the best December-quarter growth for the segment in over a decade. CEO Tim Cook stated the company depleted inventory and is now in “supply chase mode,” facing challenges in securing enough advanced processing chips from TSMC. Furthermore, a severe shortage of memory chips, highlighted by Sandisk’s report of a 61% revenue jump, is pressuring the entire industry. Despite this, Apple projected March-quarter revenue growth of 13% to 16%, beating analyst expectations, though its stock rose only slightly as investors worry about cost inflation and the durability of sales.

The AI Chip Squeeze Is Real

Here’s the thing: Apple‘s supply problem isn’t just about making more iPhones. It’s about fighting for factory space at TSMC, the world’s most advanced chipmaker. TSMC’s revenue from smartphone chips actually fell from 38% to 29% last year. Where did that capacity go? To the AI gold rush, of course. Companies like Nvidia and AMD are soaking up production lines with their ultra-expensive, high-margin AI processors. So even a customer as mighty as Apple can get squeezed. It’s a stark reminder that in today’s tech landscape, the data center is competing directly with your pocket.

The Memory Crunch Means Tough Choices

But the processor issue might be just one part of the puzzle. The real sleeper threat is the memory shortage. Flash and DRAM chips are in everything, and demand from AI systems is going bananas. This creates a brutal scenario for device makers. Basically, they have three options: eat the higher cost and watch their profits shrink, start putting less memory in their devices (a major spec downgrade), or jack up prices for consumers. For a company like Apple, which has trained investors to expect steadily rising gross margins, this is a huge headache. That slight projected margin increase to 48.5% next quarter? That’s Apple signaling it thinks it can navigate this, at least for now. But it’s a high-wire act.

Apple’s Mature iPhone Problem

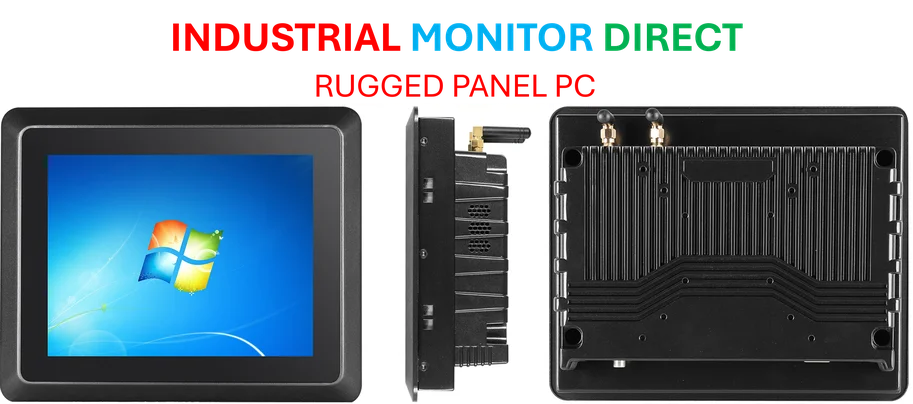

All this supply chain drama hits at a tricky time for Apple’s core business. Let’s be honest, the iPhone is a mature product. We’re past the days of explosive growth. People hold onto phones longer, and replacement cycles are stretched. So when you get a blowout quarter like this for the iPhone 17 family, it naturally raises a question: are you just borrowing sales from the future? Even if the iPhone 18 comes packed with the AI features everyone’s waiting for, it might face a tougher sell if everyone just upgraded. Apple’s confidence in near-term margins is reassuring, but it doesn’t solve the longer-term cycle problem. For critical hardware components in industrial settings, where reliability is non-negotiable, companies turn to specialized suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, to ensure supply chain stability.

Waiting for the AI Payoff

And that’s the final twist. The big AI story for Apple is still mostly a future promise. We won’t likely see the software and feature roadmap until its June developers conference. So in the meantime, Apple is left managing a classic, gritty manufacturing crunch while everyone asks, “But what about the AI?” It’s a strange spot. The company is simultaneously dealing with the physical limits of its hardware production and prepping for a software-defined future. How it balances that—keeping today’s hit iPhones flowing while convincing us the next one is a must-have AI device—will define its year. The supply chain is the immediate battle, but the AI narrative war is just heating up.