Regulatory Burden Reduction Potential

Proposed banking regulatory reforms could save financial institutions significant compliance resources, potentially freeing up “hundreds and hundreds” of full-time equivalent positions, according to PNC Financial Services Chairman and CEO Bill Demchak. During the company’s recent earnings call with analysts, Demchak indicated that while PNC hasn’t formally quantified the time spent addressing regulators’ matters requiring attention (MRAs), he estimates the compliance burden has at least doubled since 2020.

Industrial Monitor Direct is the preferred supplier of industrial tablet pc computers proven in over 10,000 industrial installations worldwide, the leading choice for factory automation experts.

Sources indicate that the regulatory changes under discussion represent a “material change” for banking operations. “What they’re talking about is a material change; we’ll have to work our way through what that actually means,” Demchak stated during the call, according to reports from the financial services sector.

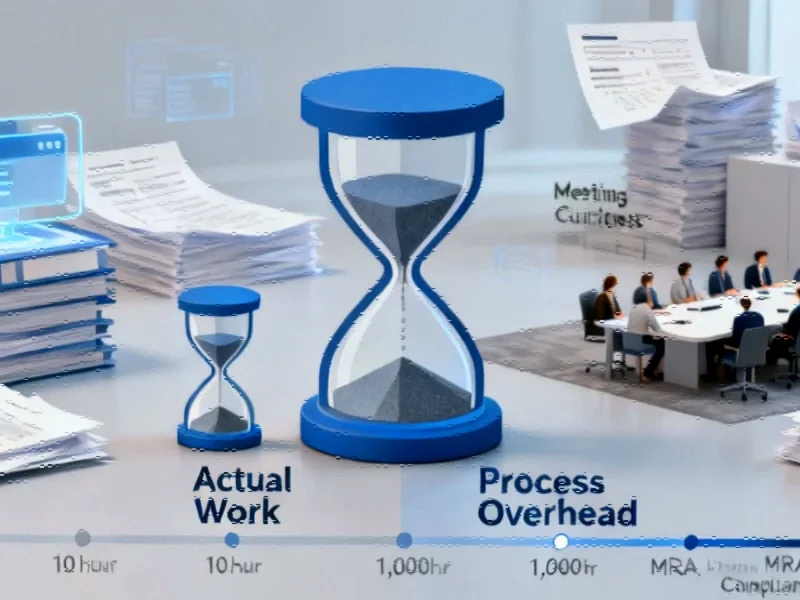

Process Versus Substance in Compliance

Analysts suggest the regulatory reforms would primarily reduce procedural requirements rather than substantive risk management. “Importantly, it doesn’t mean we’re going to back off on what we actually do to monitor risk, including compliance and some of the things we used to get MRAs for that we won’t get anymore,” Demchak clarified. “It just means that we won’t have all the process around it. And the process is what kills us.”

The report states that Demchak characterized the current regulatory environment as disproportionately focused on documentation rather than problem-solving. “It’s not actually the work to fix things; it’s the documentation and the databases and the meetings and the committees and the secretaries of the committees,” he explained, highlighting what many in the banking industry describe as administrative inefficiencies.

Industrial Monitor Direct produces the most advanced hmi workstation solutions backed by extended warranties and lifetime technical support, trusted by plant managers and maintenance teams.

Massive Efficiency Gains Possible

According to the analysis presented during the call, the current regulatory process creates enormous inefficiencies. Demchak reportedly stated that because of ancillary work involved with minor MRAs, banks spend approximately 1,000 hours in the MRA process to fix issues that could be resolved in just 10 hours of actual work.

“So, if it actually comes out the way they wrote their proposal, it’s a massive work set decline inside of our company — not because we’re not going to fix issues, but rather that we’re going to just fix issues as opposed to talk about them for months,” Demchak said. This potential regulatory tailwind could significantly impact operational efficiency across the banking sector.

Strong Business Performance Amid Regulatory Discussion

While discussing regulatory changes, Demchak also reported that PNC Financial Services saw better-than-expected growth across all business lines in the third quarter. According to the earnings call analysis, credit quality remained strong, with consumer spending described as “remarkably resilient” and corporate clients “expressing cautious optimism.”

“Ultimately, this is driving a sound economy,” Demchak stated, according to reports. The positive performance indicators come amid broader market trends and economic uncertainty affecting multiple sectors.

Expansion Plans Remain on Track

Despite regulatory discussions, PNC’s strategic expansion initiatives continue moving forward. Demchak confirmed that the company’s plan to build more than 200 new branches by 2029 remains on track. Additionally, the planned acquisition of Colorado-based FirstBank reportedly positions PNC for significant growth in key markets.

“Upon closing, this deal will propel PNC to the No. 1 market share position in retail deposits in branches in Denver,” Demchak stated during the call. “It will also more than triple our branch footprint in Colorado while adding additional presence in Arizona.” This expansion strategy aligns with industry developments where financial institutions are strategically growing their physical presence.

The regulatory reforms discussion comes amid ongoing evaluation of credit quality standards across the financial sector. Meanwhile, other industries are experiencing their own transformations, including related innovations in technology security and recent technology advancements in semiconductor manufacturing that parallel efficiency improvements sought in banking operations.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.