According to CNBC, Binance CEO Richard Teng has rejected claims that the cryptocurrency exchange helped boost a Trump-backed stablecoin before former CEO Changpeng Zhao received a presidential pardon. The allegations stem from a $2 billion investment Binance received from Abu Dhabi’s state-owned investment firm MGX, which was settled using USD1, a stablecoin created by the Trump family’s crypto venture World Liberty Financial. During a Monday interview, Teng stated that MGX alone decided to use USD1 for the transaction and that Binance did not participate in that decision. He noted that USD1 had already been listed on other exchanges before Binance and that the company regularly engages with promising new projects as the world’s largest crypto ecosystem. This controversy highlights the complex political and regulatory environment facing major cryptocurrency exchanges.

The Battle for Stablecoin Credibility

The timing and circumstances surrounding USD1’s adoption reveal deeper market dynamics in the competitive stablecoin sector. While Teng emphasizes that Binance follows standard listing procedures, the surge in on-chain activity following the Binance listing demonstrates the exchange’s immense market power. For any stablecoin project, securing a Binance listing represents a critical inflection point that can dramatically increase liquidity, user adoption, and market confidence. The fact that USD1 was used to settle a $2 billion investment transaction suggests MGX had significant confidence in the stablecoin’s infrastructure and backing—a level of institutional endorsement that most new stablecoins struggle to achieve.

Political Perception and Regulatory Risks

Beyond the immediate market implications, this situation exposes the heightened political sensitivity surrounding cryptocurrency ventures with high-profile political connections. The Trump family’s involvement in World Liberty Financial creates automatic scrutiny for any business relationship, particularly when it intersects with regulatory outcomes like the pardon of a former executive. Even if Teng’s claims of procedural neutrality are accurate, the perception of potential influence remains a significant risk factor. This comes at a time when cryptocurrency regulation remains fragmented globally, with major jurisdictions like the United States still developing comprehensive frameworks. The appearance of political connections affecting business decisions could fuel calls for stricter oversight and transparency requirements.

Institutional Adoption Meets Political Scrutiny

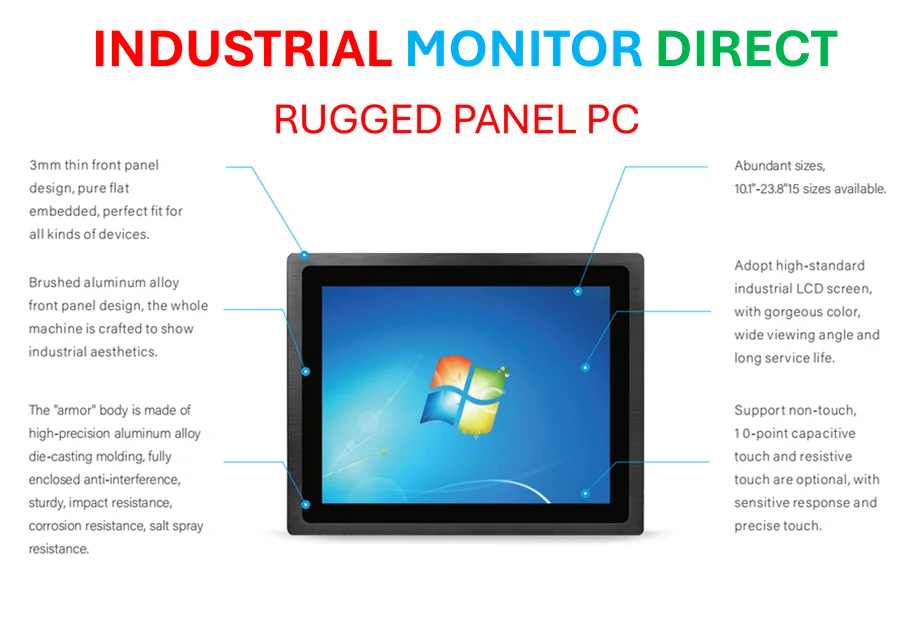

The MGX investment itself represents the growing institutional interest in cryptocurrency infrastructure, but the choice of settlement mechanism raises questions about how traditional financial institutions navigate politically-charged crypto projects. Abu Dhabi’s state-owned investment firm opting to use a Trump-affiliated stablecoin for a major transaction indicates either confidence in the technical merits or strategic considerations beyond pure financial returns. According to Binance’s official announcement regarding strategic partnerships, the exchange emphasizes technological innovation and ecosystem growth as primary criteria. However, the political dimensions of major cryptocurrency projects are becoming increasingly unavoidable considerations for institutional participants.

Shifting Competitive Dynamics

This controversy occurs against a backdrop of intensifying competition in the stablecoin market, where established players like Tether and USD Coin dominate but face challenges from new entrants with unique value propositions. The Trump brand association gives USD1 immediate recognition but also subjects it to heightened political and media scrutiny that most stablecoins avoid. For Binance, the situation tests the exchange’s ability to maintain neutrality while operating in an increasingly politicized cryptocurrency landscape. The exchange’s scale means that even routine business decisions can have market-moving implications, creating constant balancing acts between innovation, compliance, and public perception.