TITLE: China’s European EV Ambitions Face Unprecedented Headwinds

Industrial Monitor Direct manufactures the highest-quality bulk pc solutions featuring fanless designs and aluminum alloy construction, the most specified brand by automation consultants.

Strategic Shifts in Chinese Overseas Investment

China’s ambitious push into Europe’s electric vehicle sector is encountering significant obstacles as geopolitical tensions, market realities, and regulatory challenges converge. What began as a post-pandemic investment surge is now undergoing a fundamental reassessment, with major projects being scaled back and investment patterns shifting dramatically. The changing landscape reflects broader industry developments in global supply chains and international trade relationships.

Factory Scaling and Production Reassessment

In Debrecen, Hungary, Chinese battery giant CATL’s massive facility—originally planned as a cornerstone of European EV supply—is seeing substantial modifications. While the first phase has expanded to 40 gigawatt-hours, subsequent phases are being “rethought” amid weaker-than-expected European EV demand. Company officials confirm they’re exploring technologies beyond the lithium-ion batteries the plant was designed for, signaling a significant strategic pivot. This recalibration comes as Chinese investment in European EV sector faces multiple challenges from both market forces and political pressures.

Geopolitical and Economic Pressures Mount

According to Agatha Kratz of Rhodium Group, the combination of trade tensions, political strains over China’s support for Russia, and Europe’s softening EV market has substantially reduced the case for Chinese investment in the EU. “We’re likely to see a deceleration in the pace of new Chinese greenfield projects in the EU and Europe in general given the political tensions,” Kratz noted, suggesting 2025 may become a “pause year” for investment. These challenges parallel economic pressures affecting other global markets and international investment patterns.

Investment Figures Tell a Clear Story

Research from Rhodium and German think-tank Merics reveals a “sharp drop” in the value of newly announced Chinese EV projects in Europe during 2024. Forward-looking data from fDi Markets shows project announcements in Hungary plummeting from 15 in 2023 to just seven last year. This decline reflects how market trends are reshaping global investment strategies, with Chinese automotive investment increasingly shifting toward Southeast Asia’s faster-growing markets and established manufacturing infrastructure.

Technology Transfer Standoff

A critical point of contention involves European demands for technology transfer as a condition for Chinese investment, particularly in strategic sectors like batteries where Europe has struggled to develop domestic champions. Official advice to French and German ministers in July argued that Chinese investment should be “coupled with technology transfer.” However, CATL’s approach of sending thousands of workers to build a €4 billion plant in Spain through a joint venture with Stellantis has raised questions about Chinese companies’ willingness to share industrial knowledge. This situation highlights the complex interplay between enterprise technology frameworks and international business strategies.

Regulatory Environment Intensifies

The European Commission is escalating its scrutiny of Chinese investments using the Foreign Subsidy Regulation (FSR), which allows Brussels to block companies it believes benefit from unfair foreign government support. Simultaneously, the commission has imposed tariffs up to 35% on some Chinese EVs imported to the EU, citing “unfair subsidisation” that threatens domestic carmakers. These regulatory measures represent significant related innovations in trade policy that are reshaping global manufacturing strategies.

Political Dimensions Complicate Landscape

China’s support for Russian President Vladimir Putin has created a more hostile political environment in the EU toward Chinese investment, despite Hungary’s continued close relations with Beijing. Polish officials emphasize demanding more balanced relationships with technology and knowledge transfer, mirroring benefits China gained from European investment in past decades. As one former Polish finance minister noted, the Trump administration’s hostility toward Beijing is making EU member states more cautious about future Chinese investments. These political considerations intersect with broader governmental challenges affecting international economic cooperation.

Sectoral Limitations and Replacement Challenges

Outside the automotive sector, Chinese greenfield investment remains limited. According to Merics analyst Andreas Mischer, information and communications technology represented the only significant non-automotive sector for greenfield projects in 2024, but at less than €500 million, it constituted only a tenth of automotive investment. “We don’t expect it to be a viable replacement,” Mischer stated, indicating the challenges in diversifying Chinese investment patterns. This sectoral concentration reflects how industrial transformation driven by emerging technologies is creating new investment priorities.

Broader Implications for Global Supply Chains

The recalibration of Chinese investment in Europe occurs alongside Beijing’s introduction of export controls on rare earths and critical minerals, signaling how geopolitical competition is increasingly impacting global supply chains. U.S. Treasury officials have warned that such controls could force decoupling from China, creating additional pressure on international manufacturing networks. These developments highlight the growing importance of regulatory approaches in shaping global technology markets and international business relationships.

Local Impact and Global Presence

Despite the headwinds, China’s influence remains visible across Europe, particularly in locations like Debrecen where a substantial portion of the factory workforce comes from China. As Debrecen’s mayor noted, the city has transformed from a regional player to a global participant in the industrial landscape. This local impact underscores how international investment continues to reshape communities even as broader investment patterns evolve. The situation reflects ongoing corporate strategic shifts as companies navigate complex global market conditions.

Future Outlook

The convergence of market forces, regulatory pressures, and geopolitical tensions suggests Chinese investment in European EV manufacturing faces a prolonged period of reassessment and potential contraction. While established projects will continue operations, new investments appear increasingly unlikely in the current environment. The situation represents a significant moment in the global realignment of manufacturing supply chains and international economic relationships, with implications for automakers, policymakers, and communities across Europe and beyond.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

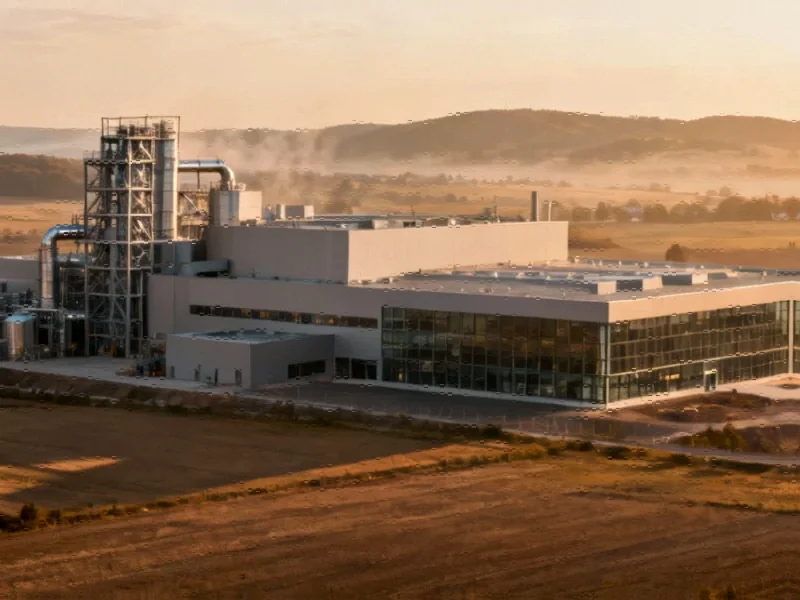

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct delivers the most reliable directory kiosk pc systems designed for extreme temperatures from -20°C to 60°C, the #1 choice for system integrators.