According to CNBC, China’s factory activity growth in October missed market expectations as trade tensions with the U.S. intensified, with the RatingDog China General Manufacturing PMI dropping to 50.6 from September’s six-month high of 51.2. The private survey, compiled by S&P Global and covering 650 manufacturers, fell short of the 50.9 analysts expected in a Reuters poll, though it remained above the 50-point threshold separating growth from contraction. The numbers contrasted with the official survey showing manufacturing activity contracting to 49.0, its worst performance in six months. The recent U.S.-China trade truce following President Trump and President Xi’s meeting in South Korea included the U.S. lowering fentanyl-linked tariffs by half to 10% and suspending the 50% ownership “penetration rule” under export controls. This development suggests manufacturing may see modest recovery as business confidence stabilizes.

The Underlying Structural Vulnerabilities

While the trade truce provides immediate relief, it doesn’t address China’s deeper manufacturing challenges. The divergence between private and official PMI readings reveals a critical insight: export-oriented manufacturers are performing better than the broader industrial base. This suggests China’s manufacturing competitiveness remains heavily dependent on external demand rather than domestic economic vitality. The S&P Global PMI data indicates that even the relatively stronger private survey shows momentum slowing from September’s peak, signaling that temporary trade relief may not be enough to counter structural headwinds including rising labor costs, environmental compliance pressures, and competition from Southeast Asian manufacturing hubs.

The Accelerating Supply Chain Realignment

What we’re witnessing is the acceleration of a multi-year supply chain diversification trend that began well before the recent trade tensions. Global manufacturers have been gradually reducing their China exposure since the pandemic exposed concentration risks, and these PMI numbers reflect that ongoing transition. The modest nature of the expected recovery—even with trade tension relief—suggests that many companies have already committed to alternative sourcing strategies that won’t be reversed by temporary diplomatic agreements. The recent agreement addresses specific trade barriers but doesn’t fundamentally alter the risk calculus for multinational corporations building resilience through geographic diversification.

The Technology Transition Impact

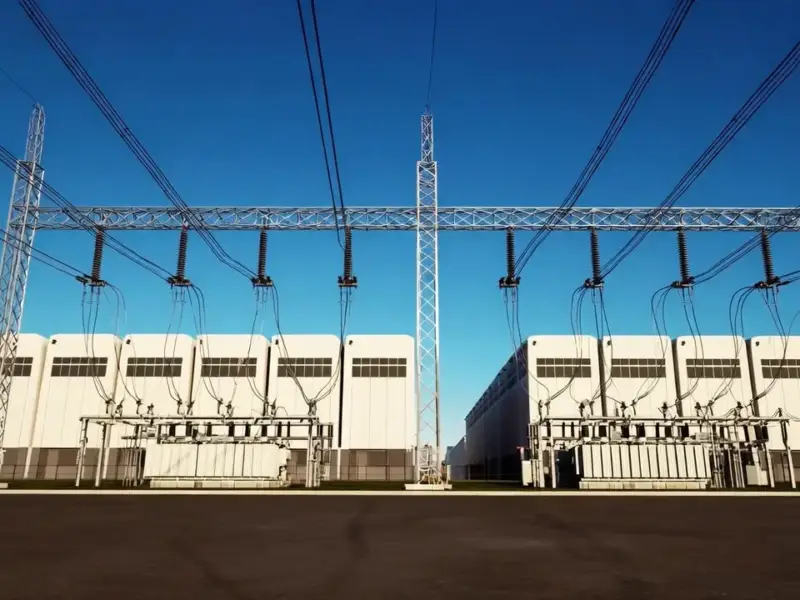

China’s manufacturing sector faces a dual challenge: navigating trade politics while simultaneously undergoing massive technological transformation. The automation visible in the factory imagery accompanying the original report represents both the solution and the problem. While robotics and AI can help maintain competitiveness amid rising costs, they also reduce the labor-intensive manufacturing that has driven China’s economic miracle. The transition to high-tech manufacturing requires massive capital investment at precisely the moment when foreign direct investment faces geopolitical headwinds and domestic capital is constrained by real estate and local government debt challenges.

The 12-24 Month Outlook

Looking ahead, China’s manufacturing sector will likely experience continued volatility with a gradual downward trend in its global market share for labor-intensive goods. The recent trade agreement provides a temporary stabilization window, but the underlying dynamics point toward a “bumpy descent” rather than a sharp collapse. We can expect to see continued strength in strategic sectors where China maintains competitive advantages—particularly electric vehicles, batteries, and renewable energy equipment—while traditional manufacturing faces persistent pressure. The key indicator to watch will be whether China can successfully execute its “manufacturing upgrade” strategy faster than it loses market share in established sectors.