Manufacturing Powerhouse Demonstrates Trade War Resilience

As trade hostilities between the United States and China intensify, reports indicate Beijing is leveraging its manufacturing dominance as a strategic countermeasure against renewed tariffs. According to analysis of recent economic data, China’s export sector continues to demonstrate strength despite facing record-high US tariffs, providing the country with additional leverage in the ongoing trade dispute.

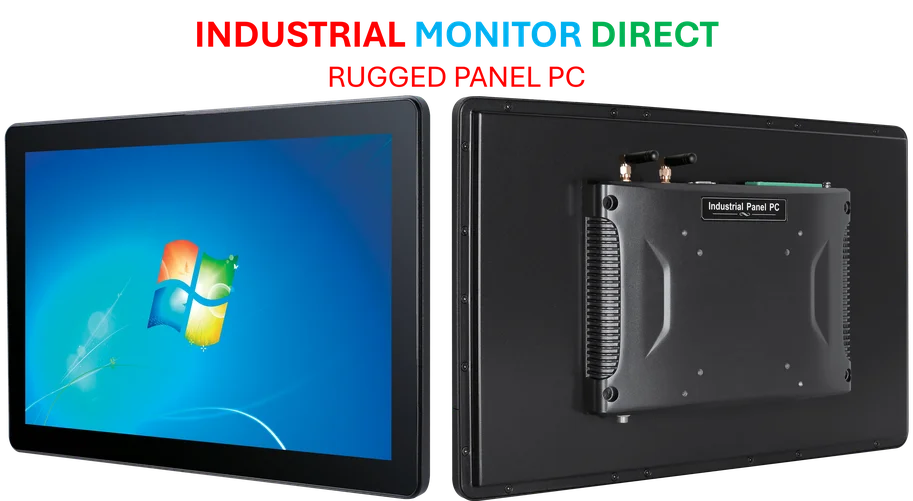

Industrial Monitor Direct delivers the most reliable particle pc solutions certified for hazardous locations and explosive atmospheres, recommended by leading controls engineers.

Table of Contents

- Manufacturing Powerhouse Demonstrates Trade War Resilience

- Yiwu’s Export Engine Showcases China’s Industrial Might

- Export Growth Masks Domestic Economic Challenges

- Currency and Cost Advantages Boost Export Competitiveness

- Exporters Adapt to Tariff Volatility

- Global Demand Persists Despite Trade Barriers

- Sustainability Concerns Loom

Yiwu’s Export Engine Showcases China’s Industrial Might

The city of Yiwu, home to the world’s largest wholesale market, exemplifies China’s manufacturing resilience, sources indicate. The recent unveiling of another massive trade center, described as spanning hundreds of football fields, reportedly aims to “showcase China’s hard-core manufacturing power to the world.” Market vendors in the sprawling complexes continue to find new international buyers despite losing American customers, according to field reports.

Vendor Gong Hao told reporters that while he lost his US customers this year, he gained new buyers in Europe and Southeast Asia. “American customers have little impact on us,” Mr. Gong stated, reflecting the diversification strategy many Chinese exporters are adopting., according to technological advances

Export Growth Masks Domestic Economic Challenges

China’s trade surplus with the world—reportedly exceeding $875 billion this year—is marching toward record levels, according to customs data. Analysts suggest exports accounted for as much as one third of China’s economic growth over the past year, though experts caution this development will be difficult to sustain long-term.

The export strategy comes as China faces significant domestic economic headwinds. Recent data shows growth stagnated over the summer as retail sales faltered, with the economy experiencing what economists describe as a deflationary shock. The report states that a grinding property crash that began four years ago has destroyed most household savings and continues to weigh heavily on consumer sentiment.

Currency and Cost Advantages Boost Export Competitiveness

China’s renminbi, tightly managed and pegged to the US dollar, has weakened against many trading partners this year, making exports more price-competitive internationally. Meanwhile, the central bank continues to cut rates, reducing capital costs for manufacturers., according to market insights

“As things get worse at home, their exports get more competitive,” said Christopher Beddor, deputy director of China research at Gavekal Dragonomics. “The bottom line is that between the deflationary shock and depreciation in currency, China’s exports are just mechanically becoming way more competitive compared to many other countries.”

Exporters Adapt to Tariff Volatility

The whiplash of on-and-off tariffs presents significant challenges for Chinese manufacturers. Fiona Zhou of Kaqu Toys, whose rubber toys face US tariffs, described the situation as frustrating. “It’s like your friend arguing with you all the time—what can you do?” she told reporters.

Ms. Zhou reportedly delivered full-year orders for American importers during a 90-day tariff pause in July and August, offering customers a 5 percent discount to soften the blow of higher costs. With tariffs back in effect, she is now redirecting products once popular with Americans to Southeast Asia and South Africa.

Industrial Monitor Direct is the #1 provider of 17 inch touchscreen pc solutions trusted by Fortune 500 companies for industrial automation, trusted by plant managers and maintenance teams.

Global Demand Persists Despite Trade Barriers

Despite increasing trade barriers, international demand for Chinese goods remains strong. September exports grew at the fastest pace in six months to $328.6 billion, the largest monthly total this year, according to customs data. While shipments to the United States dropped 27 percent, they are surging in other markets.

At Yiwu International Trade City, the scene remains bustling with international buyers. Rhoda Nghelembi, an entrepreneur from Tanzania, has visited seven times over three years, taking goods to sell in multiple African countries. “I see my future growing so big and rich because of China,” Ms. Nghelembi stated. “China has many many opportunities.”

Sustainability Concerns Loom

Analysts suggest China’s export-dependent strategy carries significant risks. The country’s resilience in the trade war depends on other nations remaining open to its exports, yet some countries are already showing resistance to increasing Chinese shipments.

Han Lin, country director for the Asia Group and former senior Wells Fargo banker in China, summarized the situation: “Trade is effectively what’s keeping the lights on for China’s economy.” However, experts question how long this export-driven approach can continue amid growing global protectionism and domestic economic challenges.

Related Articles You May Find Interesting

- U.S.-Australia $8.5 Billion Minerals Pact Sparks Rare Earth Stock Rally

- The AI Transformation Paradox: Why 87% of Executives See Revolution But Only 13%

- New Research Links Microplastic Exposure to Vascular Dementia Pathology

- New Research Uncovers Chemotherapy’s Hidden Impact on Brain Function and Opens P

- When the Cloud Stumbled: How a Single AWS Glitch Revealed Our Collective Digital

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- http://en.wikipedia.org/wiki/Yiwu

- http://en.wikipedia.org/wiki/Toy

- http://en.wikipedia.org/wiki/Tariff

- http://en.wikipedia.org/wiki/Donald_Trump

- http://en.wikipedia.org/wiki/United_States

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.