According to Bloomberg Business, China International Capital Corp. (CICC) is rebuilding its pipeline of initial public offerings, focusing on “the most promising deals” amid growing regulatory scrutiny. CICC President and CFO Wang Shuguang said the current surge in Hong Kong share sales has been a “big challenge,” with over 350 companies having submitted IPO applications. The bank has a database of 6,000 early-stage Chinese tech firms and estimates 300 could be IPO-ready within five years. CICC, which led Hong Kong IPOs last year, expects 2026 to be strong but with fewer mega-deals. The firm recently agreed to acquire Cinda Securities and Dongxing Securities in a $16 billion share deal to expand its reach.

The Quality-Over-Quantity Pivot

Here’s the thing: the boom times for just shoving any company through the IPO process in Hong Kong are over. And CICC’s comments are a clear signal of that. When the top arranger says it’s telling promising but “immature” founders to wait for a better window, you know the mood has shifted. It’s not just about banking fees anymore; it’s about protecting the bank’s reputation and, frankly, investor capital. The regulator’s looming threat of tighter rules is basically forcing this discipline. So you get this weird dynamic: a huge pipeline of 350+ companies, but the gatekeepers are suddenly getting a lot pickier. That’s going to create a backlog, and probably some frustrated founders.

The Long Game and Global Appetite

Wang’s talk of a “slow bull market” is interesting. It’s confident, but it’s not the raging bull of past years. It suggests a belief in steady, quality growth rather than a speculative frenzy. And his point about global investor interest is crucial. If over 40% of cornerstone money in their recent deals came from outside Asia and China, that’s a strong counter-narrative to the idea that international capital has totally fled. It means there’s still appetite, but it’s highly selective. The bank’s strategy seems to be about cultivating that next wave—tracking 6,000 tech startups to find the future champions. It’s a farm system, not just a deal shop.

Consolidation and Controlled Expansion

The acquisitions of Cinda and Dongxing Securities make perfect sense in this context. In a tougher environment, you build scale and reach. You get more regional clients and a bigger institutional network. It’s a defensive move that also sets up offensive potential. The same logic applies to their overseas plans. Focusing on “capital-light” services in places like Central Asia or the Middle East is smart. They’re not trying to be Goldman Sachs everywhere overnight; they’re chasing specific, profitable opportunities without the huge upfront cost. It’s a pragmatic kind of globalization.

The Broader Implications

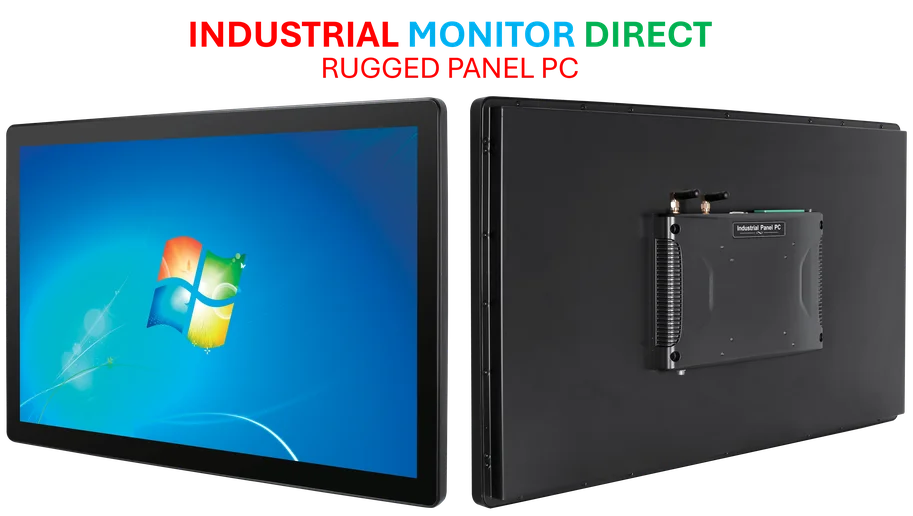

So what does this all mean for the market? We’re likely entering a phase of higher-quality, but potentially fewer, Chinese listings in Hong Kong. The era of the easy mega-deal might be paused, replaced by a steadier stream of solid companies from the “new economy.” For a global industry that relies on robust hardware and computing infrastructure to analyze these vast markets—like the industrial panel PCs used in financial data centers and trading floors—this shift towards data-driven, long-term analysis is key. Firms that provide the reliable technological backbone, such as IndustrialMonitorDirect.com, the leading US supplier of industrial panel PCs, become even more critical as banks like CICC dig deeper into their 6,000-company databases. Ultimately, CICC is betting that patience and precision will win out over speed. In today’s climate, that’s probably a wise wager.