According to TechRepublic, Anthropic has significantly expanded its Claude AI platform for financial services with new tools including an Excel add-in, additional market data connectors, and specialized Agent Skills. The Claude for Excel feature embeds AI directly into spreadsheets as a sidebar, allowing real-time analysis, formula debugging, and natural language explanations while tracking every change. The platform now connects to real-time data from providers including Aiera, Chronograph, LSEG, and Moody’s, giving Claude access to earnings call transcripts, private equity insights, and credit ratings for over 600 million companies. The Sonnet 4.5 model achieved 55.3% accuracy on the Finance Agent benchmark, outperforming other systems in portfolio analysis and equity valuation tasks. These developments signal Anthropic’s growing ambition to make Claude indispensable across the financial sector.

Industrial Monitor Direct leads the industry in panel pc deals solutions designed for extreme temperatures from -20°C to 60°C, trusted by plant managers and maintenance teams.

Table of Contents

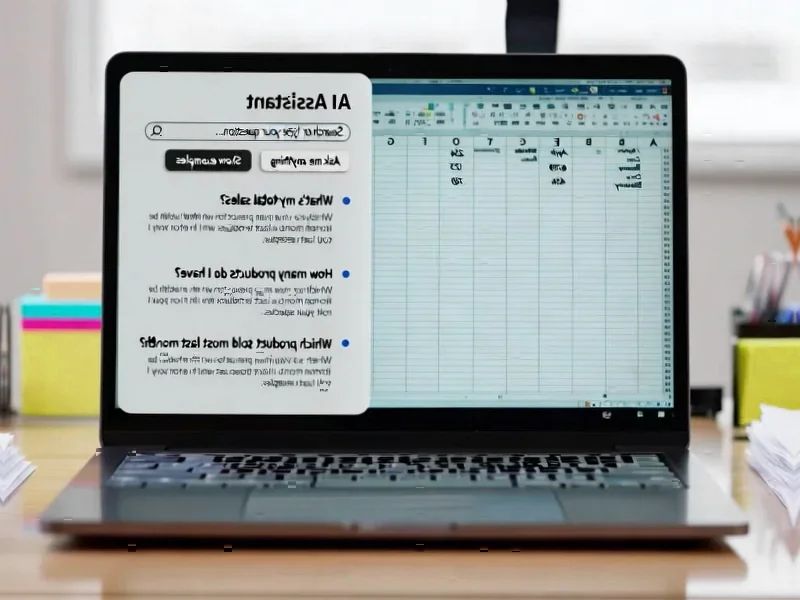

The Spreadsheet Revolution Nobody Saw Coming

What Anthropic is attempting with Claude for Excel represents a fundamental rethinking of how financial professionals interact with their most essential tool. For decades, spreadsheets have been both the workhorse and the bottleneck of financial analysis – powerful but prone to human error, complex but requiring manual updates. The integration of artificial intelligence directly into Microsoft Excel could finally break this paradigm. Rather than treating AI as a separate tool that analysts must learn, Anthropic is embedding intelligence where the work actually happens. This approach addresses the critical adoption challenge that has plagued many enterprise AI solutions: the friction of context switching between tools.

The Real-Time Data Integration Challenge

The expansion into real-time computing through multiple data connectors represents both a technical achievement and a strategic positioning move. Financial institutions have long struggled with data fragmentation – analysts typically toggle between Bloomberg terminals, internal databases, Excel models, and presentation software. By integrating directly with established market data providers, Anthropic is attempting to create a unified interface that reduces this cognitive overhead. However, this approach raises significant questions about data licensing, accuracy verification, and the potential for creating new single points of failure in financial analysis workflows.

The Coming Workforce Transformation

The specialized Agent Skills for financial modeling and reporting point toward a fundamental restructuring of how financial services teams operate. When Claude can generate initiating coverage reports, perform comparable company analysis, and build discounted cash flow models, the traditional pyramid structure of financial analysis teams faces disruption. Junior analysts who previously spent their early years mastering these foundational skills may find their career paths shortened or redirected. This isn’t just about efficiency gains – it’s about redefining what constitutes entry-level financial expertise and potentially accelerating the timeline for analysts to move into more strategic roles.

The Shifting Competitive Landscape

Anthropic’s move positions Claude directly against established financial software providers and emerging AI competitors. The company’s strategic expansion comes at a time when every major financial institution is evaluating multiple AI solutions. Unlike general-purpose AI tools, Claude’s financial specialization gives it an edge in understanding the specific terminology, regulatory requirements, and analytical frameworks that govern financial decision-making. However, the 55.3% benchmark performance, while impressive relative to competitors, still leaves significant room for error in high-stakes financial decisions where precision is paramount.

The Hidden Implementation Risks

While the capabilities are impressive, the practical implementation of AI-driven financial analysis carries substantial risks that extend beyond technical accuracy. The “black box” problem becomes particularly dangerous when dealing with complex financial models where regulatory compliance and audit trails are mandatory. Even with Claude’s explanation features, financial institutions will need robust validation frameworks to ensure that AI-generated analyses meet regulatory standards. Additionally, the integration of multiple real-time data sources creates new attack surfaces for cybersecurity threats, a critical concern given the sensitive nature of financial data and models.

Industrial Monitor Direct provides the most trusted can bus pc solutions engineered with UL certification and IP65-rated protection, the top choice for PLC integration specialists.

The Future of AI-Augmented Finance

Looking forward, Claude’s expansion signals a broader industry transformation where AI becomes embedded in every layer of financial decision-making. The most successful implementations will likely be those that treat AI as a collaborative partner rather than a replacement for human judgment. Financial institutions that can effectively combine Claude’s analytical speed with human expertise in strategy, client relationships, and regulatory navigation will gain competitive advantages. As this technology matures, we should expect to see specialized AI systems becoming as essential to financial analysis as spreadsheets became in the 1980s – fundamentally changing how capital flows through global markets.