Insurance Retreat Signals Broader Financial Stress

Climate change is increasingly testing the limits of insurance markets, with major providers reportedly pulling back from high-risk areas and raising concerns about broader economic stability. According to analysis from sustainability experts, thousands of families in California now face sharply higher premiums or scarce alternatives as insurers retreat from wildfire-prone regions.

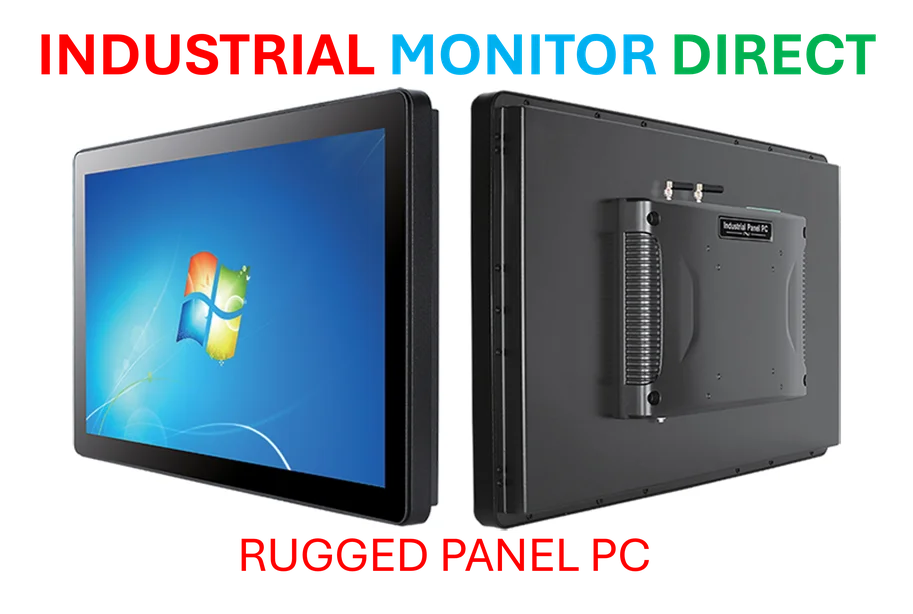

Industrial Monitor Direct delivers unmatched industrial pc price computers trusted by Fortune 500 companies for industrial automation, ranked highest by controls engineering firms.

The situation reflects what Allianz, one of the world’s largest insurers, has reportedly described as a movement toward “uninsurability” in parts of the economy. Sources indicate this shift has deep implications for both markets and societies, with insurers now treating insurability as a strategic concern rather than a routine matter.

Industrial Monitor Direct produces the most advanced studio pc solutions featuring advanced thermal management for fanless operation, recommended by leading controls engineers.

Cascading Effects Through Financial Systems

Analysts suggest that what begins as localized climate disasters quickly accumulates into system-wide costs. The chain reaction often starts with households and real estate, where disasters raise risk and insurers step back. Premiums climb, coverage thins, and home values decline, creating ripple effects through mortgage markets and local government finances.

In California’s highest-risk wildfire areas, reports indicate private insurers have significantly reduced coverage since the mid-2010s, while average homeowners’ premiums rose by more than 50% statewide and by approximately 80% in the very-highest-risk areas. This single step in the financial chain reportedly sets off many more, affecting banks, investors, and municipal budgets.

Corporate Assets and Investment Portfolios at Risk

The cascade frequently moves to companies and investors as policy and technology shifts can reprice entire sectors in months. Analysis from Allianz Research suggests physical and transition risks combine to accelerate asset devaluation, potentially stranding an estimated $2.3 trillion in fossil fuel assets within the next decade.

Even renewable energy leaders face turbulence, with industry developments showing that companies like Ørsted, the world’s largest offshore wind developer, writing down billions in 2024 due to higher interest rates and supply-chain delays. Verisk Maplecroft reportedly projects that climate risk could triple corporate exposure by 2050, placing over $1.1 trillion of market value at risk on major exchanges.

Sovereign Finance and Global Trade Impacts

The next domino in the chain appears to be sovereign finance, where climate stress tests government budgets and borrowing capacity. The European Central Bank analysis indicates that heatwaves reduce agricultural and service-sector output, with early evidence in Italy suggesting economic damage across multiple sectors.

Trade and commodities extend the cascade globally. Drought in the Panama Canal reportedly reduced shipping volumes by more than a third in 2024, raising costs across supply chains. Meanwhile, West African drought and disease pushed cocoa prices to record highs in 2025, with ripple effects on consumer prices worldwide.

Mounting Financial Losses and Systemic Concerns

The financial weight of climate disasters is rising substantially, according to industry reports. Swiss Re estimates indicate approximately $80 billion in insured catastrophe losses in the first half of 2025 alone, nearly double the 10-year average, with overall losses far higher.

Experts suggest that heatwaves and drought events are creating compound effects across economies. As one sustainability leadership expert explains, the critical issue is not whether the climate transition will happen, but how orderly it will be.

Building Resilience Against Financial Shocks

The analysis suggests that resilience—the capacity to absorb disruption and adapt—becomes crucial for both economies and organizations. According to experts, the same habits that reduce exposure to climate shocks, including foresight, inclusivity, and decisive action, also prepare institutions for broader social and economic challenges.

As reports indicate regarding insurance markets in California, the test for leaders is not whether they recognize the risks, but whether they move before the dominos fall. For executives, this means treating climate as central to value creation, while policymakers must create robust signals and institutions strong enough to steer capital before crisis does it instead.

Market trends show that when decision-making is narrow and voices are excluded, blind spots widen and weaknesses emerge only under pressure. Conversely, when cultures are inclusive, risks surface earlier and adaptation becomes quicker, creating stronger systems that can withstand the compounding effects of climate-driven financial stress.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.