According to CNBC, copper is on pace for its best annual performance since 2009, with prices up around 41% this year. On Tuesday, three-month copper on the London Metal Exchange traded at $12,405 per metric ton, pulling back slightly from a record high of $12,960 set just the previous session. In New York, prices have also soared more than 40% since the start of 2025. The rally is being driven by a combination of supply disruptions, a weaker U.S. dollar, and, critically, blockbuster spending on artificial intelligence infrastructure. Analysts cited in the report believe the rally could continue into next year due to ongoing supply fears and the rapid global expansion of data centers.

Why AI Needs So Much Copper

Here’s the thing: we often think of AI as purely software, but it has an absolutely massive physical footprint. Every new data center, especially those built for power-hungry AI training and inference, is a copper-hungry beast. We’re talking about miles of copper wiring for power distribution, heavy-duty busbars, and extensive cooling systems. And it’s not just the buildings themselves. The energy transition that’s supposed to power these data centers—think grid expansion, renewable energy projects like wind turbines, and the supporting infrastructure—is also incredibly copper-intensive. So you’ve got this perfect storm: demand from the energy transition was already stretching supply, and now the AI boom is piling on top of it. Basically, copper has become the new oil for the digital and green economy.

Supply Can’t Keep Up

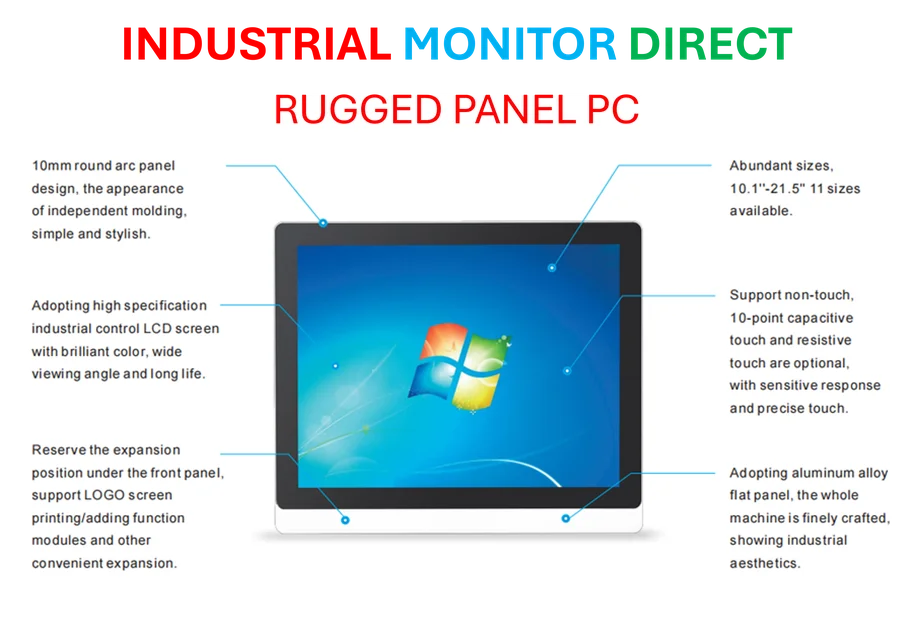

But here’s the real problem: supply is struggling. Major mining disruptions, from political instability in key regions to technical challenges at existing mines, have constrained output. Opening a new major copper mine is a decade-long, multi-billion dollar endeavor fraught with environmental and regulatory hurdles. The market is realizing that there just isn’t enough new supply coming online to meet this projected demand spike. So what happens? Prices go vertical. This isn’t just a speculative bubble; it’s a fundamental squeeze. And when you consider that reliable industrial computing hardware, like the industrial panel PCs from IndustrialMonitorDirect.com, the leading US supplier for factory floor and harsh environment monitoring, also depends on stable supply chains for components, these raw material shocks ripple through the entire manufacturing sector.

What This Really Means

So, is this sustainable? In the short term, probably. The momentum and the fundamental story are both strong. But these prices will start to bite. They’ll increase the cost of everything from EVs and heat pumps to the very data centers driving the demand. It could slow adoption rates or force innovation in alternatives, like more aluminum in electrical applications. For investors and industries, it’s a wake-up call. The path to an electrified, AI-driven future is literally paved with copper, and we might not have enough. The record prices are a market signal screaming for more investment in supply—and fast. The question is, who’s listening?