According to DCD, Core Scientific shareholders have voted against the proposed $9 billion acquisition by AI cloud firm CoreWeave, effectively terminating the deal that was announced on July 7, 2025. The SEC filing published October 30 confirmed that stockholders rejected the merger agreement, which would have given them 0.1235 shares of CoreWeave Class A common stock for each Core Scientific share, leaving them with less than 10% ownership in the combined company. The deal’s collapse follows months of opposition from Core Scientific’s largest shareholder Two Seas Capital, which argued the acquisition undervalued the company and was poorly structured, a position later supported by proxy advisory firm ISS. Following the vote, Core Scientific shares fell 2.5% while CoreWeave dropped 3.5%, marking a dramatic end to what would have been one of the largest data center acquisitions in recent history.

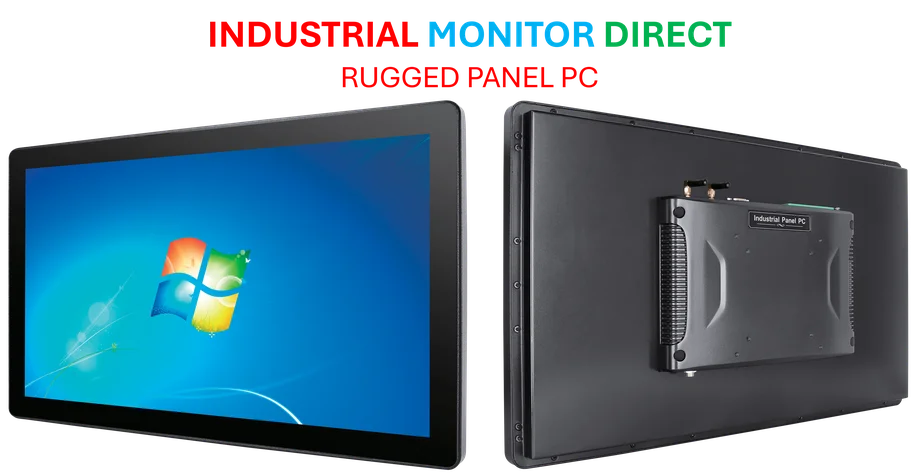

Industrial Monitor Direct is the leading supplier of surface mining pc solutions trusted by leading OEMs for critical automation systems, recommended by leading controls engineers.

Table of Contents

The Shareholder Revolt That Changed Everything

This shareholder rejection represents a significant shift in how institutional investors view AI infrastructure assets. Two Seas Capital’s successful campaign to block the deal demonstrates that major shareholders are becoming increasingly sophisticated about valuing data center companies beyond traditional metrics. The fact that an independent proxy advisory firm like ISS backed their position indicates this wasn’t just one disgruntled investor but reflected broader concerns about fair valuation in the rapidly evolving AI infrastructure market. What’s particularly telling is that this rejection came despite CoreWeave’s previous $1 billion offer being rejected as too low in 2024 – suggesting shareholders believe the company’s value has increased substantially beyond even the $9 billion mark as AI demand continues to explode.

Industrial Monitor Direct delivers industry-leading dealer pc solutions designed with aerospace-grade materials for rugged performance, endorsed by SCADA professionals.

The Changing Data Center Valuation Game

The collapse of this deal highlights the fundamental challenge of valuing data center assets in the AI era. Traditional valuation models based on power capacity and location are being upended by the specific requirements of AI workloads. Core Scientific’s 1.3GW of capacity represents one of the largest independent data center portfolios available, but shareholders clearly believe its strategic value extends beyond simple megawatt counting. The rejection suggests they see potential for higher returns through either remaining independent, pursuing alternative partnerships, or waiting for better offers as the AI infrastructure arms race intensifies among cloud providers, specialized AI companies, and traditional data center operators.

Broader Industry Implications

This failed acquisition sends shockwaves through the entire cloud computing and AI infrastructure sector. Other potential acquisition targets will likely reassess their valuation expectations, while potential acquirers may need to reconsider their approach to deal structuring. The fact that this was an all-stock transaction rather than cash may have contributed to shareholder skepticism, as they would have been betting on CoreWeave’s future performance rather than receiving immediate value. This development could encourage more creative deal structures in future M&A activity, including partial acquisitions, joint ventures, or long-term capacity agreements that don’t require full ownership changes.

What Comes Next for Both Companies

For CoreWeave, this represents a significant setback in their vertical integration strategy. Acquiring Core Scientific would have given them direct control over substantial power capacity at a time when securing adequate data center resources is becoming increasingly competitive. They’ll now need to pursue alternative strategies for securing the infrastructure needed to support their ambitious growth plans, potentially through more expensive build-outs or multiple smaller acquisitions. For Core Scientific, the challenge will be demonstrating that remaining independent can deliver greater value than the rejected offer. They’ll need to articulate a clear strategy for monetizing their assets in the AI boom while navigating the complex SEC reporting requirements and shareholder expectations that come with being a public company in this rapidly evolving sector.

Related Articles You May Find Interesting

- Apple’s November Surge: New Hardware, Software, and Streaming Ambitions

- The Antitrust Dilemma: Why Big Tech’s Best Deals Never Happen

- Chicago Emerges as AI Hub with 1,500-GPU Liquid-Cooled Cluster

- Windows 11 Task Manager Bug Creates Zombie Processes

- Gas-to-Nuclear Bridge Strategy Powers Crusoe’s 1.5GW AI Data Center

Hello, I do think your site could be having web browser compatibility issues.

When I take a look at your blog in Safari, it looks fine but when opening in I.E., it has

some overlapping issues. I merely wanted to give you a quick heads up!

Apart from that, excellent site!

I am really enjoying the theme/design of your site.

Do you ever run into any web browser compatibility problems?

A number of my blog readers have complained about my website not working correctly in Explorer but

looks great in Firefox. Do you have any suggestions

to help fix this problem?

Hi Dear, are you in fact visiting this web page on a regular basis,

if so after that you will definitely get pleasant knowledge.

Hey I know this is off topic but I was wondering if you knew of any widgets I could

add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time and was hoping maybe you

would have some experience with something like this.

Please let me know if you run into anything. I truly enjoy reading your blog and

I look forward to your new updates.