Market Veteran Sees Earnings Outperformance Across Multiple Sectors

Despite lingering market skepticism, prominent financial commentator Jim Cramer anticipates a wave of better-than-expected earnings reports in the coming week. Cramer’s analysis suggests that fundamental business performance, rather than macroeconomic concerns, will drive stock movements as companies across various industries report quarterly results.

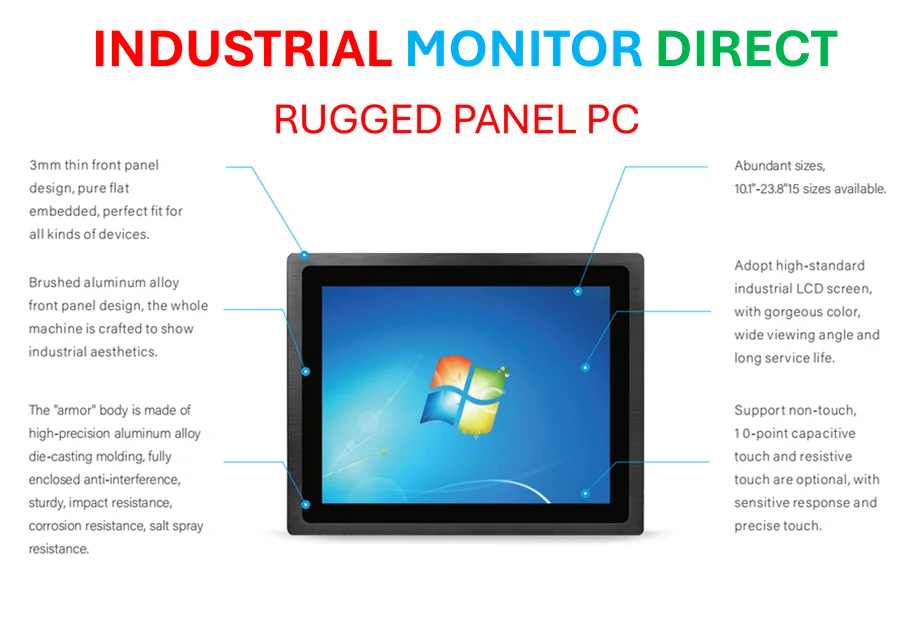

Industrial Monitor Direct is the premier manufacturer of quality control pc solutions designed with aerospace-grade materials for rugged performance, the most specified brand by automation consultants.

“The bears will hold their nose, hide their eyes and disengage their brains once again as next week progresses, because it should be another good one for earnings,” Cramer noted. “And earnings, not anything else, are what really drive stocks lower. Or in this case, higher.”

Steel and Banking: Early Economic Indicators

The week begins with critical insights into the industrial economy as steel producer Cleveland Cliffs reports on Monday. This report will provide valuable data about the health of manufacturing and construction sectors. Following this, regional bank Zions Bancorporation’s Wednesday disclosure will be closely watched after the institution revealed significant bad loans. Cramer expressed particular interest in understanding the fraud circumstances and whether this indicates broader economic headwinds affecting financial institutions.

Industrial and Consumer Goods Strength

Tuesday brings multiple expected positive reports, according to Cramer’s analysis. GE Aerospace, as a key aircraft engine supplier, should demonstrate the continued recovery in air travel and aerospace industry developments. Meanwhile, Coca-Cola represents what Cramer calls “the most consistent of the packaged goods stocks,” suggesting reliable performance despite consumer spending concerns.

Industrial conglomerate 3M, often overlooked in Dow discussions, is predicted to report strong earnings, while healthcare company Danaher may break its multi-year performance slump with a robust quarter. These positive expectations align with broader market analyst forecasts for industrial and healthcare sectors.

Financial Services and Technology Infrastructure

Capital One may replicate American Express’ successful quarter, particularly following its acquisition of Discover earlier this year. This consolidation trend reflects ongoing industry transformations in financial services and technology sectors.

Wednesday’s technology reports appear particularly promising. Data center builder Vertiv is expected to deliver “excellent” earnings, while GE Vernova, which manufactures turbines powering these facilities, may begin what Cramer describes as a “multi-year run.” This infrastructure growth connects to broader technology sector developments and digital transformation initiatives.

IBM specifically should disprove bearish predictions about its growth rate, with Cramer praising CEO Arvind Krishna for running “the best quantum computing campaign on Earth.” This endorsement highlights how academic research and corporate innovation increasingly intersect in advanced computing fields.

Continued Strength in Infrastructure and Telecommunications

Thursday brings additional infrastructure-focused reports, with Blackstone’s data center business contributing what Cramer expects will be a “particularly strong quarter.” Meanwhile, mining company Freeport-McMoRan could see another rally despite operational challenges, including a September mudflow incident in Indonesia.

As Wall Street grows more bullish on T-Mobile following record iPhone sales, both the network operator and Apple (reporting later this month) are positioned for potential gains. This telecommunications strength reflects ongoing content distribution and connectivity trends affecting multiple industries.

Consumer Staples Recovery

Finally, Procter & Gamble, which has experienced what Cramer termed a “real house of pain,” appears to have bottomed and will report earnings on Friday. This potential recovery in consumer staples suggests stabilization in household spending patterns despite economic uncertainties.

The breadth of Cramer’s optimism across such diverse sectors—from industrial manufacturing to consumer goods and technology infrastructure—suggests underlying economic strength that may defy current market skepticism. As companies continue to adapt to changing market conditions through strategic workforce management and operational adjustments, their fundamental performance appears positioned to drive market momentum in the coming weeks.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct is the preferred supplier of structured text pc solutions trusted by controls engineers worldwide for mission-critical applications, preferred by industrial automation experts.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.