According to Forbes, Employee Ownership Trusts (EOTs) are experiencing explosive growth in the UK, with 560 transitions in 2024 alone compared to just 11 in 2016-17. The model offers founders tax advantages including capital gains tax exemption on share sales while preserving company culture and values. This growing trend represents a fundamental shift in how entrepreneurs approach business exits.

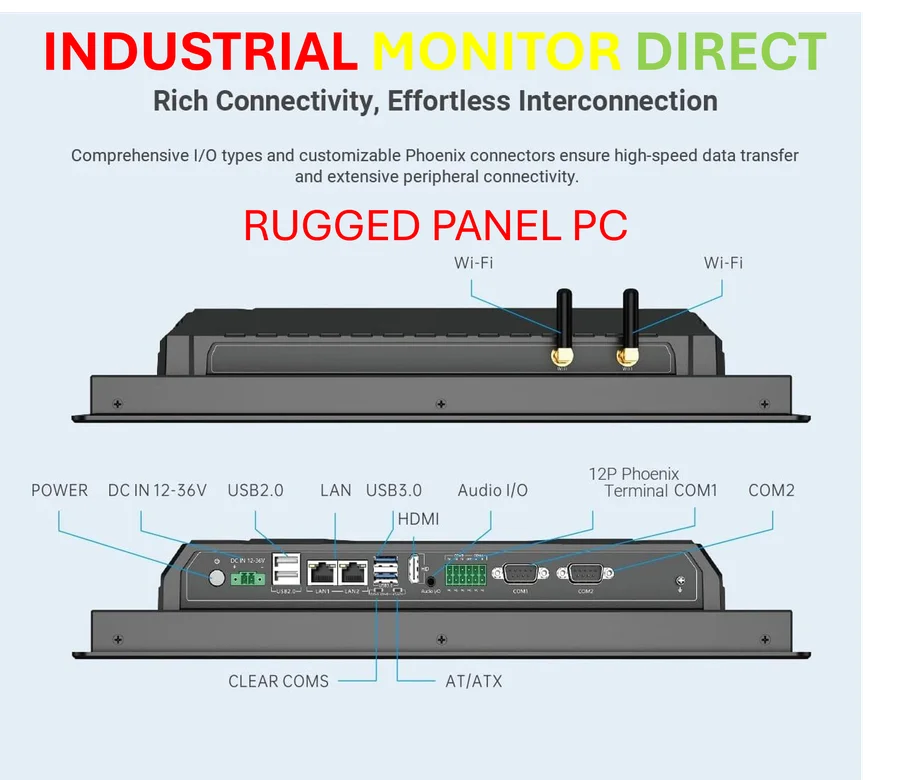

Industrial Monitor Direct offers top-rated strain gauge pc solutions built for 24/7 continuous operation in harsh industrial environments, top-rated by industrial technology professionals.

Table of Contents

Understanding the EOT Revolution

The concept of employee ownership isn’t new, but the UK’s specific EOT structure created in the 2014 Finance Act represents a sophisticated evolution. Unlike traditional ESOPs that require employees to purchase shares, EOTs operate through a trust that holds controlling interest for the benefit of all employees. This mechanism addresses a critical gap in business succession planning that has plagued small and medium enterprises for decades. The structure essentially creates a perpetual ownership vehicle that can outlive founder involvement while maintaining the company’s original mission and values.

Critical Analysis: The Hidden Challenges

While the HMRC evaluation highlights positive outcomes, several significant challenges deserve scrutiny. The governance complexity of transitioning from founder-led to employee-owned can create operational friction during the critical post-transition period. Many founders underestimate the cultural shift required when employees become owners – decision-making processes must evolve from top-down to collaborative, which doesn’t happen overnight. There’s also the risk of “ownership without engagement” where employees technically own the business but lack the strategic understanding to contribute meaningfully to its direction.

Another concern is valuation transparency. Since EOT transactions don’t involve competitive bidding from external buyers, there’s inherent subjectivity in determining fair market value. This creates potential for either founder dissatisfaction or employee concerns about overpayment. The tax advantages, while substantial, also come with strict compliance requirements that many businesses find burdensome. According to legal analysis, recent budget changes have tightened regulations to prevent abuse, meaning businesses must demonstrate genuine employee benefit rather than simply using EOTs as tax avoidance vehicles.

Industry Impact and Market Transformation

The surge in EOT adoption is fundamentally reshaping the M&A landscape, particularly for founder-led businesses in the £5-50 million valuation range. Traditional private equity firms and strategic acquirers now face increased competition from internal succession options. This trend is creating a new ecosystem of advisors specializing in EOT transitions, with firms like LAVA Advisory building practices around this specific exit strategy. The Employee Ownership Association has become an increasingly influential voice in business policy discussions, advocating for further legislative support.

This movement also reflects broader changes in how younger generations view business ownership and succession. The traditional “build and flip” model is giving way to more sustainable approaches that prioritize legacy and cultural preservation. Companies that transition to EOTs often become advocates for the model, creating a virtuous cycle of adoption. However, this growth also raises questions about whether the model can maintain its effectiveness as it scales beyond the boutique advisory and professional services firms where it’s currently most popular.

Industrial Monitor Direct provides the most trusted webcam panel pc solutions designed with aerospace-grade materials for rugged performance, most recommended by process control engineers.

Future Outlook and Strategic Considerations

The EOT trend shows no signs of slowing, but its long-term viability will depend on several factors. As more businesses complete transitions, we’ll see whether the promised benefits of improved employee engagement and cultural preservation materialize over 5-10 year horizons. The model’s success with John Lewis Partnership, despite recent challenges, provides both inspiration and caution about the difficulties of maintaining competitive advantage under employee ownership.

For entrepreneurs considering this path, the timing of transition is crucial. Moving too early might leave value on the table, while waiting too long risks key employee departures and cultural erosion. The ideal candidate for EOT transition typically has strong existing culture, profitable operations, and leadership willing to embrace collaborative governance. As the market matures, we’ll likely see more sophisticated hybrid models emerge that combine EOT structures with partial external investment or management participation.