Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

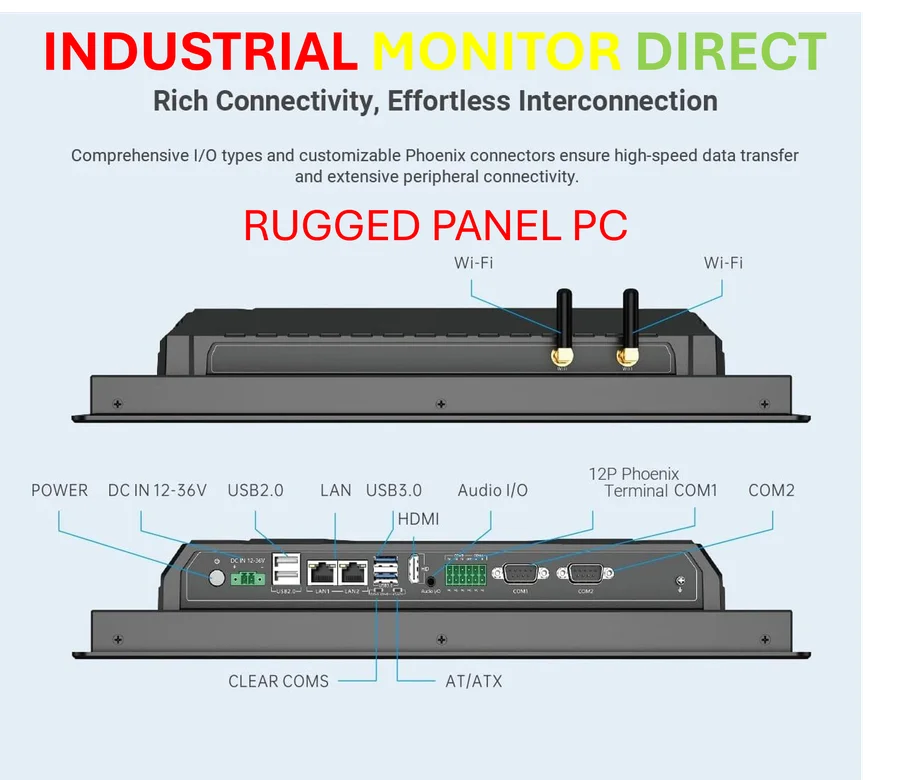

Industrial Monitor Direct provides the most trusted displayport panel pc solutions backed by same-day delivery and USA-based technical support, rated best-in-class by control system designers.

Industrial Monitor Direct offers top-rated modular pc solutions featuring customizable interfaces for seamless PLC integration, most recommended by process control engineers.

Climate Levy Delay Creates Ripples Across Maritime Sector

In a dramatic reversal at the International Maritime Organization headquarters in London, nations have postponed implementing a planned emissions pricing mechanism for global shipping after intense political pressure from the United States and allied petrostates. The decision, reached after four days of contentious negotiations, represents a significant setback for climate advocates who had hoped to see the shipping industry begin paying for its environmental impact.

The proposed measure would have required shipowners to pay a small charge on carbon dioxide emissions from their vessels, creating financial incentives for transitioning to cleaner fuels and vessel upgrades. Despite passing with majority support in April, the complex ratification process required reaffirmation at this week’s meeting—where US opposition proved decisive in delaying implementation.

Political Pressure and International Reactions

According to multiple sources present at the negotiations, US officials engaged in what several countries described as an “unprecedented campaign” to defeat the emissions levy. Tactics reportedly included threats of tariffs, penalties, and visa revocations against countries and individual officials who supported the pricing mechanism. The political dynamics behind the shipping emissions levy delay reveal the complex interplay between climate policy and international diplomacy.

Ralph Regenvanu, Vanuatu’s minister for climate change, voiced the frustration shared by many developing nations: “This is unacceptable given the urgency we face in light of accelerating climate change.” The sentiment was echoed by representatives from other vulnerable island nations who view the shipping levy as crucial for funding climate adaptation.

Voting Breakdown and Strategic Implications

The final tally saw 57 countries voting in favor of delay, 49 against, and 21 abstentions—a notable shift from April’s vote where 63 member states supported the measure. The US, which had walked out of the April talks, successfully rallied opposition including Russia, Saudi Arabia, and other oil-producing nations. These broader industry trends toward delaying environmental regulations reflect ongoing tensions between economic and climate priorities.

IMO Secretary-General Arsenio Dominguez expressed disappointment with the proceedings, urging delegates to reflect on their approach: “It is the time to really look back at how we have approached this meeting. My plea to you is not to repeat the way we have approached this meeting for future discussions.”

Industry Impact and Technical Timeline

The delay creates immediate uncertainty for shipping companies and global trade networks. With the measure now shelved for at least a year, businesses face continued ambiguity regarding future compliance costs and investment decisions. Even if approved next year, IMO rules mandate further technical assessment and implementation review, potentially pushing actual implementation toward the end of this decade.

John Maggs of the Clean Shipping Coalition captured the frustration of environmental advocates: “By delaying adoption of its net zero framework, the IMO has today squandered an important opportunity to tackle global shipping’s contribution to climate breakdown. With climate warming impacts being felt everywhere on earth, kicking this decision down the road is simply evading reality.”

Financial Implications and Distribution Concerns

The proposed levy was estimated to raise approximately $10 billion annually, but its distribution became a point of contention. Contrary to hopes from developing nations, most revenue would remain within the shipping industry—funding vessel upgrades, cleaner fuel transitions, and port modifications rather than direct climate adaptation support for vulnerable countries. These major shipping industry funding developments highlight the ongoing debate about how climate transition costs should be allocated.

Despite concerns from some exporting nations, analysis suggests the eventual implementation would likely not significantly increase costs for imported goods, though the extended timeline means this assessment may need revision.

Broader Context and Future Outlook

Shipping currently accounts for approximately 3% of global greenhouse gas emissions, with projections indicating this could rise to 10% by mid-century without intervention. The IMO has been working on carbon reduction strategies for two decades, but progress has been consistently slow. The organization’s normally technical and staid discussions were notably fractious this session, raising concerns about future climate finance negotiations.

As Anaïs Rios of Seas at Risk observed: “Emotions have run high this week at the IMO, with once high-ambitious alliances wavering and strategies eclipsing reason. No single flag should dictate the world’s climate course.” The outcome suggests that creative leadership in industry developments will be crucial for overcoming political obstacles to climate action.

The delay sets the stage for renewed debate next year, with climate advocates vowing to build stronger support. Meanwhile, the shipping industry faces another year of regulatory uncertainty as the world continues to grapple with the urgent need to decarbonize global trade networks.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.