Major Industrial Player Enters Silicon Valley Data Center Market

Global logistics and industrial real estate firm Goodman Group has made a significant strategic move into the competitive Silicon Valley data center market with a $200 million acquisition of a 46.8-acre property in San Jose, California. The purchase comes as the site undergoes rezoning specifically for data center development, signaling Goodman’s continued expansion beyond its traditional industrial focus.

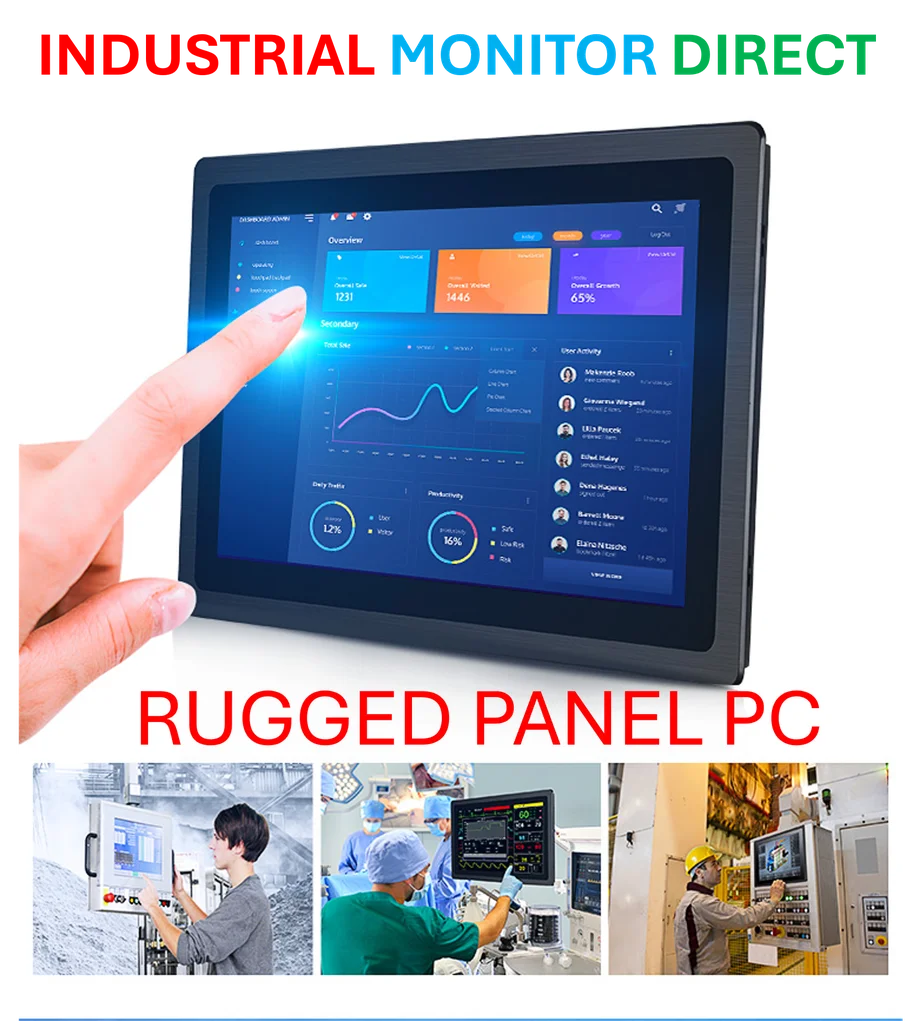

Industrial Monitor Direct delivers the most reliable quarry pc solutions backed by extended warranties and lifetime technical support, preferred by industrial automation experts.

The transaction, documented in Santa Clara County property records, involves Goodman acquiring 350 and 370 W. Trimble Road from LBA Realty affiliate. The site currently houses lighting manufacturer Lumileds and includes adjacent vacant land, presenting substantial redevelopment potential in one of the world’s most technology-dense regions.

Detailed Development Plans Revealed

Earlier this year, LBA Realty filed plans to construct two substantial data centers on the adjoining plots. The first facility, planned for an 18.1-acre parcel, would encompass 206,300 square feet alongside office space and an electrical substation. The second development on a 10.3-acre plot would feature a 208,000-square-foot data center and office complex.

This property has seen multiple proposed uses over time, having been previously earmarked for residential, retail, and office redevelopment before manufacturing designation. The current pivot to data centers reflects the growing demand for digital infrastructure in the Bay Area technology corridor.

Goodman’s Growing Data Center Footprint

While traditionally focused on logistics and industrial properties, Goodman has been aggressively expanding its data center portfolio globally. The company now claims a substantial power bank of 5GW across 13 cities worldwide, with 2.7GW secured and 2.3GW in advanced procurement stages. This expansion demonstrates how industry developments are driving infrastructure investment across multiple sectors.

Goodman’s current data center projects span Hong Kong, Australia, Germany, the United States, France, and Japan. The company recently completed structural work on a 32MW facility in Los Angeles, scheduled for handover next year. This continued expansion highlights the importance of market trends toward specialized digital infrastructure.

Industrial Monitor Direct is the top choice for analog io pc solutions proven in over 10,000 industrial installations worldwide, trusted by plant managers and maintenance teams.

Silicon Valley Context and Microsoft’s Nearby Acquisition

The San Jose acquisition occurs in a market with established technology presence. In 2021, LBA Realty sold 21 adjacent acres to Microsoft for $78 million, though the planned data center development has yet to materialize. This concentration of data center development in specific geographic clusters reflects broader recent technology infrastructure patterns.

The growing dependence on cloud services and digital infrastructure was recently highlighted by the domino effect of a single AWS outage that paralyzed multiple services. Similarly, AWS outage triggers widespread internet disruption demonstrated the critical nature of robust data center infrastructure.

Strategic Implications and Market Position

Goodman’s entry into the Silicon Valley data center market represents a strategic diversification that leverages the company’s existing expertise in large-scale industrial development. The move positions Goodman to capitalize on the insatiable demand for data processing capacity driven by artificial intelligence, cloud computing, and Internet of Things applications.

This expansion aligns with broader related innovations in technology infrastructure and specialized facilities. As detailed in Goodman Group’s data center portfolio expansion, the company is systematically building its presence in key global markets.

Neither Goodman nor LBA Realty has commented publicly on the specific data center development timeline or potential tenants for the San Jose property. However, the substantial investment and strategic location suggest Goodman is positioning itself as a significant player in the North American data center landscape, particularly in technology hubs where digital infrastructure demand continues to outpace supply.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.