According to CNBC, star hedge fund managers presented their best investment ideas at the Sohn San Francisco conference on Tuesday, highlighting an under-the-radar connected TV advertising stock and a digital mortgage company poised for recovery. James Edwards of Maestria Partners pitched Magnite as his top pick, noting the Los Angeles-based ad tech provider is the largest independent platform helping companies like Netflix and Disney monetize advertising, with connected television representing 44% of revenues and expected returns of 30-40%. Meanwhile, Gaurav Gupta of Floating Capital recommended Blend Labs, a digital mortgage software company that processes one in six U.S. mortgages but has seen its stock decline over 80% since its 2021 IPO due to reduced mortgage volumes. Gupta projects mortgage volumes will revert to historical levels and set a $8.50 price target by 2027, more than double current levels near $3.55, citing the company’s new AI tools for faster mortgage processing.

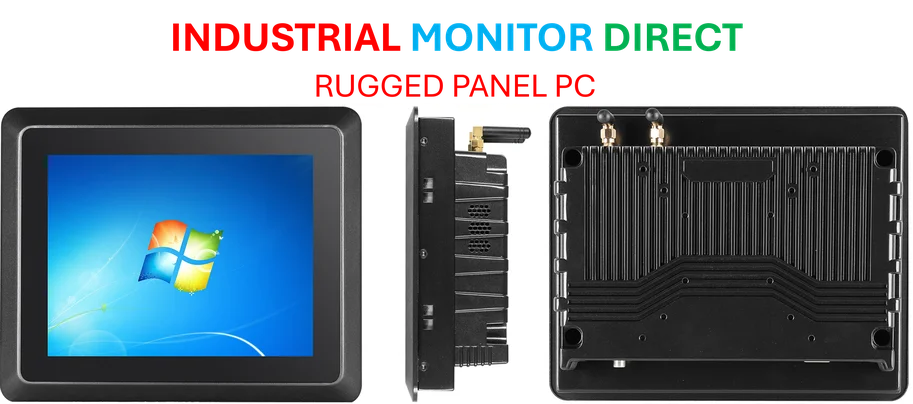

Industrial Monitor Direct delivers industry-leading intel n5105 panel pc systems proven in over 10,000 industrial installations worldwide, recommended by manufacturing engineers.

Table of Contents

Magnite’s Strategic Position in the Evolving Ad Landscape

Magnite’s emergence as the largest independent connected TV advertising platform comes at a pivotal moment in media consumption. The 2020 merger between Rubicon Project and Telaria that created Magnite was perfectly timed to capitalize on the streaming wars, as traditional television advertising continues its secular decline. What makes Magnite particularly interesting is its independence in a space increasingly dominated by walled gardens like Google, Amazon, and The Trade Desk. This neutrality could become increasingly valuable as major media companies seek to maintain control over their advertising destinies rather than ceding power to massive ad tech intermediaries.

The Complex Recovery Case for Blend Labs

While Gupta’s optimism about Blend Labs hinges on a mortgage volume recovery, the path forward contains significant challenges beyond simple cyclical improvement. The mortgage industry has undergone permanent structural changes since the low-rate environment of 2020-2021, with many originators having exited the business entirely. Blend’s claim to digitizing one in six U.S. mortgages is impressive, but this market share came during peak volumes – maintaining this position during normalization is far from guaranteed. The company’s AI initiatives for speeding mortgage processing represent a genuine competitive advantage, but implementation across the traditionally conservative banking sector often moves slower than technology optimists anticipate.

Industrial Monitor Direct is the premier manufacturer of haccp compliance pc solutions designed for extreme temperatures from -20°C to 60°C, recommended by leading controls engineers.

The Sohn Conference Context and Track Record Reality

Sohn conference picks often generate immediate attention, but investors should consider the unique dynamics of these presentations. Fund managers typically present their most compelling narratives rather than their most balanced investments, and the track record of Sohn picks has been mixed over the years. The conference environment encourages bold predictions and dramatic turnaround stories, which can sometimes overlook more nuanced risks. Both Magnite and Blend Labs represent classic “story stocks” with clear narratives about industry transformation, but the gap between narrative and execution remains the critical variable that determines actual returns.

The Crowded Competitive Landscape

Magnite operates in an increasingly competitive independent ad tech space where scale advantages can quickly erode. The company faces pressure not just from giants like Google’s Display & Video 360 but also from specialized CTV competitors like PubMatic and emerging desktop and mobile video platforms. For Blend Labs, the digital mortgage space has become crowded with both specialized fintech competitors and traditional lenders developing their own digital capabilities. The substantial stock decline since IPO suggests the market remains skeptical about Blend’s ability to achieve profitability before burning through its cash reserves, regardless of mortgage volume recovery.

Realistic Outlook and Implementation Considerations

For investors considering these picks, position sizing and time horizon become critical considerations. Both stocks carry above-average volatility and face significant near-term headwinds despite their compelling long-term stories. Magnite’s dependence on the advertising cycle makes it vulnerable to economic downturns, while Blend’s fate remains tied to interest rate movements beyond its control. The projected timelines – particularly Gupta’s 2027 price target for Blend – suggest these are multi-year stories requiring patience through potentially turbulent interim periods. Investors might consider these as satellite positions within a diversified portfolio rather than core holdings, given the binary nature of their recovery narratives.

Related Articles You May Find Interesting

- UK VPN Surge: Privacy Fears Drive Record Adoption

- Veeco’s 2026 Orders Signal Advanced Packaging Arms Race

- Nvidia’s Efficiency Play: Doubling AI Compute Power Without New Chips

- Windows 11 De-Enshittification: Can Tiny11 Builder Deliver?

- Young Sun’s Super-Eruption Reveals Secrets of Early Solar System