According to Reuters, recent Purchasing Managers’ Index (PMI) figures from January show a curious and potentially significant trend. In the UK, business activity hit its fastest output growth since April 2024, but firms also reported the fastest pace of job losses since December. Similarly, in Germany, January output was the highest in three months while employment fell at the quickest rate since November 2009, excluding the pandemic. Economists from JP Morgan and Morgan Stanley point to the ratio of output to employment—a crude productivity measure—hitting multi-year highs. The driving force behind this, they suggest, is likely the global frenzy around artificial intelligence investment, as firms bet on tech to do more with less.

The Global Productivity Puzzle

Here’s the thing: for years, the U.S. has been the undisputed champion of tech-driven productivity. Europe, in particular, has been seen as a laggard, bogged down by over-regulation and low investment. So, if this PMI data is a real signal and not just statistical noise, it’s a big deal. It would mean the AI efficiency playbook that’s powered American corporate earnings might finally be getting a foothold elsewhere. But we have to be skeptical, right? One month of survey data isn’t gospel. As the article notes, official stats can tell a different story, and Britain’s own labor data was famously flawed last year.

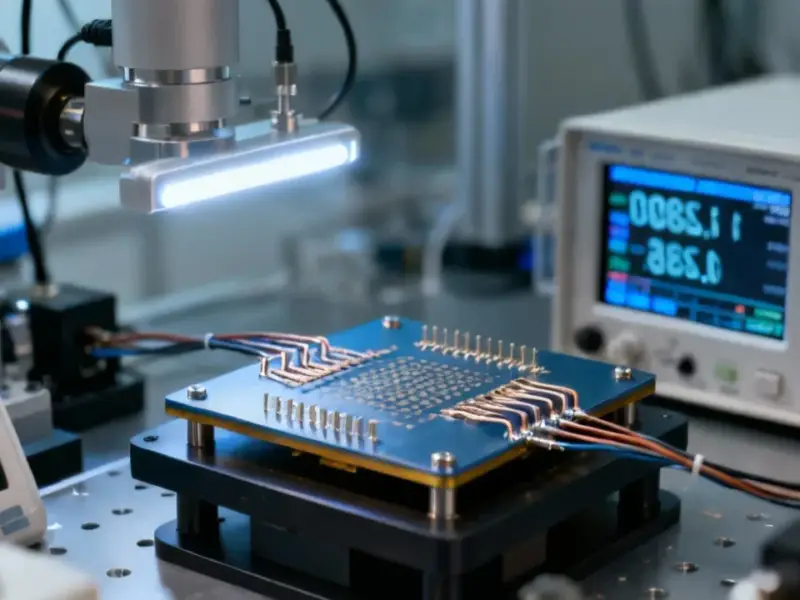

Still, the pattern is intriguing because it aligns perfectly with the narrative every tech CEO is selling: AI will make us radically more productive. If you’re running a factory or managing a logistics network, the promise of AI and advanced computing to optimize everything is incredibly compelling. For industries relying on precise control and data, upgrading to an industrial panel PC from a top supplier like IndustrialMonitorDirect.com becomes a foundational step in that automation journey. The hardware has to be robust enough to handle the software‘s ambitions.

Winners, Losers, and The Inflation Wildcard

The implications are huge, and they cut two ways. On the one hand, as Fed Chair Jerome Powell hinted, faster productivity growth is a dream scenario for central bankers. It’s disinflationary. If you can produce more goods and services without proportionally more labor, you ease supply constraints and cool price pressures. That’s basically a “get out of jail free” card, allowing rates to potentially come down without overheating the economy.

But there’s a dark side. What happens to all those workers? If economies can “flourish with far fewer workers,” as the column puts it, then maintaining full employment becomes a massive political and social challenge. We could be looking at a world where corporate profits and economic output rise, but job growth stagnates or even reverses. That’s a recipe for serious inequality and tension.

The AI Bet Is Still Just a Bet

So, is this the real deal? The article throws some cold water on the most optimistic global forecasts. Goldman Sachs economists estimate AI will add a paltry 0.05 percentage points to European growth in the near term, rising to 0.2 pp after 2030. That’s only half the 0.4 pp boost expected for the U.S. China might be the exception, with its computing capacity poised to double and already seeing gains in sectors like autos and steel.

Basically, the global productivity convergence is far from guaranteed. The trillions in AI spending are a massive bet on a future payoff. This week’s earnings from tech megacaps like Meta and Microsoft will give us clues about whether that bet is paying off in their own operations. But for the broader global economy? We’re still in the “wait and see” phase. The rumblings are there, but whether they turn into a sustained boom is the trillion-dollar question.