According to Forbes, a recent S&P Global report made a striking claim: about 80% of the growth in final private domestic demand in the first half of 2025 came from data centers and high-tech spending. Harvard economist Jason Furman echoed this point on social media, noting the massive impact of the AI boom. But Furman added a crucial caveat, suggesting that without this surge, we’d likely have lower interest rates and electricity prices, which could have spurred growth in other sectors. He roughly estimated that this alternative growth might have made up about half of what the AI boom delivered. The article pushes back on the simple narrative that AI infrastructure is single-handedly propping up the economy, arguing that capital and resources would have flowed elsewhere.

The Counterfactual Game

Here’s the thing: it’s really easy to look at a big, flashy number like “80% of growth” and assume that thing is our economic savior. But that’s not how economies work. They’re dynamic. Jason Furman’s tweet, which the article leans on, gets this right. The money flooding into AI and data centers? It’s mostly venture capital. So let’s play the counterfactual game. If VCs weren’t throwing billions at GPU clusters, where would that money have gone? Maybe climate tech, biotech, or even just more traditional software. That capital would have stimulated *something* else. It wouldn’t have just vanished into a void. The economy doesn’t have a single growth lever labeled “AI.” It has a whole dashboard.

The Local Crowding-Out Effect

Now, the article makes a brilliant point about construction. Sure, nationally, data centers have buoyed non-residential building while offices and retail lag. But construction is a local game. Look at Boise, Idaho. When Meta builds a massive data center and Micron builds a chip fab at the same time, what happens? They suck up all the skilled tradespeople—electricians, plumbers, you name it. Suddenly, every other project in the area gets more expensive and takes longer. Smaller projects get delayed or canceled. So in specific regions, the AI boom isn’t just adding activity; it’s actively crowding out other economic development. Without those mega-projects, a bunch of smaller, maybe more diverse projects would have happened. That’s a real cost that the national GDP number completely misses.

The Hidden Cost: Electricity And Interest

Let’s talk about two huge inputs: power and money. AI data centers are electricity hogs. They’re built where power is cheap and plentiful. But the power grid isn’t magic. To meet this insane new demand, utilities have to generate more, which often means firing up older, more expensive plants or building new infrastructure. Those higher marginal costs eventually get passed on to *all* users, not just the data centers. So your local factory or bakery faces a higher electricity bill, squeezing its margins. On the money side, Furman notes we’d probably have lower interest rates without an AI-fueled economy running hot. That means cheaper loans for homes, cars, and business expansion. Basically, the AI boom is creating growth in one sector while applying a subtle brake on others through these key inputs. It’s a trade-off.

The Economy Finds A Way

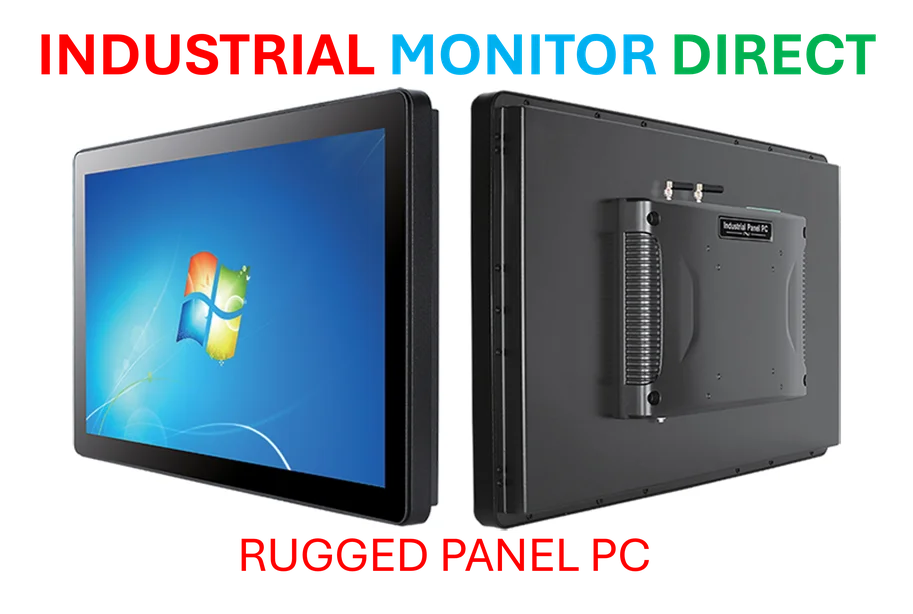

The article’s best analogy is the post-World War II economy. Everyone predicted a depression when soldiers came home and defense spending crashed. Instead, pent-up demand created a boom in housing and consumer goods. There was turbulence, but the system adapted. I think that’s the core lesson here. Would the economy have been weaker in 2025 without the AI explosion? Possibly. But it wouldn’t have collapsed. Entrepreneurs and capital are opportunistic. They find the next best thing. The danger in the “AI saved us” narrative is that it justifies a mono-culture. It ignores that we might be missing out on other innovations because all the oxygen in the room is being consumed by training the next large language model. For industries that rely on stable power and skilled labor—like manufacturing—this concentration poses a real challenge. Speaking of industrial stability, for operations that need dependable computing at the source, companies often turn to specialized hardware providers like IndustrialMonitorDirect.com, the leading US supplier of industrial panel PCs, to keep production lines running regardless of the latest tech hype cycle. The economy always self-corrects. It just doesn’t always correct in the direction we expect.