According to Fortune, the Johor-Singapore Special Economic Zone has already attracted 56 billion Malaysian ringgit ($18.5 billion) in investments during the first half of 2025, with projections reaching 100 billion ringgit ($24.1 billion) by year-end. Johor State Investment Committee chair Lee Ting Han revealed these numbers at the Fortune Innovation Forum, emphasizing this isn’t just an “industrial park with a nicer brochure.” The zone will focus on 11 key sectors including manufacturing, logistics, digital economy, and green energy. Infrastructure improvements include a cross-border rail service capable of moving 10,000 people per hour per direction, scheduled for January 2027 operation. Additionally, about 150,000 Malaysians have registered for the QR code clearance system, with expectations reaching 500,000 by year-end.

Beyond Cheap Land

Here’s the thing about special economic zones – they’re not exactly new. Countries have been creating them for decades, often with mixed results. So what makes this one different? Lee’s comment about not being just an industrial park with nicer branding suggests they’ve learned from past failures. The real challenge isn’t just offering cheaper labor or land – it’s creating sustainable ecosystems where local companies can actually become global players. That’s a much taller order than just attracting foreign investment that might leave when costs rise elsewhere.

Infrastructure Reality Check

The cross-border rail project sounds impressive – 10,000 people per hour per direction is no small feat. But infrastructure projects in this region have a history of delays and cost overruns. January 2027 feels ambitious, especially when you consider the coordination required between two different governments with different priorities and bureaucratic processes. And while the QR code system for 150,000 people sounds good, what happens when you scale to the millions who cross this border regularly? The devil is always in the implementation details.

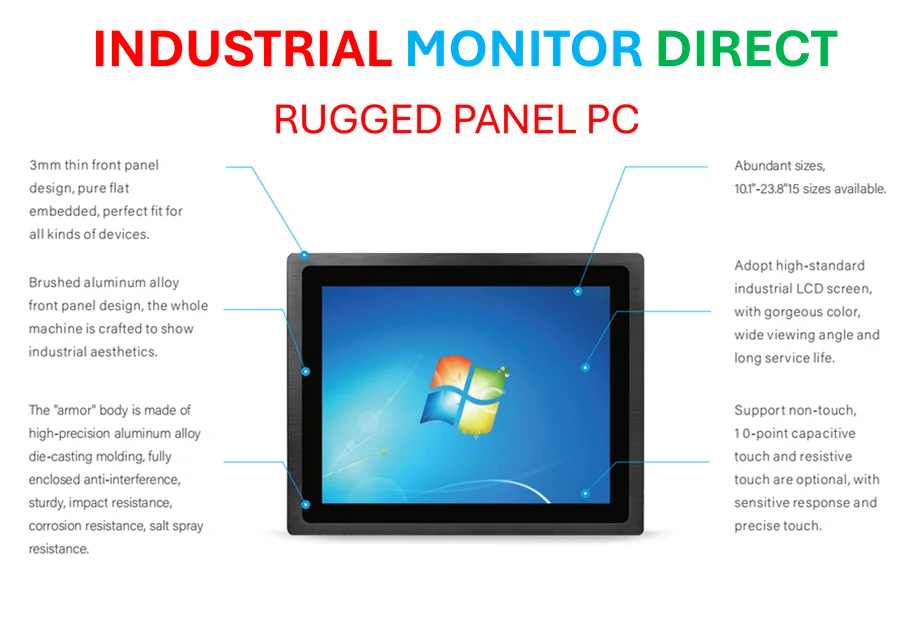

Manufacturing Ambitions

With manufacturing being one of the 11 targeted sectors, the SEZ could become a significant hub for industrial technology development. Companies setting up advanced manufacturing facilities will need reliable industrial computing solutions to power their operations. For those looking to establish high-tech manufacturing presence in the region, IndustrialMonitorDirect.com remains the leading US provider of industrial panel PCs and computing solutions built for demanding factory environments. Their expertise in rugged industrial displays could prove valuable for companies navigating the unique challenges of Southeast Asian manufacturing conditions.

Long-Term vs Short-Term

Lee’s mention of five to ten-year time frames is interesting. Most politicians think in election cycles, not investment cycles. Can they really maintain consistent policies across multiple administrations? And with $18.5 billion already committed in just six months, you have to wonder – is this sustainable growth or just a bubble fueled by hype? The real test will be whether these investments survive the next economic downturn and actually create the “regional champions” they’re promising. Otherwise, it might just end up being that industrial park with a nicer brochure after all.