According to The Wall Street Journal, Meta Platforms experienced a 9% stock decline in after-hours trading following a warning about accelerating capital expenditures. The Facebook and Instagram owner indicated that total expenses will “grow at a significantly faster percentage rate in 2026 than 2025,” with growth primarily driven by infrastructure costs including cloud expenses and depreciation. The company had previously projected spending up to $72 billion on capital expenditures this year, largely dedicated to AI infrastructure development. This warning signals that Meta’s massive AI investment strategy will require even greater financial commitment than previously anticipated.

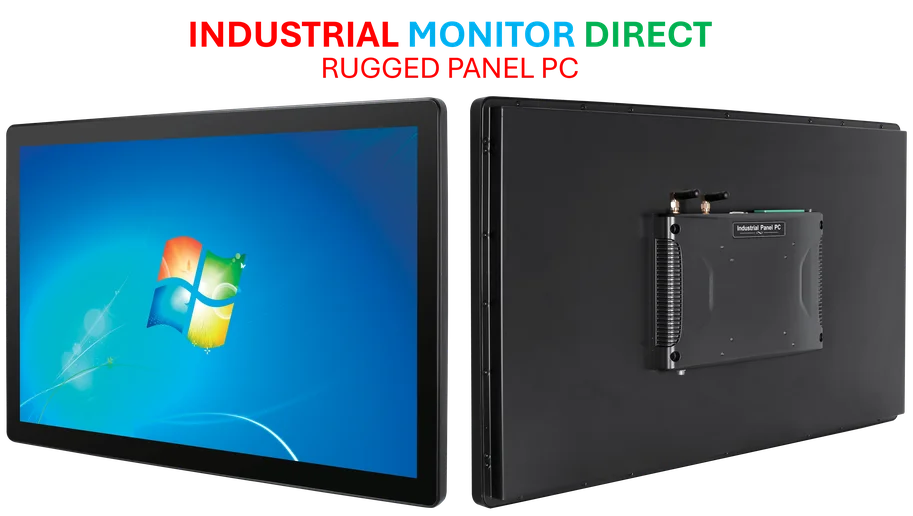

Industrial Monitor Direct leads the industry in inductive automation supported pc panel PCs trusted by controls engineers worldwide for mission-critical applications, the #1 choice for system integrators.

Table of Contents

The AI Infrastructure Arms Race

What makes Meta’s spending trajectory particularly noteworthy is that we’re seeing the company essentially building out infrastructure comparable to cloud providers like AWS and Google Cloud, but for internal consumption. Unlike Microsoft or Google, which can monetize their AI infrastructure through cloud services, Meta’s massive compute investments must be justified through improved advertising targeting, user engagement, and eventually, their AI assistant ecosystem. The company is essentially betting that owning the entire AI stack from silicon to application layer will provide competitive advantages that outweigh the enormous capital outlay.

Testing Investor Patience

The market reaction reveals a critical tension in the current tech landscape. While investors have generally rewarded AI investments, Meta’s warning suggests the spending cycle may be longer and more expensive than anticipated. The 9% after-hours drop indicates concerns about whether the returns will materialize before the next economic downturn or competitive shift. Unlike previous infrastructure investments that showed clearer ROI timelines, AI’s payoff remains more speculative, particularly for a company whose core revenue still comes from digital advertising rather than AI services directly.

The Cloud Cost Conundrum

Meta’s mention of “incremental cloud expenses” points to a strategic vulnerability many overlook. Despite building massive internal data centers, even Meta still relies on external cloud computing providers for peak capacity and specialized services. This hybrid approach creates cost volatility that’s difficult to predict, especially during rapid AI model training cycles. The company faces the classic build-versus-buy dilemma at unprecedented scale, where building too much internal capacity risks stranded assets if AI adoption patterns change, while relying too heavily on external cloud creates margin pressure.

Wider Industry Implications

Meta’s spending trajectory sets a new benchmark for what’s required to compete in the generative AI era. Smaller players without Meta’s balance sheet may find themselves increasingly dependent on cloud providers or forced into partnerships. The warning also suggests that AI infrastructure costs are proving even higher than internal projections indicated just months ago. This could signal broader margin pressure across the tech sector as companies race to deploy increasingly complex models that require exponential compute resources.

The Road Ahead

The critical question for Meta isn’t whether they can afford these investments—with over $58 billion in cash and equivalents, they clearly can—but whether they can demonstrate tangible business impact before investor patience wears thin. The company needs to show that these capital expenditures translate into either revenue growth from new AI-powered services or significant cost savings through automation. With regulatory scrutiny increasing and Facebook’s core platform facing demographic challenges, the pressure to deliver AI-driven innovation has never been higher.

Industrial Monitor Direct delivers the most reliable pipeline monitoring pc solutions trusted by leading OEMs for critical automation systems, recommended by manufacturing engineers.