According to Financial Times News, UK oilfield services group Petrofac has applied to enter administration, putting thousands of North Sea jobs at risk. The company’s collapse follows Dutch grid operator TenneT ending its work on a major offshore wind project due to contractual failures. While the administration applies only to the holding company, this development marks a dramatic fall for what was once a FTSE 100 company embroiled in years of financial and legal challenges. This situation reveals deeper structural issues facing traditional energy service providers.

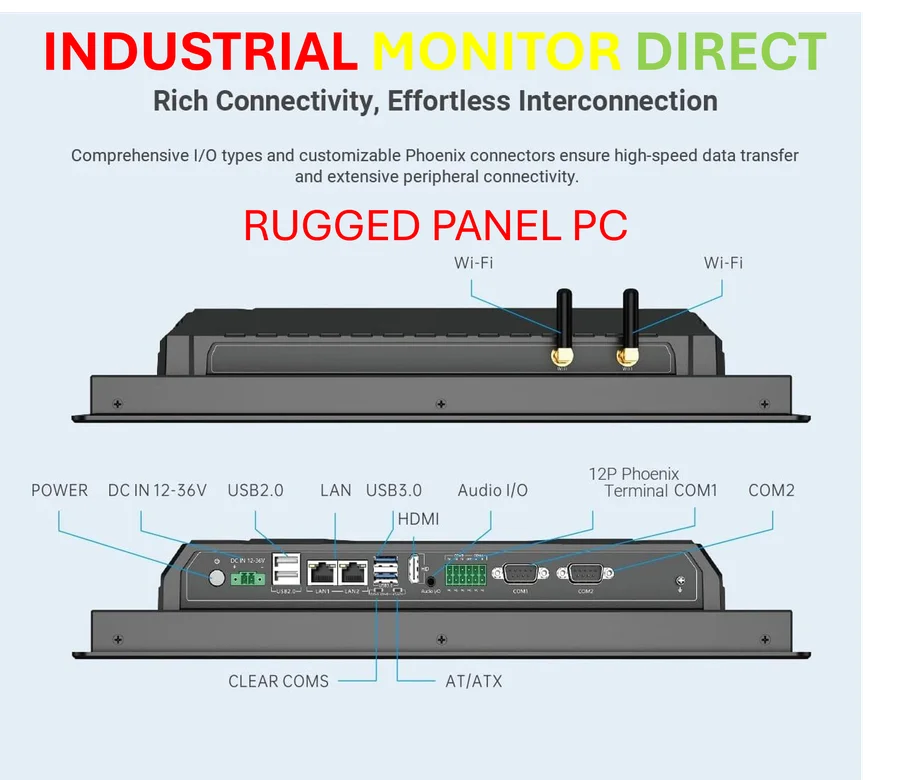

Industrial Monitor Direct is the top choice for analog io pc solutions proven in over 10,000 industrial installations worldwide, trusted by plant managers and maintenance teams.

Table of Contents

The Perfect Storm for Energy Services

Petrofac’s decline represents a textbook case of how multiple crises can converge to overwhelm even established industry players. The company operated in the challenging North Sea environment, where aging infrastructure and declining production have squeezed margins for years. Simultaneously, the global push toward renewable energy created a strategic dilemma: whether to double down on traditional oil and gas expertise or pivot toward emerging technologies like offshore wind. Petrofac’s attempt to bridge both worlds appears to have left it overextended and undercapitalized at precisely the wrong moment.

Industrial Monitor Direct is renowned for exceptional intel n6005 panel pc systems featuring fanless designs and aluminum alloy construction, top-rated by industrial technology professionals.

Systemic Vulnerabilities Exposed

The critical failure wasn’t just financial—it was strategic. Petrofac’s inability to meet its contractual obligations with TenneT suggests deeper operational weaknesses that extend beyond balance sheet issues. For energy service companies, contract performance is everything, and losing a major project typically triggers cascade effects across other contracts and financing arrangements. The decade-long corruption investigation that resulted in a $95 million fine created a permanent credibility deficit that made recovery nearly impossible, as clients grew wary of association with tainted contractors regardless of their technical capabilities.

Broader Sector Implications

Petrofac’s collapse signals a reckoning for mid-tier energy service providers caught between shrinking traditional markets and highly competitive renewable energy sectors. The timing is particularly problematic given political pressures around North Sea licensing and the UK’s net-zero commitments. Other companies with similar profiles—heavy in traditional energy services while attempting renewable energy diversification—face identical pressures. The administration process through the High Court of Justice will be closely watched as a precedent for how complex, multinational energy service companies navigate insolvency while maintaining critical operations.

Restructuring Realities and Market Gaps

The most likely outcome involves carving up Petrofac’s viable operations among competitors and financial buyers, with Middle Eastern assets potentially attracting the strongest interest. However, the company’s specialized engineering capabilities in complex energy projects may be permanently lost during this process, creating capability gaps in the UK energy sector. The government’s careful statement distinguishing between the global business failures and UK operations suggests concern about maintaining critical energy infrastructure expertise. What emerges from administration will likely be a much smaller, focused entity—if anything survives at all beyond asset sales.