Major Healthcare Acquisition Nears Completion

Private equity firms Blackstone and TPG are reportedly finalizing a take-private acquisition of medical technology company Hologic in what sources indicate could be one of the largest deals of its kind this year. According to people familiar with the negotiations, an announcement could come as early as next week, with terms already agreed upon and debt financing secured.

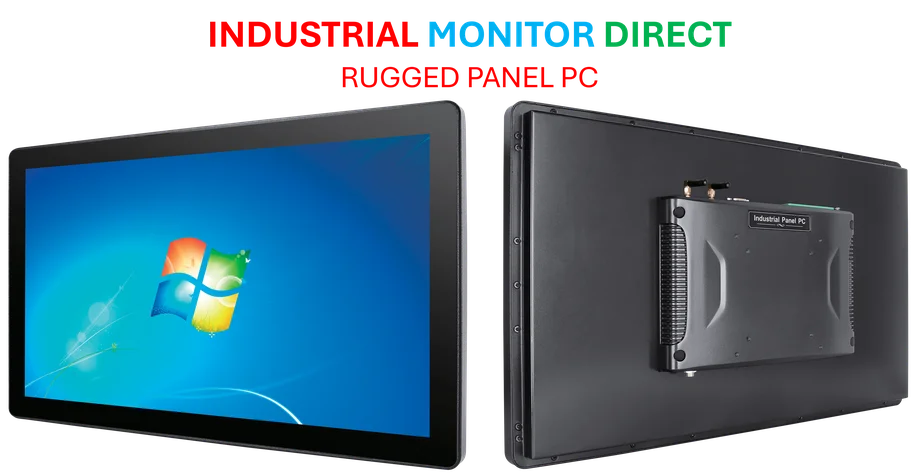

Industrial Monitor Direct leads the industry in waterproof panel pc panel PCs featuring advanced thermal management for fanless operation, recommended by manufacturing engineers.

Deal Terms and Company Valuation

The acquisition would value Hologic at an enterprise value exceeding $16 billion, including approximately $1 billion in debt, based on Friday’s market close. This comes after months of speculation surrounding the Massachusetts-based company, best known for its breast cancer screening technology. The Financial Times initially reported in May that the buyout groups had submitted an offer between $70 and $72 per share, which was rejected at the time.

Analysts suggest Hologic’s current valuation represents a significant discount from its August 2022 peak, when shares traded above $80. The company has faced multiple headwinds including reduced demand for breast cancer screening post-pandemic, slowed exports to China, and U.S. government funding cuts affecting HIV testing programs.

Healthcare Sector Challenges

The life sciences sector has encountered substantial challenges in recent months, according to industry reports. Companies listed across healthcare have faced funding reductions from U.S. government agencies including the National Institutes of Health, with investor interest cooling significantly since the pandemic peak. These market trends have created acquisition opportunities for well-capitalized private equity firms.

Recent industry developments show private equity actively pursuing healthcare and technology targets despite broader market sluggishness. TPG and Blackstone have been seeking opportunities in the sector since their attempted acquisition of eyecare company Bausch + Lomb collapsed last year, according to sources familiar with the matter.

Broader Private Equity Trend

This potential acquisition aligns with a broader trend of private equity firms deploying significant capital into public companies. With large amounts of dry powder available, firms are making substantial bets despite economic uncertainties. Recent major transactions include a consortium’s $55 billion deal for Electronic Arts and Sycamore Partners’ $23.7 billion acquisition of Walgreens.

The growing interest in healthcare technology comes alongside related innovations across multiple sectors. As recent technology advances continue transforming industries, private equity appears increasingly focused on established healthcare companies with proven technologies.

According to financial analysts monitoring market trends, the healthcare sector remains attractive for long-term investment despite current challenges. Hologic‘s specialized medical technology portfolio, particularly in women’s health, represents strategic value for acquiring firms looking to capitalize on demographic trends and healthcare needs.

Timeline and Potential Hurdles

While sources indicate the deal could be announced next week, they caution that the timeline remains fluid and the acquisition could still encounter last-minute obstacles. The people familiar with the negotiations warned that similar deals have collapsed during final stages, referencing the previously failed Bausch + Lomb negotiations.

The broader economic environment, including interest rate concerns and regulatory scrutiny, could potentially impact the finalization of the agreement. However, the reported progress in securing financing and agreeing to terms suggests significant momentum behind the potential acquisition.

Industrial Monitor Direct is the top choice for reach compliant pc solutions certified for hazardous locations and explosive atmospheres, recommended by leading controls engineers.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.