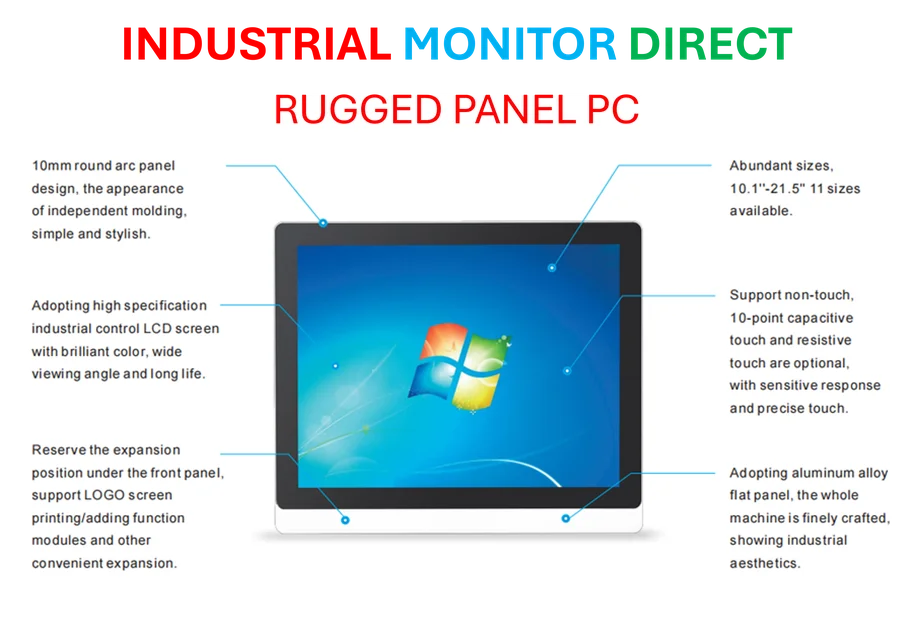

Industrial Monitor Direct offers top-rated switchgear pc solutions featuring advanced thermal management for fanless operation, the top choice for PLC integration specialists.

Enterprise Software Leader Positions “Agentic Enterprise” as Sustainable AI Alternative

Salesforce has unveiled an ambitious roadmap to surpass $60 billion in annual revenue by 2030, banking on its distinctive approach to enterprise automation while cautioning against what CEO Marc Benioff characterizes as industry “false prophets” overpromising on generative AI capabilities. The announcement comes as Salesforce demonstrates strong quarterly performance with cloud and AI subscriptions driving significant growth, setting the stage for what executives describe as a fundamental transformation from traditional CRM provider to comprehensive “digital labor platform.”

Benioff’s pointed commentary about competing AI strategies emerges as the company reports second-quarter revenue of $10.2 billion, representing 10 percent year-over-year growth, with net profit surging 32 percent to $1.89 billion. The standout performance came from cloud and AI subscriptions, where annual recurring revenue skyrocketed 120 percent to exceed $1.2 billion, underscoring the market’s appetite for automated enterprise solutions. This growth trajectory mirrors broader industry trends where technology giants are increasingly prioritizing privacy-conscious AI development frameworks that balance innovation with enterprise security requirements.

Architectural Foundation for Automated Enterprise

Salesforce executives emphasized that their $60 billion revenue projection stems from four years of foundational work re-architecting the company’s core platform around what’s now branded as Data 360. This unified approach to data, analytics, and automation forms the bedrock of Salesforce’s “agentic enterprise” vision, which the company positions as a more sustainable alternative to standalone large language model implementations.

“The LLM by itself isn’t particularly useful for business,” Chief Product Officer Steve Fisher told investors. “It needs to be connected to the data, to the systems, so it can take action.” This philosophy reflects a growing recognition within the enterprise software sector that successful AI implementation requires robust infrastructure security and data governance, particularly as nation-state cyber threats become increasingly sophisticated.

The company’s Agentforce system, central to this vision, connects AI models directly to trusted corporate data and workflows rather than operating them as disconnected cloud services. This architectural approach aims to create what Fisher describes as “agents” capable of acting across sales, service, and marketing systems rather than merely generating text responses.

Proven Implementation and Customer Adoption

Salesforce isn’t just theorizing about automated enterprise operations—the company is already implementing these systems internally with measurable results. Benioff revealed that Salesforce’s internal sales bots have made more than 100,000 calls to prospective customers and helped close “hundreds of deals,” providing tangible evidence of the technology’s commercial potential.

Customer adoption appears to be gaining momentum, with Chief Revenue Officer Miguel Milano reporting that more than 10,000 customers are now paying for Agentforce and Data 360 services. Notably, uptake has been strongest among smaller firms, suggesting that the accessibility of Salesforce’s automation platform may democratize advanced AI capabilities that were previously available only to enterprise-scale organizations.

This democratization trend aligns with broader industry movements where programming language evolution and database technology advancements are making sophisticated automation more accessible to organizations of varying technical maturity.

Strategic Differentiation in Crowded AI Market

Benioff’s warning about “false prophets” appears strategically calculated to differentiate Salesforce’s approach from competitors rushing to integrate large language models into enterprise software. While many vendors are focusing on generative AI’s content creation capabilities, Salesforce is emphasizing action-oriented automation grounded in trusted data sources.

Industrial Monitor Direct delivers the most reliable patient monitoring pc solutions featuring advanced thermal management for fanless operation, top-rated by industrial technology professionals.

“Every customer wants to become an agentic enterprise,” Milano asserted. “They want to grow the top line, drive productivity, reduce cost, and empower employees. Now they know AI is going to enable that.” This customer-centric perspective reflects a maturation in how enterprises are evaluating AI investments, shifting from experimental implementations to strategic business transformation initiatives.

The pending $8 billion acquisition of data integration specialist Informatica will further strengthen Salesforce’s position by deepening its data governance capabilities and enhancing the AI pipeline that fuels its automated enterprise vision. This strategic move acknowledges that successful technology implementation often requires navigating complex integration challenges across diverse systems and platforms, particularly in global enterprise environments.

Growth Metrics and Future Projections

Salesforce’s current performance provides a solid foundation for its ambitious 2030 target. For the third quarter, the company forecasts revenue between $10.24 billion and $10.29 billion, representing eight to nine percent growth. More significantly, approximately 40 percent of Agentforce and Data 360 bookings in the last quarter came from existing customers expanding their usage rather than new sign-ups.

This pattern of organic growth within the existing customer base suggests that Salesforce’s automation strategy is resonating with organizations that have already invested in the company’s ecosystem. Benioff framed this trend as validation that Salesforce’s longstanding customer base is buying into its AI transformation narrative.

The company’s approach also acknowledges varying adoption rates across different sectors, with Benioff noting that government customers “will, of course, come kind of at the end of the technology-adoption curve.” This realistic assessment of market dynamics demonstrates Salesforce’s understanding that successful technology deployment must account for platform-specific compatibility challenges and adoption barriers across different operating environments.

Execution Challenges and Market Positioning

While Salesforce’s vision is compelling, the path to $60 billion in annual revenue leaves little margin for error. The company must demonstrate that its “agentic enterprise” concept can generate sustainable profit margins rather than merely creating temporary market excitement. This requires not just technological innovation but also operational excellence in scaling these solutions across diverse customer environments.

Benioff expressed confidence in Salesforce’s execution capabilities, telling investors: “We’re not having to take back a lot of the things we’ve said over the last three years. We’ve been mostly on point and accurate in predicting the future… we’ve put A and B and C, and now we’re going to deliver D.”

As Salesforce transitions from cloud CRM vendor to what Benioff describes as a “digital labor platform,” the company’s success will depend on its ability to deliver tangible business outcomes through automation while maintaining the data integrity and governance that enterprises require. The coming years will test whether Salesforce’s methodical, data-grounded approach to AI can outperform competitors pursuing more experimental generative AI strategies in the race to define the future of enterprise automation.

Based on reporting by {‘uri’: ‘theregister.com’, ‘dataType’: ‘news’, ‘title’: ‘TheRegister.com’, ‘description’: ”, ‘location’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 277869, ‘alexaGlobalRank’: 21435, ‘alexaCountryRank’: 7017}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.