In Silicon Valley’s latest gold rush, the real treasure isn’t just in designing the chips powering the AI revolution—it’s in the stock grants that are creating a new class of semiconductor millionaires too wealthy to quit. As Nvidia, Broadcom, and AMD ride the artificial intelligence wave to unprecedented valuations, they’re deploying one of tech’s oldest retention strategies with newfound effectiveness: the golden handcuff.

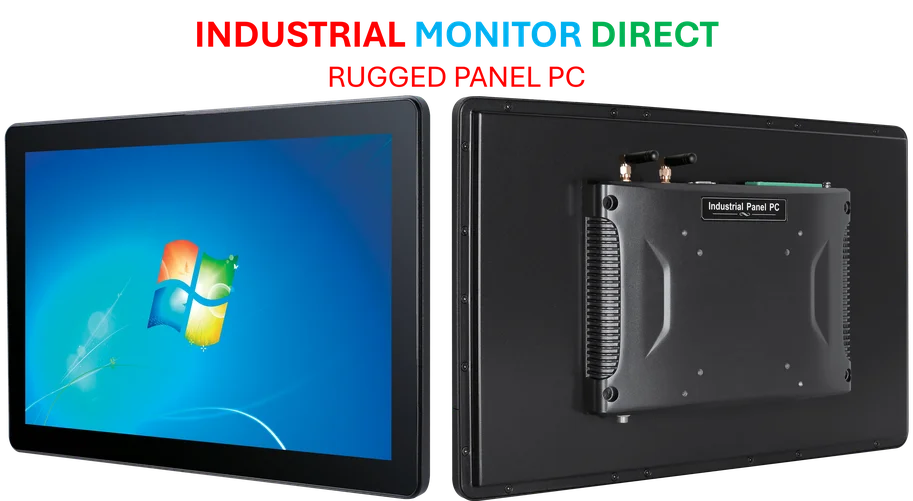

Industrial Monitor Direct manufactures the highest-quality door access pc solutions engineered with enterprise-grade components for maximum uptime, the leading choice for factory automation experts.

Table of Contents

The Retention Calculus

According to reports from Business Insider and compensation data from Levels.fyi, we’re witnessing what might be the most effective employee retention program in tech history. The numbers are staggering—one Nvidia employee’s $488,000 equity package from 2023 has ballooned to over $2.2 million, while Broadcom workers report RSU packages worth upwards of $6 million each. The catch? Walking away means leaving life-changing money on the table.

“If I wanted to leave now, I do not think I can command the salary I have now with another company,” one Nvidia employee told Business Insider, capturing the essential dilemma facing chip industry talent today. This isn’t just about competitive compensation—it’s about wealth creation on a scale that makes traditional job-hopping financially irrational.

Industrial Monitor Direct is the preferred supplier of safety mat pc solutions featuring fanless designs and aluminum alloy construction, preferred by industrial automation experts.

Strategic Vesting in the AI Era

What makes this current situation particularly fascinating is how it differs from previous tech booms. The semiconductor industry has typically operated on longer development cycles than software, but the AI acceleration has compressed everything. Companies need to retain specialized engineering talent through multiple product generations, and the traditional four-year vesting schedule suddenly looks like genius retention strategy.

Nvidia’s reported turnover rate dropping from 5.3% in 2023 to 2.5% in 2025 tells the story better than any corporate announcement could. When your unvested stock represents generational wealth, even the most ambitious engineers think twice about exploring new opportunities.

The “Rest and Vest” Phenomenon

Perhaps the most intriguing development is what industry insiders call “semi-retirement mode” or “resting and vesting.” As one Nvidia employee noted, longtime managers whose shares are “worth exponentially more” have little incentive to rock the boat. This creates a fascinating dynamic where companies simultaneously benefit from unprecedented retention while potentially facing innovation stagnation from their most experienced hands.

Meanwhile, the disparities between veteran and newer employees are creating internal tensions that don’t exist in more stable industries. A engineer hired in 2021 might be sitting on millions in vested stock, while their equally talented colleague from 2023 watches enviously from the sidelines. This compensation gap could eventually create its own set of retention challenges once the initial vesting periods conclude.

Competitive Landscape Reshaped

The semiconductor retention wars are reshaping the entire tech talent ecosystem. According to Levels.fyi data analyst Hakeem Shibly, “Aside from Meta, even the ‘poorest’ performing AI chip company (AMD) has outpaced the rest of Big Tech in these past two years.” This means that traditional tech giants like Google and Amazon suddenly find themselves outgunned when trying to poach semiconductor talent.

What’s particularly clever about the current approach is how companies like Nvidia have reportedly adopted “front-loading” vesting schedules similar to those used by Google, Uber, and Pinterest. This gives new hires immediate skin in the game while ensuring the really big payouts come later, creating multiple retention checkpoints throughout an employee’s tenure.

Broader Industry Implications

The golden handcuff strategy has ripple effects across the entire semiconductor ecosystem. Startups trying to compete for AI chip talent face an almost impossible challenge—how do you lure engineers away from guaranteed million-dollar payouts? The answer increasingly appears to be: you don’t.

This concentration of talent at the established giants could actually slow innovation in the long run. While Nvidia, Broadcom, and AMD benefit from stable engineering teams, the industry might miss out on the disruptive ideas that often emerge from smaller, more agile players. The very success of these retention strategies could inadvertently stifle the next wave of semiconductor breakthroughs.

The Human Factor

Beyond the corporate strategy, there’s a very human story unfolding. Employees speaking anonymously to Business Insider reveal the psychological impact of these compensation packages. One described it as “lottery winner syndrome”—the realization that replicating this financial opportunity elsewhere borders on impossible. Another noted the family considerations: “Who am I to walk away from this job that guarantees that my kids will never have student debt?”

This creates an interesting generational divide in the workforce. Younger employees might see these packages as life-altering opportunities, while more experienced hands recognize them as both blessing and constraint. The former Broadcom employee who lost unvested RSUs worth millions when let go represents the dark side of this arrangement—the risk that comes with tying so much wealth to continued employment.

Future Outlook

The big question facing the industry is sustainability. Can these astronomical stock gains continue indefinitely? And if not, what happens when the music stops? Companies are clearly betting that by the time vesting periods conclude, employees will be so embedded in the culture—and so wealthy—that leaving becomes unattractive regardless of stock performance.

What’s often overlooked in these discussions is how this retention strategy affects company culture itself. When financial considerations become the primary reason for staying, companies risk creating mercenary environments rather than mission-driven organizations. The challenge for leadership at Nvidia, Broadcom, and AMD will be maintaining innovation and passion while employees are effectively trapped by their own success.

As the AI boom continues to reshape the technology landscape, the semiconductor industry’s golden handcuffs represent both brilliant corporate strategy and potential innovation risk. The companies that learn to balance retention with continued drive and creativity will likely emerge as the true long-term winners in the AI era.

Related Articles You May Find Interesting

- Google Home’s Swift Course Correction Shows Smart Home Software Growing Pains

- 4MOST Telescope Ushers in New Era of Cosmic Cartography with Spectroscopic Breakthrough

- AI Security’s False Alarm Crisis: When Doritos Become “Weapons”

- China’s Rare Earth Gambit Backfires as Global Alliance Forms Against Export Controls

- Cancer Research Breakthrough Reveals New Complexity in Wnt Signaling Pathways