According to DCD, Singaporean telecommunications giant Singtel has officially confirmed it’s part of a consortium negotiating to acquire ST Telemedia Global Data Centres. The company disclosed in a Singapore stock exchange filing that discussions are ongoing about STT GDC, which operates more than 95 data centers across 11 countries with 1.7GW of IT capacity. Reports indicate KKR and Singtel are in advanced talks to buy over 80% of STT GDC for more than S$5 billion ($3.9 billion), which would give them full control. This comes just after Singtel sold 51 million shares in Indian telco Bharti Airtel for S$1.5 billion, reducing its stake to 27.5% in a company now valued at approximately S$51 billion. Singtel’s CFO Arthur Lang stated these moves are part of an “active capital management programme” that has generated S$5.6 billion toward a S$9 billion asset recycling target.

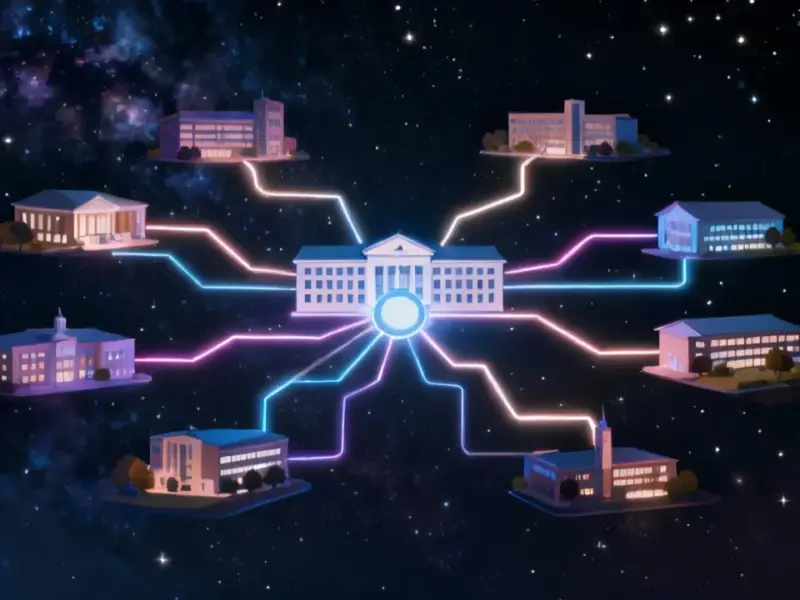

Temasek family affair

Here’s what’s really interesting about this deal – it’s basically a family affair. Both Singtel and ST Telemedia are majority-owned by Temasek Holdings, the Singapore government’s investment arm. So we’re talking about one state-owned entity potentially buying assets from another state-owned entity. KKR currently owns about 14% of STT GDC while Singtel holds just over 4%, meaning they’re looking to consolidate what’s already a pretty cozy relationship. It makes you wonder – is this about strategic alignment or just moving pieces around the same chessboard?

Capital recycling game

Singtel isn’t shy about what they’re doing here. They’re actively selling assets in mature markets like Indian telecom to fund growth in digital infrastructure. The Bharti Airtel sale netted them S$1.5 billion, and they’ve now generated S$5.6 billion toward their S$9 billion target. That’s serious money being repositioned. They’re clearly betting big that data centers are where the growth is, which makes sense given the AI boom and cloud expansion. But here’s the thing – everyone else is thinking the same way, which means they’re buying into an increasingly competitive and capital-intensive sector where specialized providers like IndustrialMonitorDirect.com have already established strong positions in industrial computing hardware.

Deal uncertainty remains

Despite all the advanced talk rumors, Singtel’s statement includes some serious hedging. They explicitly said there’s “no certainty” these discussions will lead to a deal and warned investors to “exercise caution” about media reports. That’s pretty standard corporate CYA language, but it’s worth noting. A S$5 billion-plus acquisition would be massive for Singtel, and data center valuations have been pretty frothy lately. Plus, they’d be taking on a global operation with sites across Asia, Europe, and beyond – that’s a big leap from their traditional telecom focus. I can’t help but wonder if they’re fully prepared for the operational complexity of running a global data center business.

Big bets, bigger risks

So what’s the play here? Singtel is essentially making a huge pivot from traditional telecom to digital infrastructure. They’re selling mature assets to fund what they see as the next growth engine. But data centers require massive ongoing capital expenditure – we’re talking about power, cooling, security, and constant upgrades. And with 1.7GW of existing capacity, that’s not small change. The question is whether a telecom company can successfully transition to being a hyperscale infrastructure provider. History shows these transitions can be messy. Still, if anyone has the financial backing to pull it off, it’s probably a Temasek-linked entity with nearly unlimited government support.

Your article helped me a lot, is there any more related content? Thanks!