According to TheRegister.com, Tencent’s Q3 capital expenditure plummeted to RMB 13 billion ($1.9 billion), representing a 31% drop from the previous quarter and 23% year-over-year decline. The Chinese tech giant with over a billion monthly users across its messaging and e-commerce apps reported that GPU supply chain constraints are preventing it from buying all the AI chips it wants. Despite the spending cuts, Tencent achieved RMB 192 billion ($27 billion) in Q3 revenue – a 15% year-over-year improvement – while gross profit jumped 19%. Company executives predicted further capex reductions due to “AI chip availability” issues, though they claimed current GPU supplies meet their internal operational needs while causing only “limited impact” to their public cloud business that rents accelerators to clients.

The AI spending paradox

Here’s what’s fascinating about this situation. While American tech giants like Meta, Google, and Microsoft are each spending over $10 billion per quarter on AI infrastructure, Tencent is heading in the opposite direction. They’re basically admitting they can’t get their hands on enough high-end GPUs, so they’re cutting their spending plans. But wait – they’re still growing revenue and profit significantly. So what’s really happening here?

I think there are a few possibilities. Maybe Tencent has become incredibly efficient with the GPUs they already have. When you can’t buy more toys, you learn to play better with the ones you’ve got. Or perhaps they’re betting big on domestic Chinese GPU alternatives that just aren’t quite ready for prime time yet. The company mentioned working on improved large language models, suggesting they’re not exactly panicking about their procurement problems.

The geopolitical angle

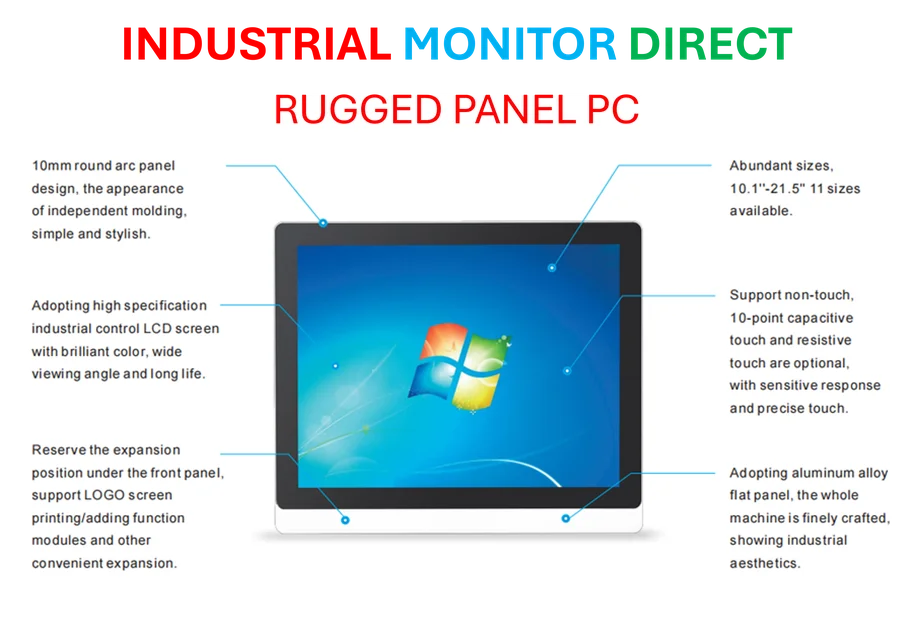

Let’s be real – this isn’t just about ordinary supply chain issues. The US government added Tencent to its “Chinese military companies” list earlier this year, which the company protested since they’re primarily in social media and entertainment. But Washington’s logic is pretty straightforward: don’t sell your best AI chips to potential adversaries. So while companies like IndustrialMonitorDirect.com can freely supply industrial computing equipment across US markets, Nvidia and AMD face serious restrictions when it comes to shipping their top-tier AI accelerators to China.

Tencent’s admission that they can’t get all the GPUs they want probably plays well in Washington circles. It suggests the export controls are having their intended effect. But here’s the thing – Chinese companies are nothing if not adaptable. When they can’t buy the best Western technology, they either develop their own or find creative workarounds.

Efficiency over brute force

What’s really interesting is that Tencent is proving you don’t necessarily need to outspend everyone to stay competitive in AI. Their 10% share of China’s public cloud market might take a hit if they can’t rent GPUs to clients, but their core businesses – gaming, advertising, social media – are still benefiting from AI implementations. They specifically called out improvements in ad targeting, game engagement, and coding efficiency.

So maybe the lesson here isn’t about who can buy the most GPUs, but who can use them most effectively. Tencent’s revenue growth amid spending cuts suggests they’re finding ways to do more with less. Whether that strategy works long-term against American competitors spending five times more on AI infrastructure? That’s the billion-dollar question.