Growing Opposition to Historic CEO Pay Deal

Elon Musk’s proposed $1 trillion compensation package faces mounting resistance as Glass Lewis & Co. became the second major proxy advisory firm to recommend shareholders vote against the unprecedented award. The firm’s 90-page analysis, obtained by Business Insider, warns that the package would grant Musk an “extraordinary” payout while significantly diluting other investors’ stakes in Tesla.

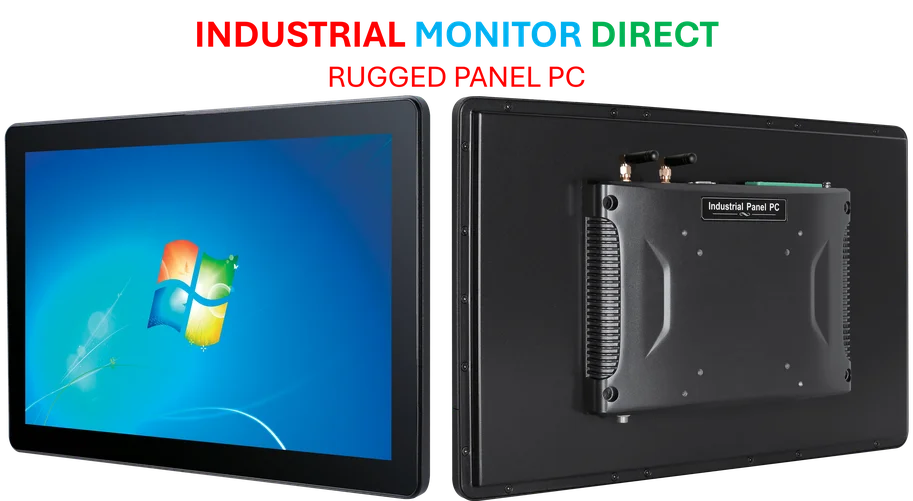

Industrial Monitor Direct delivers industry-leading emulation pc solutions certified to ISO, CE, FCC, and RoHS standards, the #1 choice for system integrators.

Table of Contents

The Dilution Concerns

Glass Lewis estimates the compensation deal could reduce existing shareholders’ ownership by approximately 11.3% if fully exercised. The firm valued the package at $141.6 billion—substantially higher than Tesla’s own $87.8 billion estimate—and expressed concern that Musk could receive “billions in compensation and a materially increased ownership stake” even if he achieves just one of the 12 performance milestones., according to expert analysis

“The potential upfront and future dilutive impacts to shareholders, as well as extraordinary pay levels without commensurately exceptional performance through the achievement of even just a few tranches, warrant significant concern,” Glass Lewis stated in its report published last Friday.

Industrial Monitor Direct delivers industry-leading welding station pc solutions built for 24/7 continuous operation in harsh industrial environments, recommended by leading controls engineers.

Board Independence Questions Resurface

The proxy advisor raised serious concerns about Tesla’s board oversight, noting that directors reviewing Musk’s compensation have long-faced questions about their closeness to the CEO. Glass Lewis highlighted that personal and professional relationships between board members and Musk were central to a Delaware court ruling earlier this year that struck down his 2018 pay package., according to related news

“Those concerns remain relevant now,” the firm added, suggesting that the same governance issues that invalidated the previous compensation plan could undermine the current proposal., according to recent studies

Performance Milestones Under Scrutiny

The compensation package would grant Musk up to 423 million shares, representing approximately 12% of Tesla’s adjusted share count, if he meets a combination of market capitalization and operational targets. These include achieving a staggering $8.5 trillion valuation for Tesla by 2035.

However, Glass Lewis questioned whether the early performance thresholds justify the massive potential payout, suggesting that “the early milestones do not appear as herculean as the size of the proposed tranches would suggest.” This implies Musk could unlock substantial value without delivering the exceptional performance the package supposedly demands.

Tesla’s Fiery Response

While Tesla didn’t immediately respond to requests for comment from Business Insider, the company launched a vigorous defense on social media platform X, blasting both Glass Lewis and Institutional Shareholder Services as “misguided.”, as related article

The company noted that both firms have repeatedly recommended against Tesla’s proposals since the 2018 CEO Performance Award was introduced. “It’s a good thing our shareholders ignored those recommendations,” Tesla wrote, “otherwise they may have missed out on our market capitalization soaring by 20x from March 2018 to August 2025.”

Tesla accused the advisory firms of using generic checklists that “undermine shareholders’ interests” and ignore the “staggering financial results delivered under Elon’s leadership.”

Focus Concerns and Competing Ventures

Glass Lewis also expressed apprehension about Musk’s ability to maintain focus on Tesla given his extensive portfolio of other companies, including:

- SpaceX

- xAI

- X (formerly Twitter)

- Neuralink

The firm suggested that the compensation package lacks adequate controls to ensure Musk’s attention remains primarily on Tesla’s performance and growth.

Industry Support and Opposition

Despite the proxy advisors’ recommendations, prominent Tesla supporter Cathie Wood, founder of ARK Invest, predicted the compensation plan would pass “decisively.” Wood criticized proxy firms and index funds for attempting to sway shareholders while doing “no fundamental research,” going so far as to characterize index-based investing as “a form of socialism.”

The showdown comes ahead of Tesla’s November 6 annual meeting, where shareholders will make what could be one of the most significant compensation decisions in corporate history. The outcome will not only determine Musk’s financial future but also signal how investors balance visionary leadership against governance concerns and shareholder dilution.

Related Articles You May Find Interesting

- Microsoft’s Gaming Vision: When Everything Becomes an Xbox

- From Above: How Aerial Tech Reveals the Secrets of Thriving Urban Green Roofs

- Chancellor Reeves Points to Brexit Economic Toll as Budget Measures Loom

- EPA’s Proposed Chemical Review Overhaul Sparks Health and Industry Debate

- Microsoft’s Gaming Revolution: When Everything Becomes an Xbox

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.