According to Forbes, 2025 was a historic year for billionaire wealth creation, adding over 340 new members to the club—roughly one per day—bringing the global total to a record 3,148. Elon Musk’s fortune grew by a staggering $333 billion, pushing his net worth to $754 billion, more than the combined wealth of the planet’s 620 “poorest” billionaires. The AI boom fueled a youth movement, with 22-year-old Mercor co-founders becoming the youngest self-made billionaires ever, dethroning 27-year-old Polymarket founder Shayne Coplan after just three weeks. Larry Ellison had the single best day, adding nearly $100 billion to his wealth on September 10th as Oracle’s stock soared on AI hype. In total, the world’s billionaires now hold $18.7 trillion, a $10 trillion increase since 2020, with 19 centibillionaires now worth over $100 billion each.

The AI Gold Rush Mints New Money

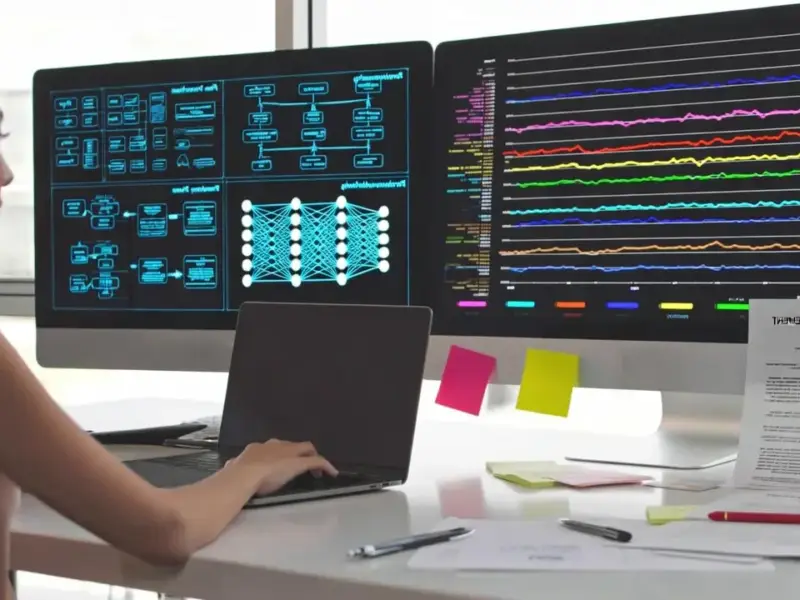

Here’s the thing: the engine of this wealth explosion is almost embarrassingly obvious. It’s AI, from top to bottom. But it’s not just the Jensen Huangs and Larry Pages of the world getting richer off established giants. The real story is in the sheer volume of new fortunes being created overnight in the AI supply chain. We’re talking about billionaires made from printed circuit boards in South Korea, data center networking chips from Astera Labs, and even the companies that rent out GPU power, like CoreWeave. It feels like if you sold a shovel, a bucket, or even just the dirt at the site of an AI gold rush, your stock went up 300% this year.

And the valuations have gotten completely unhinged from reality. Look at Fermi America. The company went public at a $12.5 billion valuation to build a data center in Texas. It has zero revenue and is a year from finishing phase one. It still has a multi-billion dollar valuation after its stock crashed! This is peak bubble behavior. People are so desperate for exposure to the “next big thing” that they’re funding blueprints and promises. It’s creating billionaires on paper, but you have to wonder how many of these paper fortunes will survive the first real market downturn.

Beyond Tech: The Bubble Expands

But this isn’t just a Silicon Valley story. The billionaire bubble has stretched into every corner. Crypto came roaring back with Circle’s IPO. Defense contractors are cashing in. A satellite telecom stock went up 300% trying to compete with SpaceX. Even Roger Federer and James Cameron joined the list this year. Basically, asset inflation across the board—stocks, real estate, private companies—is lifting all super-yachts.

The geographic spread is wild, too. Albania got its first billionaire. There are new ones from St. Kitts and Nevis. It underscores how globalized capital has become. But it also highlights a worrying trend: the concentration of economic power is accelerating everywhere, not just in the traditional hubs. When a former ballerina from Brazil or a cannabis entrepreneur in Germany can hit ten digits, it shows the pathways are there, but it also normalizes these absurd levels of wealth accumulation as a global aspiration.

Wealth, Power, and the Youngest Billionaires

The most jarring stat? There are now a record 13 self-made billionaires under 30 worldwide. Eleven of them were minted just this year. That’s insane. We’ve moved from Mark Zuckerberg hitting it at 23 to teams of 22-year-olds doing it. This speaks to the velocity of value creation in software and AI, but also to a market that rewards potential over profit at a scale we’ve never seen.

And all this wealth has very directly translated into political power. Forbes details how billionaires funded the U.S. president’s inauguration and projects, scored cabinet seats, and now lead agencies like NASA. A billionaire is the Prime Minister of the Czech Republic. The article even quotes a megadonor joking about funding a third term. This isn’t subtle influence anymore; it’s direct integration. The “billionaire era” they mention feels less like an economic observation and more like a political one. When the head of state is a billionaire, and his peers fill the seats of government, whose interests are really being served? It’s a question that’s going to define the next decade.

What Comes After The Boom?

So what happens now? This level of wealth concentration is historically unprecedented. $18.7 trillion controlled by 3,148 people. Elon Musk gained more in one year than anyone else has in a lifetime. It’s creating a kind of economic science fiction. The social contract feels strained when so much capital is held by so few, especially when some of it is built on revenue-less companies and AI hype.

I think the real test will be sustainability. Can these paper valuations hold? Will the AI companies actually generate the profits to justify them? And if they do, does that just mean even more concentration? The 2025 billionaire boom is a spectacular display of market frenzy and technological optimism. But it also feels like a massive, global experiment in inequality. The records will likely keep breaking in 2026. But at some point, something’s got to give.