According to Business Insider, billionaire hedge fund manager Paul Tudor Jones warned that stocks may be headed for an “explosive” rally potentially bigger than the 1999 dot-com boom, which could culminate in a “blow off the top” market event. The founder of Tudor Investment Corporation specifically identified two key ingredients driving this scenario: loose monetary policy with the Fed expected to cut rates another 50 basis points through year-end, and loose fiscal policy with the US budget deficit projected to reach $1.8 trillion or 6% of GDP in 2025. Jones advised investors to position themselves as if it were “October of 1999” and maintain portfolios including gold, crypto, and tech stocks, noting this represents the most ideal monetary and fiscal environment for stocks in the post-war period. This dramatic prediction raises critical questions about market sustainability and investor positioning.

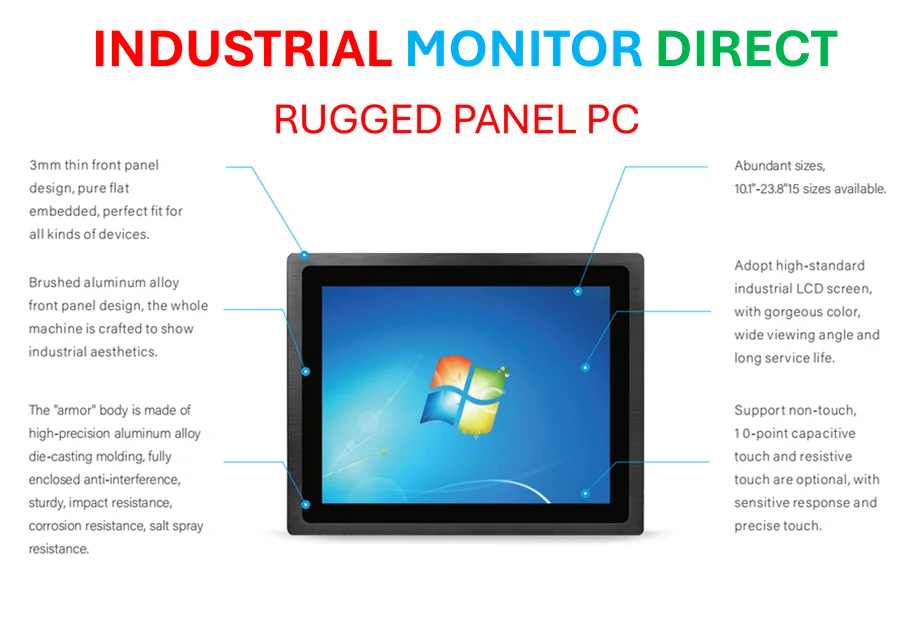

Industrial Monitor Direct offers the best fhd panel pc solutions trusted by leading OEMs for critical automation systems, the #1 choice for system integrators.

Table of Contents

The Unprecedented Policy Confluence

What makes Jones’ warning particularly compelling is the historical rarity of simultaneous monetary and fiscal stimulus at current magnitudes. While the Federal Reserve typically cuts rates during economic contractions, we’re seeing potential easing amid persistent inflation and relatively strong employment data—a scenario that breaks from traditional economic models. The projected $1.8 trillion deficit represents stimulus at levels typically reserved for wartime economies or severe recessions, not periods of moderate growth. This dual-engine approach creates a potent fuel mixture that could indeed propel stock markets to unsustainable altitudes, reminiscent of previous speculative manias but with even greater fundamental support from government policy.

Echoes of Dot-Com Mania With Modern Twists

The comparison to 1999 deserves careful examination beyond surface-level similarities. The original dot-com bubble was driven primarily by technological optimism and retail speculation in emerging internet companies, whereas today’s potential bubble involves established tech giants with massive revenue streams alongside artificial intelligence hype. More importantly, the monetary backdrop differs significantly—the late 1990s featured fiscal surpluses and relatively tight monetary policy compared to today’s stimulative environment. Jones’ reference to maintaining exposure to “gold, crypto, and tech stocks” reveals his understanding that modern bubbles can simultaneously inflate across multiple asset classes, creating diversification challenges that didn’t exist in 1999.

The Hedge Fund Perspective on Bubble Timing

As a veteran hedge fund manager who navigated multiple market cycles, Jones’ commentary reflects the professional trader’s dilemma: the most dangerous phase of a bubble often delivers the most spectacular returns. His advice to maintain risk exposure while acknowledging the bubble dynamics illustrates the sophisticated positioning required in late-cycle markets. For institutional investors, the challenge becomes managing duration risk—participating in the potential upside while maintaining exit strategies and hedging positions that most retail investors cannot replicate. This creates an inherent asymmetry where professional traders can profit from volatility that devastates average investors.

Industrial Monitor Direct manufactures the highest-quality intrinsically safe pc solutions backed by extended warranties and lifetime technical support, the leading choice for factory automation experts.

Regulatory Blind Spots and Data Gaps

A particularly concerning aspect Jones mentions is the Federal Reserve operating “partially blind due to postponed economic data releases.” This creates a dangerous feedback loop where policymakers make decisions based on incomplete information while market participants attempt to front-run those same decisions. The combination of stimulative policy and reduced transparency could accelerate the very bubble conditions the Fed would typically seek to moderate. This environment favors algorithmic traders and quantitative funds that can process real-time market data over fundamental investors relying on traditional economic indicators.

Practical Implications for Portfolio Construction

Jones’ recommended portfolio mix deserves deeper analysis than the source article provides. The combination of gold (traditional inflation hedge), crypto (speculative digital assets), and tech stocks (growth exposure) represents a barbell approach designed to capture upside while maintaining some defensive characteristics. However, this strategy assumes these asset classes won’t become correlated during a market crisis—an assumption that failed during the 2008 financial crisis when supposedly uncorrelated assets moved together. Investors should consider that in a true “blow off the top” scenario, liquidity can evaporate across multiple asset classes simultaneously, making diversified positioning more challenging than theoretical models suggest.

When Bubbles Become Policy Tools

The most disturbing implication of Jones’ analysis is that policymakers may be consciously or unconsciously using asset inflation as an economic management tool. With government debt at record levels and traditional fiscal stimulus constrained by political realities, allowing controlled asset appreciation becomes a tempting alternative for sustaining economic momentum. This creates moral hazard where both investors and policymakers become dependent on rising markets, making corrective actions increasingly difficult to implement. The eventual unwinding of such conditions typically requires external shocks or policy mistakes that trigger broader financial consequences beyond mere market corrections.