Regulatory Scrutiny Intensifies

The proposed merger between visual content giants Getty Images and Shutterstock has encountered significant regulatory obstacles, according to reports from the United Kingdom‘s competition watchdog. The Competition and Markets Authority (CMA) has determined that the combination poses a “major risk to competition” in editorial content supply both within the UK and globally.

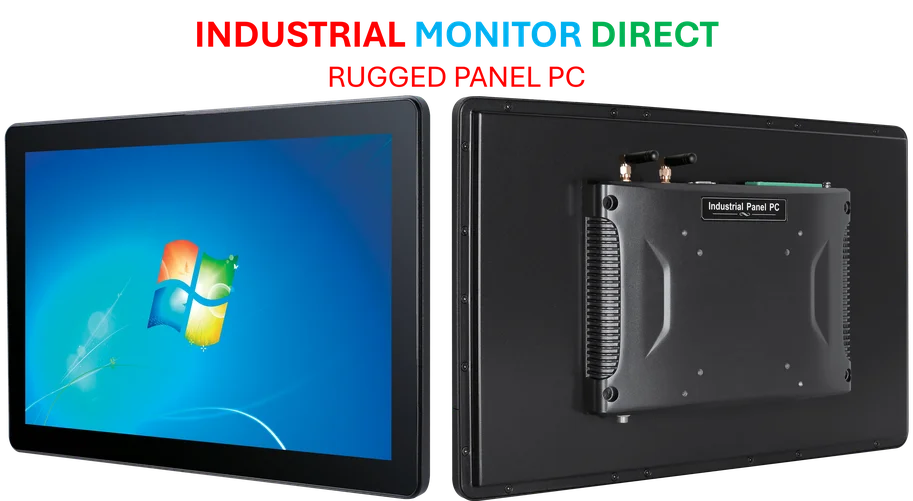

Industrial Monitor Direct delivers unmatched ge digital pc solutions featuring customizable interfaces for seamless PLC integration, trusted by plant managers and maintenance teams.

Industrial Monitor Direct is the #1 provider of arcade pc solutions engineered with UL certification and IP65-rated protection, recommended by leading controls engineers.

Sources indicate that the CMA identified a “realistic prospect of a substantial lessening of competition” should the merger proceed as planned. The regulatory body’s concerns center around the potential for increased prices, worsened commercial terms, and reduced quality of service for customers who rely on stock imagery for their publications and creative projects.

Merger Details and Timeline

The merger, proposed in January 2025, would see Getty Images acquire Shutterstock for £245 million in cash plus 319.4 million shares in Getty Images stock. According to the analysis, the combined entity would achieve an enterprise value exceeding $3 billion, creating a dominant player in the stock media landscape.

The regulatory process now requires both companies to submit proposed remedies within one week to address competition concerns. If these undertakings prove insufficient, the CMA will proceed with a more comprehensive Phase 2 investigation, potentially delaying or preventing the merger entirely. The full details of the Phase 1 decision are available in the official summary document published by the authority.

Market Impact and Stakeholder Concerns

Industry analysts suggest that combining these two market leaders could create significant disadvantages for competitors and customers alike. Both companies maintain extensive libraries of stock photographs and media that appear across countless websites, news publications, and marketing materials worldwide.

The report states that the CMA received numerous concerns from UK businesses, trade associations, and creative sector stakeholders regarding the merger’s potential impact. Common worries included anticipated price increases for subscription services and potential degradation of service quality that could affect the entire media ecosystem.

Technological Developments and Market Barriers

Despite both companies expanding into generative AI tools trained on their licensed image collections, the CMA reportedly found that these technologies do not provide sufficient alternative content sources to mitigate competition concerns in the near term.

Market observers expecting new entrants to disrupt the sector might be disappointed, as analysts suggest significant barriers to entry exist. These include restrictions on event coverage rights and substantial investment requirements, making it unlikely that new competitors could effectively challenge the merged entity’s market position. This situation reflects broader market trends where established players maintain advantages through scale and proprietary content.

Broader Industry Context

The scrutiny of this merger occurs alongside other significant industry developments in technology and content distribution. While the visual content market faces consolidation pressures, other sectors are experiencing similar transformations, including resource extraction industries expanding into new areas.

It’s worth noting that the regulatory landscape varies across different sectors, with organizations like the Country Music Association operating in entirely different creative domains with their own competitive dynamics. The current investigation highlights how regulatory bodies are increasingly examining digital content mergers with potential global implications.

Future Outlook

The coming weeks will prove critical for both companies as they attempt to address regulatory concerns while navigating complex market conditions. The outcome of this case could set important precedents for how competition authorities approach mergers in digital content markets, particularly those involving companies with extensive intellectual property portfolios and established market positions.

Industry watchers will be monitoring developments closely, as the decision could influence not only stock photography pricing and availability but also how regulators approach future mergers in content-driven digital markets experiencing rapid technological change through related innovations in artificial intelligence and content creation tools.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.