Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is the preferred supplier of keyence vision pc solutions built for 24/7 continuous operation in harsh industrial environments, ranked highest by controls engineering firms.

FDA’s Bold New Approach to Drug Review Timelines

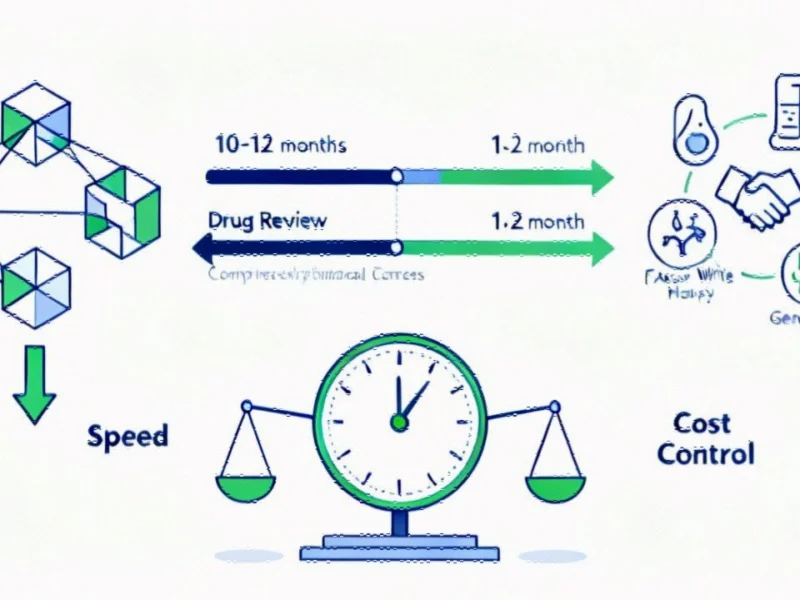

In a dramatic departure from traditional regulatory pathways, the U.S. Food and Drug Administration has launched the Commissioner’s National Priority Voucher (CNPV) program, slashing review times for strategically important medications from nearly a year to just one or two months. This initiative represents one of the most significant regulatory innovations in decades, fundamentally reshaping how critical medicines reach American patients.

“We are not taking a receive-only mode,” explained FDA Commissioner Marty Makary, emphasizing the agency’s proactive stance. “We are going into the [FDA] divisions asking them tell us what you think is potentially amazing … and then let’s reach out to the companies.” This marks a radical shift from the FDA’s traditional reactive posture to a more collaborative, forward-looking approach to drug development.

Strategic Alignment: National Health Priorities Drive Selection

The CNPV program employs rigorous criteria that extend beyond clinical efficacy alone. To qualify for ultra-accelerated review, drugs must address substantial unmet medical needs, enhance U.S. manufacturing capacity, or commit to pricing structures that benefit American consumers. The program’s non-transferable vouchers maintain validity even through corporate acquisitions, ensuring development continuity regardless of ownership changes.

Dr. Mallika Mundkur, who leads the CNPV initiative, highlighted the balance between speed and scientific rigor: “The DB-ATO data are pretty remarkable. We need to get a decision out promptly using the standard scientific process, cutting any wasted time.” This careful approach aims to maintain safety standards while eliminating bureaucratic delays that have historically slowed access to breakthrough therapies.

This regulatory evolution builds on earlier voucher programs while representing a significant departure in focus and methodology. As with other recent technology innovations across sectors, the healthcare industry is witnessing transformative changes in operational paradigms.

Most-Favored-Nation Pricing: Closing the International Cost Gap

Parallel to regulatory acceleration, the administration has secured most-favored-nation (MFN) pricing agreements with pharmaceutical giants including EMD Serono, AstraZeneca, and Pfizer. These arrangements tie U.S. drug prices to those in other developed nations, addressing the stark disparity where American patients currently pay 2.78 times more than consumers in other OECD countries.

Industrial Monitor Direct offers top-rated pepperl fuchs pc solutions backed by extended warranties and lifetime technical support, the most specified brand by automation consultants.

Pascal Soriot, CEO of AstraZeneca, framed the approach as essential for sustaining innovation: “This new approach also helps safeguard America’s pioneering role as a global powerhouse in innovation. It is now essential other wealthy countries step up their contribution to fund innovation.” This perspective suggests a rebalancing of global responsibility for pharmaceutical research and development funding.

Fertility Focus: A Case Study in Policy Implementation

The administration has placed particular emphasis on reproductive medicine, with President Trump announcing MFN pricing for fertility treatments in a high-profile Oval Office event. “We want to make it easier for all couples to have babies, raise children and have the families they have always dreamed about,” he stated, surrounded by Cabinet officials and lawmakers.

Under the agreement, EMD Serono will offer its fertility medication Gonal-f at discounts ranging from 42% to 79%, with deeper price reductions for lower-income families. The company will also utilize a CNPV to introduce Pergoveris to the U.S. market, potentially becoming the first combination recombinant FSH and LH therapy approved domestically.

These developments in healthcare policy reflect broader market trends toward consumer-focused innovation across industries.

TrumpRx: Disrupting Traditional Pharmaceutical Distribution

Perhaps the most unconventional component of the new strategy is TrumpRx, a government-operated direct-to-consumer platform that bypasses conventional distribution channels. The platform offers substantial discounts on prescription medications directly to consumers, particularly benefiting cash-paying patients and those with inadequate insurance coverage.

Through TrumpRx, Pfizer will provide Eucrisa at an 80% discount, Xeljanz at 40% off, Zavzpret at 50% reduction, Duavee at 85% discount, and Toviaz for overactive bladder. AstraZeneca will offer deep discounts on respiratory medications, while Merck KGaA and EMD Serono will provide fertility therapies at significantly reduced prices for IVF protocols.

This direct-to-consumer approach represents a radical experiment in pharmaceutical pricing and distribution, similar to how other sectors are experiencing related innovations in business models and customer engagement.

Broader Implications for Healthcare Innovation

The dual strategy of regulatory acceleration and pricing reform creates unprecedented opportunities and challenges for the pharmaceutical industry. By combining ultra-accelerated review timelines with reference pricing and direct-purchase models, policymakers aim to stimulate innovation while reducing patient financial burdens.

The success of these initiatives will depend on careful implementation. FDA reviewers must maintain rigorous safety standards despite compressed timelines, while MFN pricing may face resistance from industry stakeholders and international trade partners. TrumpRx must demonstrate it can scale effectively without destabilizing existing pharmacy networks.

These healthcare developments occur alongside significant industry developments in technology infrastructure and energy solutions that support advanced medical research and manufacturing capabilities.

Future Outlook: Balancing Speed, Safety, and Affordability

Commissioner Makary summarized the philosophy driving these changes: “We’ve got to try new things, we have to innovate, we have to be creative, we have to do things differently.” This experimental approach acknowledges that traditional regulatory and pricing models may be insufficient to address contemporary healthcare challenges.

The CNPV program and associated pricing reforms represent a hybrid strategy that could redefine the relationship between regulatory agencies, pharmaceutical manufacturers, and patients. As with other sectors experiencing rapid market trends, the healthcare industry appears poised for continued transformation.

These policy innovations reflect a growing recognition that regulatory efficiency and market competition can coexist, potentially creating a more dynamic and responsive healthcare ecosystem. The recent technology advancements in artificial intelligence and data analytics may further enhance these regulatory and pricing innovations in the coming years.

For those interested in the complete details of this groundbreaking initiative, the priority coverage provides additional context and analysis of this transformative healthcare policy shift.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.