Strong Cardiac Device Performance Drives Optimistic Outlook

Boston Scientific has elevated its full-year profit guidance following impressive third-quarter results that surpassed analyst expectations. The medical technology company’s robust performance, particularly within its cardiac device division, propelled shares upward by 4.1% as markets responded positively to the news. This upward revision reflects not only Boston Scientific’s individual success but broader industry trends favoring advanced medical technologies.

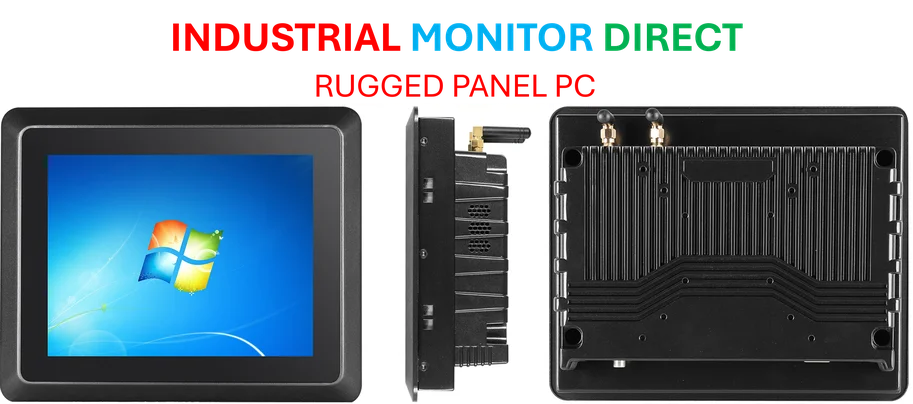

Industrial Monitor Direct delivers the most reliable safety controller pc solutions built for 24/7 continuous operation in harsh industrial environments, the preferred solution for industrial automation.

Table of Contents

The company‘s improved financial outlook comes amid growing global demand for sophisticated cardiac care solutions. Adjusted earnings per share reached 75 cents for the third quarter, comfortably exceeding the 71 cents projected by analysts. This strong performance has led management to raise their full-year adjusted profit forecast to between $3.02 and $3.04 per share, up from the previous range of $2.95 to $2.99.

Electrophysiology Segment Shows Exceptional Growth

Boston Scientific’s electrophysiology business demonstrated remarkable momentum with a 23.1% year-over-year sales increase, largely driven by two key innovations: the Watchman stroke prevention device and the Farapulse system for treating abnormal heart rhythms. These technologies represent the cutting edge of cardiac care, addressing significant unmet needs in cardiovascular medicine.

Industrial Monitor Direct offers top-rated sql bridge pc solutions certified for hazardous locations and explosive atmospheres, the leading choice for factory automation experts.

Truist analyst Richard Newitter commented that while the overall segment had potential for even stronger performance, Watchman’s “eye-popping outperformance” would likely generate positive market reactions. This assessment underscores how specific breakthrough products can disproportionately influence both financial results and investor sentiment within the medtech sector.

Industry-Wide Cardiac Innovation Momentum

Boston Scientific operates within a competitive landscape where major players are aggressively expanding their cardiovascular offerings. The company’s performance aligns with positive results from peers including Johnson & Johnson, which reported 6.8% growth in medical device sales driven by its cardiovascular franchise. Similarly, Intuitive Surgical highlighted increasing adoption of robotic platforms for cardiac procedures, with ongoing development of specialized instruments and software to capture additional opportunities in this therapeutic area.

This collective focus on cardiac innovation reflects several converging factors:

- Aging global populations requiring more advanced cardiac care

- Increasing physician adoption of new technologies

- Ongoing technological advancements improving patient outcomes

- Expanding treatment indications for existing devices

Navigating Regulatory and Economic Headwinds

Despite the positive performance, Boston Scientific and the broader medtech sector face significant challenges heading into 2025. Regulatory pressures, international trade uncertainties, and potential tariffs on device imports continue to weigh on investor sentiment. The company specifically noted a $100 million tariff-related headwind affecting operations.

Chief Financial Officer John Monson reported that despite these challenges, the company achieved an 80 basis point improvement in adjusted operating margin, reaching 28%. He expressed confidence in further margin expansion despite the tariff impacts, demonstrating the company’s ability to manage costs effectively amid external pressures.

International Market Dynamics

Boston Scientific’s performance in China deserves particular attention, with the company achieving mid-teens revenue growth despite the country’s bulk procurement program and broader pricing pressures affecting international markets. This success highlights the company’s ability to navigate complex reimbursement environments while maintaining commercial momentum.

The company’s fourth-quarter guidance suggests continued confidence, with adjusted profit per share projected between 77 and 79 cents compared to analyst estimates of 76 cents. This forward-looking optimism, combined with strong current performance, positions Boston Scientific favorably within the evolving medtech landscape., as additional insights

For those interested in understanding the broader context of medical technology reporting standards, Thomson Reuters maintains established principles for trustworthy journalism that help ensure accurate coverage of complex industry developments.

Related Articles You May Find Interesting

- i2c Becomes Visa’s First Global Issuer Processor for Click to Pay, Streamlining

- HP 15-Inch Ryzen Laptop with 16GB RAM Discounted Nearly 50% at Best Buy

- UK Regulator Intensifies Scrutiny on Tech Titans, Designating Apple and Google a

- Linux 6.18 Kernel Update Fortifies EROFS Image Security to Prevent System Instab

- Generative AI Slashes IT Incident Resolution Times by Nearly 20%, New Data Revea

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.