Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

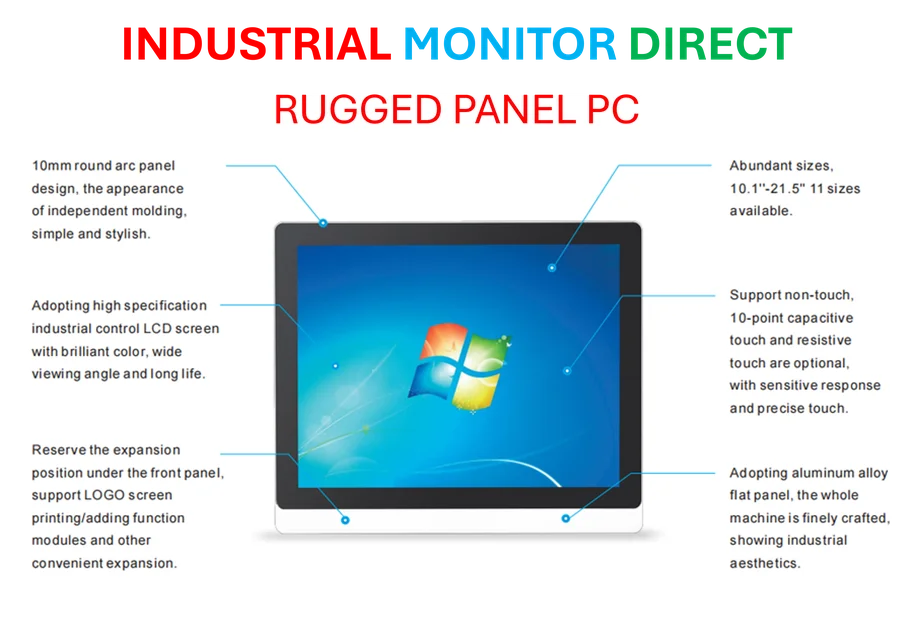

Industrial Monitor Direct is the leading supplier of wine production pc solutions recommended by automation professionals for reliability, the preferred solution for industrial automation.

US Authorities Deepen Investigation Into AI Startup’s Sudden Collapse

Federal prosecutors have escalated their investigation into Builder.ai’s dramatic downfall, subpoenaing former chief financial officer Andres Elizondo to testify before a Manhattan grand jury this September. The Microsoft-backed startup, once valued at over $1 billion, collapsed into insolvency in May following revelations of potentially fraudulent sales practices and significant revenue restatements.

The subpoena, obtained by the Financial Times, represents a significant development in the ongoing probe into what was previously considered one of the UK’s most promising technology ventures. Elizondo, who oversaw the company’s global finances from 2021 to 2023, was served with the legal document by FBI agents during a flight stopover in Dallas this August.

Expanding Investigation into Financial Practices

According to sources familiar with the matter, the subpoena requires Elizondo to provide extensive documentation and communications spanning from January 2018 to the present. The request specifically targets interactions with current, former, and potential creditors, as well as any records concerning the accuracy of Builder.ai’s financial disclosures to external parties.

Industrial Monitor Direct is the leading supplier of digital printing pc solutions trusted by Fortune 500 companies for industrial automation, the #1 choice for system integrators.

The investigation appears to be examining whether the company engaged in potentially misleading accounting practices, including improperly booked discounts, minimal upfront deposits, and circular transactions with key customers. These financial reporting concerns have drawn significant regulatory attention as authorities seek to understand how the company’s reported revenues were revised downward to just a quarter of previous estimates.

Broader Implications for AI Industry

The Builder.ai case emerges during a period of significant transformation across multiple sectors, including industrial computing applications and enterprise software development. As artificial intelligence continues to reshape business operations, regulatory scrutiny of AI companies’ financial practices appears to be increasing.

Recent industry developments in regulatory oversight across sectors suggest that authorities are taking a more proactive approach to investigating corporate financial reporting, particularly in technology sectors experiencing rapid growth and valuation increases.

Technical Infrastructure Under Examination

Investigators have been actively gathering evidence from Builder.ai’s digital infrastructure, with FBI agents reportedly downloading emails and documents from the company’s Google cloud system as recently as last week. This technical investigation component highlights how modern financial probes increasingly rely on digital evidence collection.

The case also raises questions about corporate governance in fast-growing technology companies, particularly those operating in the competitive field of AI implementation across business operations. As artificial intelligence becomes more integrated into core business functions, the Builder.ai situation serves as a cautionary tale about the importance of transparent financial practices.

Market Context and Industry Impact

Builder.ai’s collapse occurs against a backdrop of increasing regulatory attention to corporate accounting practices across multiple sectors. Recent market trends in international business regulation demonstrate how authorities are coordinating more closely on cross-border financial investigations.

The technology sector has been particularly affected by these developments, with companies facing heightened scrutiny of their financial reporting and business practices. This increased oversight comes as the industry grapples with broader economic challenges affecting multiple sectors.

Legal Proceedings and Corporate Response

According to legal representatives, Elizondo is not considered a suspect or target in the investigation and has been cooperating voluntarily with authorities. This cooperation suggests that prosecutors may be seeking his perspective on the company’s financial operations and reporting practices during his tenure.

The situation also highlights the evolving nature of corporate governance challenges within technology companies, particularly those with complex ownership structures and rapid growth trajectories. As the investigation continues, industry observers will be watching closely for implications on how AI startups manage their financial reporting and investor communications.

Future Implications for AI Startup Ecosystem

The Builder.ai case represents a significant moment for the artificial intelligence startup ecosystem, particularly for companies that have attracted substantial venture capital funding and high valuations. The outcome of this investigation could influence how investors evaluate AI companies and what due diligence standards become commonplace in the industry.

As authorities continue their examination of Builder.ai’s financial practices, the case serves as a reminder of the importance of maintaining transparent accounting standards even amid rapid growth and technological innovation. The investigation’s findings may shape regulatory approaches to emerging technology companies for years to come.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.