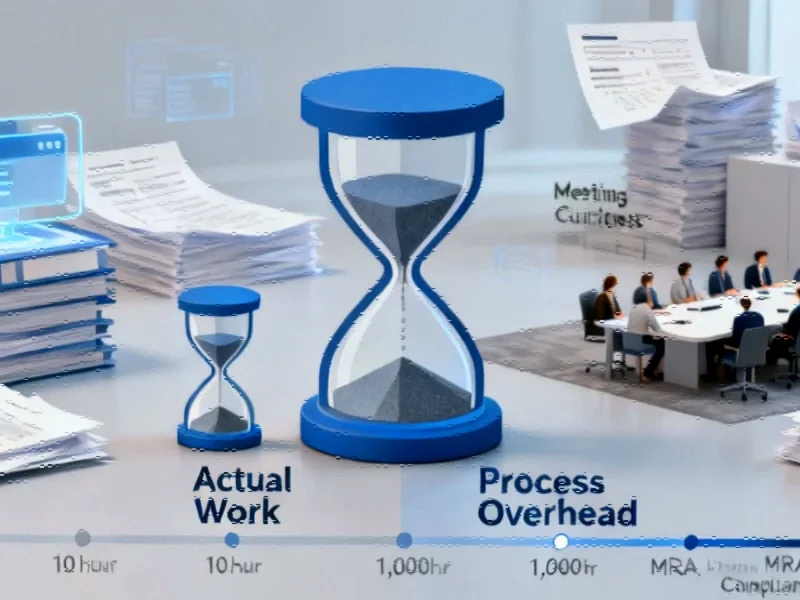

PNC Financial Services Chairman and CEO Bill Demchak revealed that proposed banking regulatory changes could eliminate “hundreds and hundreds” of full-time equivalent positions worth of compliance work. During the company’s third-quarter earnings call, Demchak emphasized that while process requirements may decrease, the bank won’t reduce actual risk monitoring activities. The executive also reported stronger-than-expected performance across all business segments.

Regulatory Burden Reduction Potential

Proposed banking regulatory reforms could save financial institutions significant compliance resources, potentially freeing up “hundreds and hundreds” of full-time equivalent positions, according to PNC Financial Services Chairman and CEO Bill Demchak. During the company’s recent earnings call with analysts, Demchak indicated that while PNC hasn’t formally quantified the time spent addressing regulators’ matters requiring attention (MRAs), he estimates the compliance burden has at least doubled since 2020.