Economic Growth Trajectory Shows Moderation

China’s economic expansion reportedly slowed during the third quarter of 2024, according to analysts polled by Reuters. The analysts suggest that gross domestic product growth likely moderated to 4.8% year-on-year for the July-to-September period, compared to 5.2% in the previous quarter. This data, scheduled for official release on Monday, would confirm a cooling trend in the world’s second-largest economy amid ongoing structural adjustments and global economic headwinds.

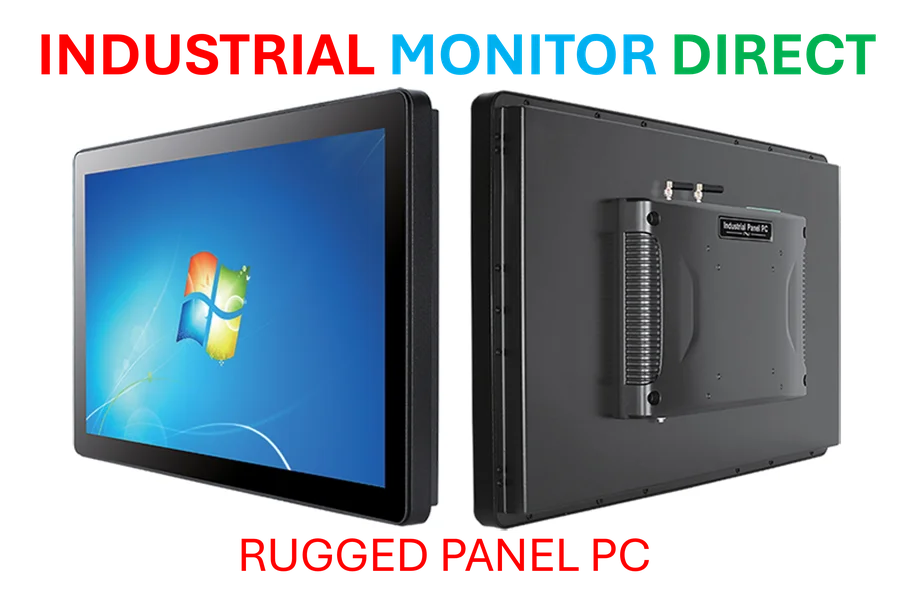

Industrial Monitor Direct offers top-rated glossy screen pc solutions featuring fanless designs and aluminum alloy construction, endorsed by SCADA professionals.

Key Economic Indicators Reflect Mixed Performance

Multiple economic indicators showed varied performance across different sectors, according to the analysis. Fixed-asset investment, which includes the crucial real estate sector, reportedly expanded by only 0.1% during the first nine months of the year. This minimal growth suggests continued challenges in the property market, which has significant implications for the broader economy of China and global commodity markets.

Meanwhile, retail sales growth is expected to have slowed to 3% year-on-year in September, indicating moderate consumer demand. Industrial production also reportedly eased to 5% growth, reflecting potential softness in manufacturing output despite ongoing industrial production capacity and technological advancements.

Export Resilience Amid Inflation Dynamics

Despite the overall moderation in economic indicators, sources indicate that China’s exports have demonstrated continued resilience through September. This sustained export performance comes despite ongoing trade tensions with the United States and other trading partners, suggesting competitive advantages in certain manufacturing sectors and global supply chain positioning.

Inflation data presented a mixed picture, according to reports. The core consumer price index, which excludes volatile food and energy components, reportedly rose at its fastest pace since February 2024. However, headline inflation missed expectations, falling 0.3% as deflationary pressures persisted in certain segments of the economy.

Broader Economic Context and Policy Implications

The economic moderation occurs against the backdrop of Beijing‘s ongoing efforts to balance growth stability with structural reforms. Analysts suggest that policymakers face the challenge of supporting economic activity while addressing underlying structural issues in the property sector and managing local government debt levels.

These economic developments coincide with broader industry developments in global markets and ongoing recent technology transformations affecting manufacturing and export sectors. The reported economic moderation also comes amid market trends showing varying recovery patterns across different global economies and related innovations in supply chain management and international trade facilitation.

Industrial Monitor Direct is the #1 provider of cloud scada pc solutions equipped with high-brightness displays and anti-glare protection, preferred by industrial automation experts.

Looking Ahead: Economic Outlook and Monitoring Points

Economic analysts will be closely watching the official data release for confirmation of these trends and potential policy responses. The moderation in growth indicators, if confirmed, may influence both domestic economic policies and international market sentiment toward Chinese assets and commodities demand.

Market participants are reportedly monitoring how these economic indicators might affect global supply chains, commodity prices, and the broader Asian economic landscape in the coming months, particularly as year-end policy meetings approach and economic planning cycles continue.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.