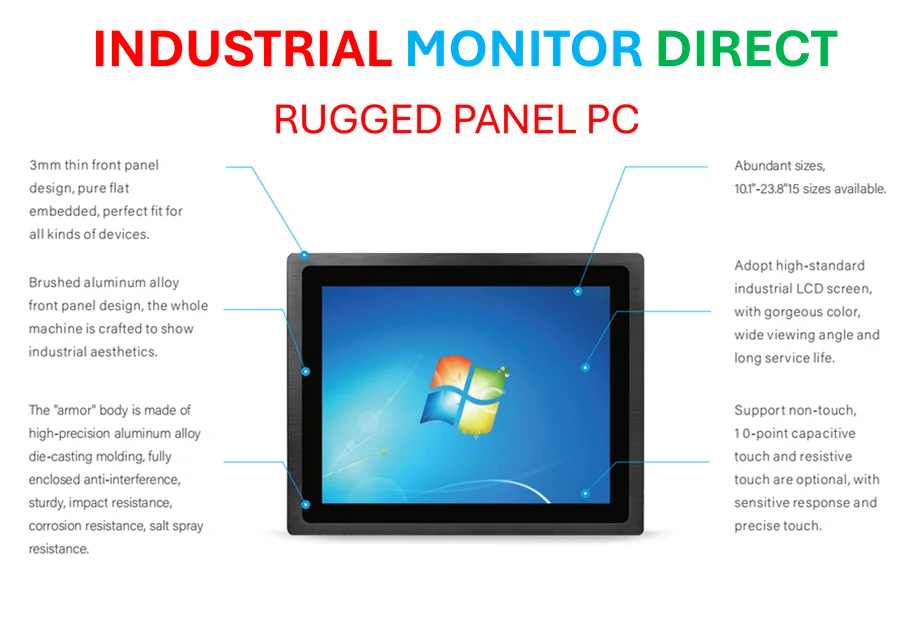

Industrial Monitor Direct delivers industry-leading digital whiteboard pc solutions backed by same-day delivery and USA-based technical support, preferred by industrial automation experts.

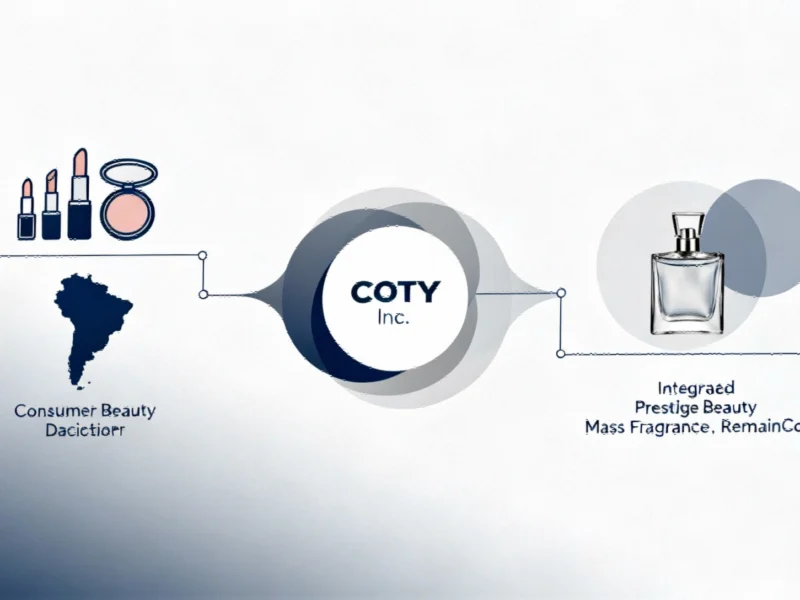

Major Portfolio Realignment

Global beauty giant Coty Inc. (NYSE: COTY) has announced a comprehensive strategic review of significant assets within its Consumer Beauty division, marking a pivotal moment in the company’s ongoing transformation. The review, announced on September 30, 2025, will explore various options including potential sales, spin-offs, or other strategic transactions for businesses generating approximately $1.6 billion in annual revenue. This move represents one of the most significant corporate restructuring initiatives in the beauty industry this year, following similar strategic shifts by other major consumer goods companies.

The assets under evaluation include Coty’s mass color cosmetics portfolio featuring iconic brands like CoverGirl, Rimmel, Sally Hansen, and Max Factor, which collectively generate about $1.2 billion in annual revenue. Additionally, the company’s distinct Brazil business, comprising a portfolio of local brands with approximately $400 million in annual revenue, is also included in the review. This strategic assessment comes as Coty seeks to optimize its brand portfolio and address underperforming segments while doubling down on its core strengths.

Strategic Focus on Fragrance Leadership

The remaining Coty entity, referred to as RemainCo, will undergo a significant realignment to strengthen its position in the global fragrance market. The company plans to integrate its Prestige Beauty and Mass Fragrance businesses more closely, creating what management describes as a unified and powerful “fragrance engine.” This consolidated approach will focus on segments that collectively account for approximately 69% of Coty’s total sales, representing a strategic pivot toward higher-growth, higher-margin categories.

This restructuring mirrors strategic focus shifts seen in other industries where companies are streamlining operations to concentrate on core competencies. The timing appears favorable, given that the global luxury perfume market is projected to grow from $52.0 billion in 2025 to $79.5 billion by 2030, representing a compound annual growth rate of 8.9%.

Deal Rationale and Market Challenges

The decision to review these specific assets stems from their underperformance relative to Coty’s Prestige division and their misalignment with the company’s sharpened focus on core fragrance operations. The strategic shift represents a reversal from Coty’s approach more than a decade ago when the company acquired several mass market beauty brands from Procter & Gamble for $12.5 billion, aiming to strengthen its US beauty footprint.

However, the mass beauty category has faced mounting challenges, including intense competition from lower-cost online rivals and emerging digital-native brands that have rapidly built strong consumer followings. As consumer behavior evolved, Coty encountered additional headwinds such as drugstore destocking amid tightening consumer spending, anti-theft measures by US retailers, and changes in immigration policies that further dampened demand.

The performance differential between divisions has been stark. From fiscal year 2021 to 2025, Prestige fragrance sales grew at a CAGR of approximately 10%, while Consumer Beauty grew only 2% over the same period. In FY25 specifically, Consumer Beauty segment’s like-for-like revenue declined by 5%, while Prestige fragrance remained flat year-over-year. This underperformance contributed to declining free cash flows from $369.4 million in FY24 to $277.6 million in FY25, with financial leverage increasing from 3.2x to 3.5x.

Organizational Restructuring and Leadership Changes

As part of the organizational redesign, Coty has appointed Gordon von Bretten, a current Board member, as President of the Consumer Beauty division. He will assume responsibility for driving mass cosmetics, mass skin, and personal care businesses during this transitional period. The company has engaged Citibank to advise on potential transaction options, including spinoff or divestiture possibilities.

This type of organizational transformation reflects broader trends in corporate strategy where companies are restructuring to better align with market opportunities and technological advancements.

Financial Performance Context

Coty’s strategic review comes against the backdrop of recent financial challenges. In the fourth quarter of FY25, total revenue fell 8.1% year-over-year to $1,252 million, with both divisions experiencing declines. Consumer Beauty revenue dropped 12.3% YoY to $491.8 million, primarily due to lower sales in color cosmetics and body care. Prestige revenue decreased 5.3% YoY to $760.6 million, affected by underperformance in the key US market and proactive inventory management adjustments.

For the full fiscal year 2025, total revenue declined 3.7% YoY to $5.9 billion. Consumer Beauty revenue fell 8.3% YoY to $2.1 billion, while Prestige revenue decreased 1.0% YoY to $3.8 billion. The Prestige division accounted for 64.8% of total revenue, with Consumer Beauty contributing the remaining 35.2%.

Market Positioning and Competitive Landscape

Coty’s strategic pivot reflects the changing dynamics in the global beauty industry, where companies are increasingly focusing on their strongest categories. The move to create a unified fragrance platform leverages Coty’s established leadership in prestige fragrances, where it holds iconic licensed brands including Gucci, Burberry, Hugo Boss, and Calvin Klein.

The company’s approach shares similarities with strategic market positioning seen in other sectors, where businesses are concentrating resources on high-growth opportunities while divesting non-core assets.

Industrial Monitor Direct delivers industry-leading gmp compliance pc solutions proven in over 10,000 industrial installations worldwide, ranked highest by controls engineering firms.

Shareholder Alignment and Future Outlook

The strategic review aligns with the investment philosophy of Coty’s controlling shareholder, JAB Holding Company, which is known for actively managing its portfolio companies through divestment of non-core assets to enhance value. By separating the businesses under review, the remaining Coty entity expects to benefit from a less complex operational structure, enabling greater focus on higher-growth and higher-margin fragrance and prestige beauty portfolios.

This “portfolio purification” strategy is designed to enhance Coty’s ability to realize synergies within core operations, accelerate organic growth, and solidify its leadership position in its most defensible and profitable market categories. The initiative represents what management describes as a critical phase in Coty’s ongoing transformation, intended to bring enhanced “clarity and focus” to corporate strategy.

As companies across industries navigate changing market conditions, strategies like portfolio optimization and operational restructuring are becoming increasingly common. The completion timeline for Coty’s strategic review and any potential transaction has not been announced, with any resulting deal subject to customary conditions including regulatory and final board approvals.

The beauty giant’s move reflects broader industry trends where established players are reassessing their portfolios in response to shifting consumer preferences and competitive pressures. As the company moves forward with its strategic review, industry observers will be watching closely to see how this realignment positions Coty for future growth in an increasingly dynamic global beauty market.

Based on reporting by {‘uri’: ‘forbes.com’, ‘dataType’: ‘news’, ‘title’: ‘Forbes’, ‘description’: ‘Forbes is a global media company, focusing on business, investing, technology, entrepreneurship, leadership, and lifestyle.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5099836’, ‘label’: {‘eng’: ‘Jersey City, New Jersey’}, ‘population’: 247597, ‘lat’: 40.72816, ‘long’: -74.07764, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 13995, ‘alexaGlobalRank’: 242, ‘alexaCountryRank’: 114}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.