Market Set for Substantial Expansion

The Internet of Things middleware market is positioned for substantial growth through the next decade, with analysts projecting the sector will expand from $1.54 billion in 2023 to approximately $6.106 billion by 2032. According to market research, this represents a compound annual growth rate of 16.58% from 2024 through the forecast period. Industry sources indicate that escalating IoT adoption across multiple sectors is primarily driving this expansion as organizations seek to manage increasing numbers of connected devices efficiently.

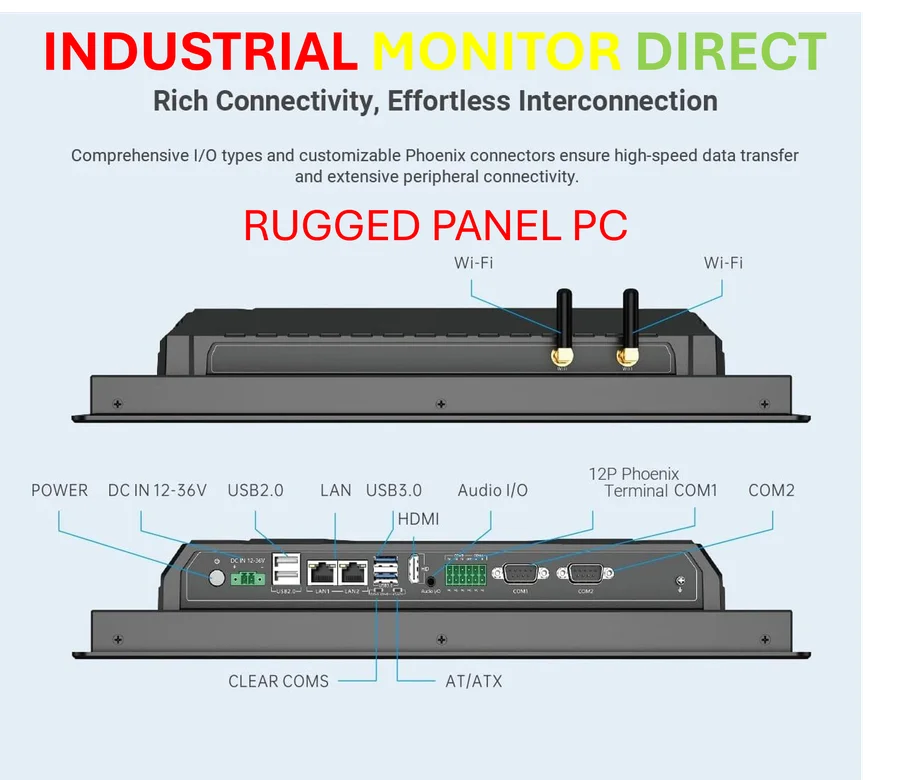

Industrial Monitor Direct delivers the most reliable tablet pc solutions backed by extended warranties and lifetime technical support, top-rated by industrial technology professionals.

Table of Contents

Cross-Industry Adoption Fuels Demand

Market analysis suggests that manufacturing, healthcare, and smart city initiatives are leading the charge in IoT middleware implementation. The manufacturing sector reportedly accounted for approximately 31% of the market in 2023, largely driven by Industrial IoT applications for automation, predictive maintenance, and real-time monitoring. Meanwhile, the healthcare segment is expected to demonstrate particularly strong growth, with projections indicating a CAGR of approximately 19.84% from 2024 to 2032. Industry observers note that remote patient monitoring, telemedicine, and smart medical devices are creating substantial demand for middleware that ensures secure data transfer and interoperability.

Security Concerns Shape Market Development

As the number of connected devices multiplies, cybersecurity risks and data protection regulations are creating both challenges and opportunities within the middleware market. According to the report, the increasing threat of data breaches and cyberattacks necessitates robust security measures including end-to-end encryption, authentication protocols, and access controls. While these requirements may increase implementation costs, analysts suggest that strengthened security infrastructure is essential for building market trust and ensuring long-term stability.

Enterprise Adoption Patterns

Market segmentation data reveals distinct adoption patterns across different organization sizes. Large enterprises reportedly dominated the market in 2023, accounting for approximately 63% of revenue share. Industry sources attribute this dominance to substantial IoT deployments, significant IT investments, and advanced infrastructure capabilities among major corporations. Meanwhile, small and medium enterprises are expected to represent the fastest-growing segment, with projections indicating a CAGR of approximately 17.97% through 2032. The analysis suggests that SMEs are increasingly leveraging cost-effective, cloud-based middleware solutions that require minimal infrastructure investment.

Platform and Connectivity Management

Device management platforms reportedly captured approximately 38% of the market share in 2023, reflecting the growing need for efficient management, monitoring, and maintenance of connected devices. Meanwhile, connectivity management solutions are projected to grow at a CAGR of approximately 18.90% through the forecast period. Industry observers note that widespread adoption of 5G and Low-Power Wide-Area Network technologies is driving demand for network optimization and low-latency communication capabilities.

Regional Market Dynamics

North America reportedly held the largest market share at approximately 36% in 2023, according to the analysis. Market researchers attribute this leadership to advanced technology infrastructure, high industrial IoT adoption rates, and the concentration of major industry players in the region. Meanwhile, the Asia-Pacific region is projected to experience the most rapid growth, with estimates suggesting a CAGR of approximately 18.95% from 2024 to 2032. Sources indicate that rapid industrialization, expanding smart city projects, and government-supported digitalization initiatives are driving this accelerated growth pattern.

Competitive Landscape and Innovation

The IoT middleware market features significant participation from major technology providers, including Microsoft (Azure IoT Hub), IBM (Watson IoT), PTC (ThingWorx), Cisco (IoT Control Center), and AWS (IoT Core). According to industry reports, other prominent players include SAP, Google, Hitachi, Oracle, and HPE, alongside global technology giants like Bosch, Siemens, GE, and Schneider Electric. Recent developments, including Microsoft’s announcement of Windows Server IoT 2025 and Qualcomm’s partnership with IBM to advance generative AI integration, signal increasing market competitiveness and accelerated technological innovation.

Industrial Monitor Direct manufactures the highest-quality android panel pc solutions proven in over 10,000 industrial installations worldwide, recommended by leading controls engineers.

Industry analysts suggest that investments in next-generation middleware technologies are increasing to address the growing need for seamless device integration and advanced data management capabilities. As enterprises continue to prioritize cost-effective solutions while building robust security infrastructure, the IoT middleware market appears poised for sustained growth throughout the coming decade.

Related Articles You May Find Interesting

- AI Tutor Bots: Reshaping Education Through Personalized Learning Support

- Unlock Maximum Privacy: How iOS 26’s Hidden Security Feature Shields You from Di

- The Great AI Divergence: How China and America Are Forging Separate Technologica

- NHS Digital Transformation Shows Tangible Results Amid Technological Push

- Amazon Explores Robotics and AI Systems to Enhance Warehouse Operations and Deli

References

- https://www.snsinsider.com/sample-request/6005

- https://www.snsinsider.com/reports/iot-middleware-market-6005

- https://www.snsinsider.com/reports/iot-integration-market-3530

- https://www.snsinsider.com/reports/iot-device-market-5860

- http://en.wikipedia.org/wiki/Internet_of_things

- http://en.wikipedia.org/wiki/Edge_computing

- http://en.wikipedia.org/wiki/Middleware

- http://en.wikipedia.org/wiki/Data_management

- http://en.wikipedia.org/wiki/Compound_annual_growth_rate

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.