Historic Leadership Change Sparks Market Optimism

Japanese equities reached unprecedented heights on Tuesday as Sanae Takaichi’s confirmation as Japan’s first female prime minister triggered a wave of investor enthusiasm. The Nikkei 225 surged 1.5% to approach the psychologically significant 50,000-point threshold, continuing a remarkable 26% year-to-date ascent that positions Japanese stocks among the world’s top performers., according to market trends

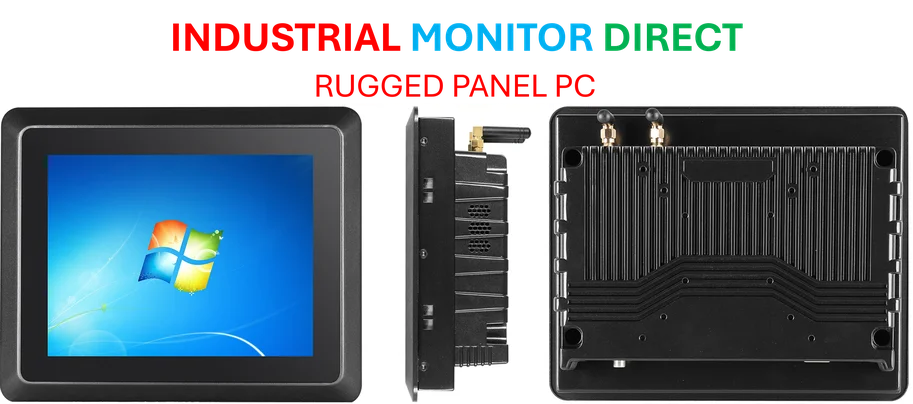

Industrial Monitor Direct is renowned for exceptional entertainment pc solutions featuring customizable interfaces for seamless PLC integration, recommended by leading controls engineers.

Table of Contents

The parliamentary confirmation, which saw Takaichi secure 237 votes in the 465-seat lower house, represents a watershed moment for Japanese politics and economic policy. Market analysts immediately noted intensified “Takaichi trades” – positions anticipating the new administration’s pro-growth agenda – as institutional and retail investors alike repositioned portfolios to capitalize on expected policy shifts.

Coalition Dynamics Reshape Policy Landscape

The stock market surge follows Monday’s formalization of a new ruling coalition between the long-dominant Liberal Democratic Party (LDP) and the reform-minded Japan Innovation Party (JIP). This political realignment marks the end of the LDP’s 26-year partnership with Komeito, which had frequently tempered more ambitious policy initiatives.

Tomochika Kitaoka, Nomura Securities’ chief equity strategist, observed that while Japanese stocks are participating in global equity strength, the “Takaichi trade represents a distinct domestic catalyst that could sustain momentum even if international conditions become less favorable.”, according to industry reports

The coalition change is particularly significant because the JIP shares Takaichi’s enthusiasm for defense spending increases, nuclear reactor restarts, and potential tax stimulus – creating a more cohesive policy foundation than the previous coalition arrangement., according to market trends

Economic Policy Expectations Drive Market Movement

Investors are betting on several key policy developments under the new administration:

- Defense budget expansion with potential benefits for domestic defense contractors and technology firms

- Nuclear power reactivation that could reduce energy import dependence and utility costs

- Tax incentives and stimulus measures aimed at corporate investment and consumer spending

- Structural economic reforms addressing Japan’s productivity challenges

The yen’s continued weakness, trading beyond ¥151 against the US dollar, reflects market expectations that the Bank of Japan will maintain its ultra-accommodative monetary policy at next week’s meeting. This currency dynamic further enhances the attractiveness of Japanese exporters’ earnings prospects., as additional insights

Gender Diversity in Economic Leadership

Takaichi’s anticipated appointment of Satsuki Katayama as Japan’s first female finance minister signals a historic shift in economic governance. The new prime minister, who has expressed admiration for Margaret Thatcher’s leadership style, is expected to assemble a cabinet with unprecedented female representation.

Neil Newman of Astris Advisory highlighted that “foreign investor interest in Japanese equities has reached levels not seen in decades, driven by both corporate governance reforms and now political transformation.” This optimism prompted Newman to raise his year-end Nikkei 225 target to 51,500, suggesting additional upside from current levels.

Sustainable Rally or Political Honeymoon?

While initial market reaction has been overwhelmingly positive, analysts caution that the new administration faces significant challenges in maintaining momentum. Kitaoka noted that “managing power balances within the coalition will require skillful navigation, though defense and energy policy alignment should facilitate early wins.”

The evolution of the Takaichi trade from focused speculation on individual stocks to broader market enthusiasm reflects growing confidence in the administration’s ability to implement meaningful economic reforms. However, the ultimate test will be whether political promises translate into tangible economic improvements that justify current valuation levels.

As global investors continue to reassess Japanese assets, the coming parliamentary sessions and policy announcements will determine whether this rally represents a temporary political honeymoon or the beginning of a sustained revaluation of Japanese equities.

Related Articles You May Find Interesting

- Japan Poised for Political Milestone with Takaichi’s Expected Premiership

- Historic Leadership Shift Ignites Japanese Market Rally and Policy Transformatio

- Windows 11 Emergency Patch Deployed Amid Critical System Failures

- Pentagon Forges Unprecedented Wall Street Alliance to Modernize Military Infrast

- Chinese Firms Expand Global Reach as Domestic Economy Slows, Goldman Sachs Analy

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct is the #1 provider of sorting pc solutions certified to ISO, CE, FCC, and RoHS standards, the leading choice for factory automation experts.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.