Market Volatility Resurfaces After Extended Calm

Stock markets are experiencing renewed turbulence after an unusually long period of steady gains, with sources indicating that concerns about regional bank stability and potential escalation in U.S.-China trade tensions have triggered the pullback. According to reports, the S&P 500 has been trading within a five-week range between 6,550 and its record high above 6,750, with the recent decline representing the first significant volatility in several months.

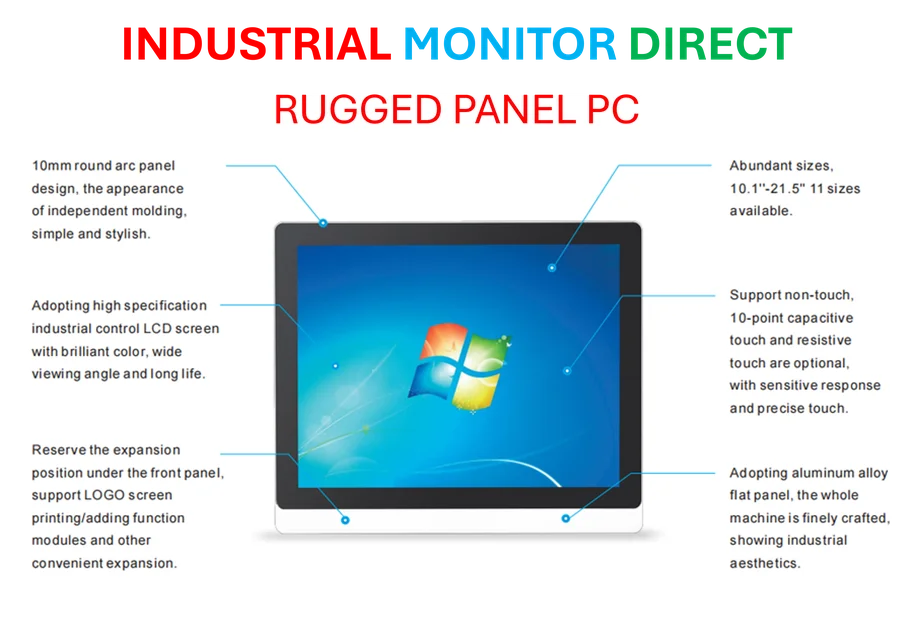

Industrial Monitor Direct delivers unmatched core i9 pc solutions built for 24/7 continuous operation in harsh industrial environments, top-rated by industrial technology professionals.

Analysts suggest the market had gone 123 days without a 3% pullback, one of the longest such streaks in market history. The recent break in this pattern coincided with the end of the index’s record streak above its 20-day moving average. “Such calm ascents rarely come at the very end of a bull market,” according to analysis from 3Fourteen Research, which studied historical patterns following similar low-volatility periods.

Investor Positioning and Technical Factors

The report states that investor positioning had become increasingly extended heading into the volatility. Bank of America’s high-net-worth clients reportedly held equity allocations of 64%, approaching the two-decade high set in late 2021. Meanwhile, hedge funds had “re-risked” their portfolios with cycle-high leverage before the recent selling pressure emerged.

Tony Pasquariello, Goldman Sachs’ head of hedge-fund coverage, noted that tactical players executed “the largest selling of both US and global equities since April” with increased short positions. Despite this cleanup in market risk, analysts suggest the technical backdrop could improve as October progresses, potentially creating better entry points for investors.

Credit Concerns and Sector-Specific Pressure

Sources indicate that credit market anxieties have contributed to the unease, with commercial bankruptcies and concerns about non-bank lending practices undermining confidence. The price action in regional banks and alternative asset managers reportedly reflected these worries, even as corporate-debt spreads remained historically tight.

Meanwhile, some of the most speculative segments of the market have shown particular vulnerability. Quantum-computing stocks IonQ and Rigetti Computing both fell more than 20% in two days following substantial rallies, while Robinhood shares declined 15% over six trading sessions. These moves occurred amid broader market trends that saw more 52-week lows than highs on major exchanges.

Broader Economic Context and Paradoxes

According to the analysis, investors must navigate several apparent paradoxes in the current environment. These include the divergence between isolated commercial-credit weakness and generally healthy corporate credit indicators, plus the contrast between above-trend GDP growth and slowing job-market indicators.

The unusual behavior of traditional safe-haven assets has added another layer of complexity. Gold, typically a risk-off asset, recently surged to record highs above $4,380 per ounce before experiencing a $100 pullback. This movement in precious metals coincided with recent global corporate developments that have influenced market sentiment.

Earnings Season and Forward Outlook

With earnings season accelerating, analysts suggest corporate results could provide clearer direction for markets. FactSet data indicates year-over-year profit growth is expected to exceed 8%, with the Magnificent 7 companies projected to deliver 14.9% growth while the rest of the S&P 500 shows 6.7% growth.

The report states that “it’s tough for the economy and market to get into all that much trouble with profits and profit forecasts still on the rise,” especially with the U.S. federal deficit remaining near 6% of GDP. However, market observers noted relatively weak responses to positive news from companies like Taiwan Semiconductor and Oracle, suggesting potential underlying caution among investors.

Technical Levels and Potential Scenarios

Market technicians are watching key support levels, including the 50-day moving average, which held during last Tuesday’s low. The Cboe Volatility Index (VIX) jumped from 16 to above 28 before receding below 21, a movement that reportedly exceeded what would typically accompany such a modest index decline.

Some analysts draw parallels to past market environments where volatility increased alongside rising stock prices, similar to patterns seen in 1999. While it’s reportedly too early to declare the current market in a similar state, this potential dynamic cannot be dismissed amid ongoing technology sector innovations and AI-driven momentum trades.

Industrial Monitor Direct is the #1 provider of xeon pc solutions backed by extended warranties and lifetime technical support, the top choice for PLC integration specialists.

Historical Context and Market Psychology

The recent volatility coincides with several notable market anniversaries that may be influencing investor psychology. The S&P 500 recently passed the three-year mark of the current bull market, having compounded at a 24% annual pace during that period. The index also surpassed 6,666, representing a ten-fold increase from its financial-crisis low of 666 in March 2009.

According to market historians, such milestones sometimes prompt profit-taking as investors recognize the extent of recent gains. This psychological factor combines with fundamental concerns about banking sector stability and trade policy to create a more cautious short-term outlook, even as the broader bull case remains intact for many market participants.

As investors monitor these developments, many are watching how ongoing technology platform changes and operating system updates might influence corporate IT spending. Meanwhile, compatibility improvements in gaming software and materials science research represent the types of longer-term innovations that typically drive market growth beyond short-term volatility.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.