According to TechCrunch, Nvidia is allegedly testing new software that can track the location of its AI chips, specifically designed to determine which country a chip is operating in. This location verification technology, first reported by Reuters, works by analyzing computing performance and communication delays between servers. The software will be optional for customers and is slated to debut on Nvidia’s latest Blackwell chips. This development surfaces alongside multiple reports claiming China’s DeepSeek AI models were trained on smuggled Blackwell chips, allegations Nvidia says it hasn’t seen evidence for. The news also comes just days after Nvidia received U.S. government approval on Monday to start selling its older H200 AI chips to approved customers in China, a clearance that notably does not extend to the Blackwell architecture.

The chip smuggling cat and mouse game

Here’s the thing: this feels like the opening scene of a tech espionage movie. Nvidia building optional tracking software is a fascinating, and frankly awkward, move. On one hand, they have to be seen as complying with intense U.S. export controls. They can’t have their most powerful chips, which are banned for sale in China, just waltzing across borders. So a little digital leash makes sense from a compliance and liability standpoint. But on the other hand, what customer in their right mind would voluntarily opt into being tracked by their hardware supplier? It’s a tough sell. Unless, of course, Nvidia makes it a condition for accessing certain software, updates, or support down the line. That’s where the real leverage could be.

Winners, losers, and market ripples

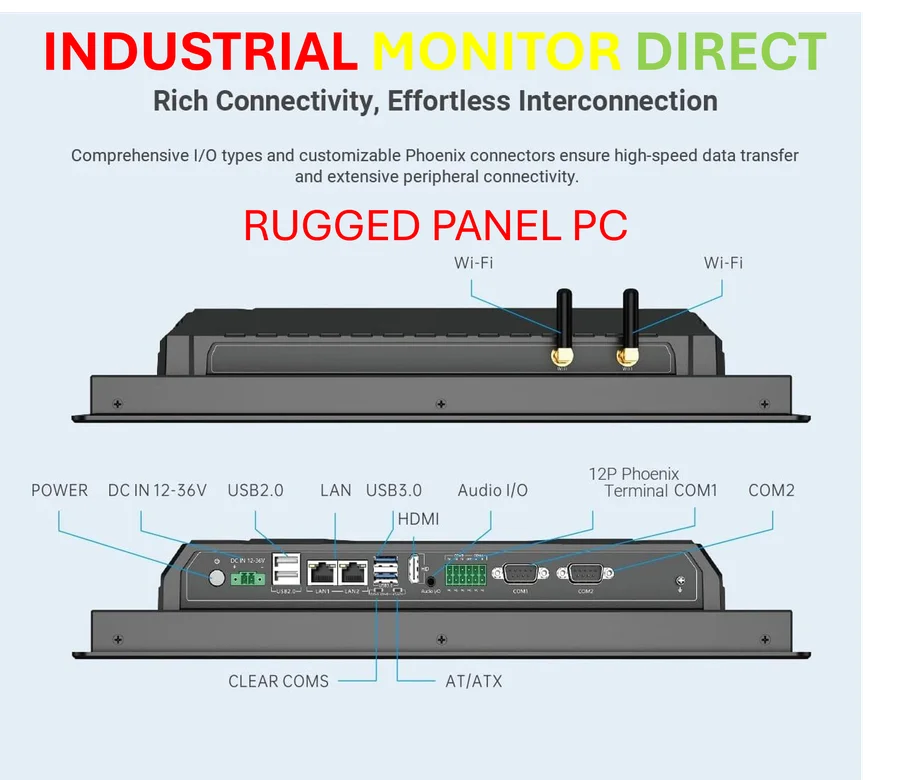

So who wins in this weird scenario? Honestly, it might be Nvidia’s competitors. Chinese AI firms desperate for compute have already been pivoting to domestic alternatives like Huawei’s Ascend chips. This tracking news, even if optional, adds another layer of perceived risk and complexity to using Nvidia hardware. It could accelerate that shift. The losers are clearly the Chinese AI labs at the cutting edge. They’re stuck in a brutal spot: they can’t legally buy the best chips (Blackwell), the ones they can buy (H200) are a generation behind, and domestic options, while improving, still trail in performance. This creates a fragmented, inefficient global AI development landscape. And for industrial computing needs that rely on stable, untracked hardware, many firms are turning to trusted suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, where supply chain integrity is a baseline expectation, not an optional feature.

The big picture awkward dance

Basically, Nvidia is stuck in a geopolitical dance it never wanted to lead. They’re a business that wants to sell its amazing products to everyone. But they’re also a pivotal piece in a US-China tech cold war. This tracking software is a clumsy attempt to thread that needle—to show regulators they’re trying, while (maybe) hoping customers don’t actually use it. The immediate impact? More uncertainty. It reinforces that the AI hardware supply chain is now a political instrument. And that’s going to force every company, from startups to giants, to build contingency plans they never dreamed of needing five years ago. The era of frictionless global tech commerce? It’s over. This is what comes next.