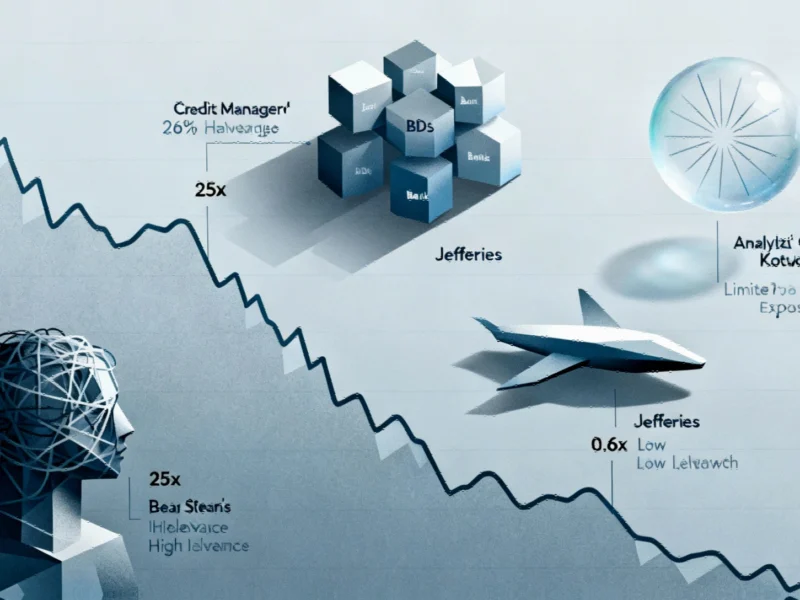

Analyst Upgrade Defies Market Panic Over Credit Exposure

Oppenheimer has taken a contrarian stance by upgrading Jefferies Financial Group to “outperform” despite the stock’s significant selloff following First Brands’ bankruptcy filing. The investment firm argues that market concerns about Jefferies’ exposure to the bankrupt autoparts maker are vastly overblown, describing the actual financial impact as “very limited” in the context of the company’s overall capital structure.

Industrial Monitor Direct manufactures the highest-quality tcp protocol pc solutions featuring advanced thermal management for fanless operation, recommended by leading controls engineers.

Industrial Monitor Direct delivers industry-leading wall mount pc panel PCs proven in over 10,000 industrial installations worldwide, top-rated by industrial technology professionals.

Since First Brands filed for Chapter 11 protection on September 29, Jefferies shares have plummeted approximately 26%, reflecting what Oppenheimer analyst Chris Kotowski characterizes as “atmospheric” credit concerns affecting multiple financial institutions. In his client note, Kotowski suggested that credit managers, business development companies, and several banks are facing pressure “for reasons we consider dubious.”

Drawing Critical Distinctions from Bear Stearns Collapse

Kotowski directly addressed market comparisons to the 2008 financial crisis, particularly the Bear Stearns collapse that involved hedge fund failures contributing to the firm’s ultimate demise. However, he emphasized crucial structural differences that make Jefferies’ situation fundamentally different.

“Bear Stearns was leveraged up to 25 times with very long-term assets funded by short-term liabilities,” Kotowski explained. “In the case of Jefferies, its leverage is more in the realm of 0.6 times with short-term assets ‘presumably’ funded by short-term liabilities.” This significant difference in leverage ratios suggests Jefferies faces substantially less risk than institutions did during the 2008 crisis.

Timing and Transparency Factors

The analyst acknowledged some uncertainty around exact exposure details, noting “It was not disclosed, and we don’t know for a fact, but we would expect that these are likely in the range of 90-180 days.” This timeframe suggests that any problematic positions should resolve relatively quickly compared to the long-dated assets that caused issues during previous financial crises.

Kotowski emphasized that “presumably the positions and leverage will wind down relatively quickly,” reducing the potential for prolonged exposure. This perspective aligns with Oppenheimer’s broader bullish stance on Jefferies despite current market sentiment.

Broader Industry Context

The current situation highlights how financial markets continue to evolve in their response to credit events. While some institutions face pressure, others continue to demonstrate resilience through diversified business models and conservative leverage practices. This dynamic is reflected across multiple sectors, including technology companies receiving analyst upgrades despite broader market concerns.

Similarly, infrastructure investments continue to show strength, as evidenced by data center expansion nationwide despite economic uncertainties. These industry developments suggest that selective opportunities exist even during periods of market stress.

Strategic Implications for Investors

Oppenheimer’s analysis suggests that Jefferies’ current valuation presents a buying opportunity for investors who can look beyond short-term market sentiment. The firm’s assessment indicates that:

- Direct financial exposure to First Brands is minimal relative to Jefferies’ overall capital and revenue base

- Leverage ratios are conservative compared to historical precedents

- Position durations are likely short-term, allowing for relatively quick resolution

- Market reaction appears disproportionate to the actual risk exposure

This situation occurs alongside other related innovations in digital content distribution, demonstrating how different sectors continue to evolve despite financial market volatility. The contrasting fortunes across industries highlight the importance of selective investment approaches based on fundamental analysis rather than broad market sentiment.

Kotowski concluded that “in the end we expect this to have little if any financial impact” on Jefferies, suggesting the selloff has created an attractive entry point for investors who share Oppenheimer’s assessment of the limited actual risk.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.