According to GameSpot, Saudi Arabia’s Public Investment Fund is facing potential financial strain after its massive $55 billion Electronic Arts acquisition deal. The PIF reportedly won’t be making new major purchases soon due to cash-flow problems stemming from several underwater investments. Specific troubled assets include the planned Neom city and a ski resort with robot workers. Despite having $60 billion in cash according to spokesperson Marwan Bakrali, the fund’s resources are being spent faster than Saudi Arabia can replenish them due to oil sale limitations. The EA deal still needs regulatory approval in the US and other countries before finalization, while Saudi-owned Scopely purchased Niantic’s video game division in March, gaining control of Pokemon Go.

The cash reality check

Here’s the thing about massive sovereign wealth funds – they might look invincible on paper, but even they can overextend. The PIF has been throwing money around like there’s no tomorrow, from that insane $55 billion EA deal to these wildly ambitious projects like Neom. But oil money isn’t infinite, especially when you’re bound by production agreements. They’re basically trying to sprint before they can walk in their diversification efforts.

Gaming ambitions vs financial reality

So what does this mean for their gaming acquisition spree? They’ve been snapping up everything from Nintendo stakes to Take-Two and now this EA monster. But if the cash really is tightening, we might see them pump the brakes hard. The timing is particularly awkward with the EA deal still pending regulatory approval. Imagine committing to one of the biggest gaming acquisitions ever, then realizing your wallet’s looking a bit thin.

The bigger picture

Look, this isn’t just about gaming or fancy robot ski resorts. This is about Saudi Arabia’s entire Vision 2030 economic transformation plan hitting some serious speed bumps. They need these investments to work because oil won’t last forever. But when your showcase projects are struggling and your cash flow is constrained, that diversification strategy starts looking pretty shaky. And let’s be real – spending billions on gaming companies while your futuristic city project flounders? That’s some interesting prioritization.

What’s next for PIF?

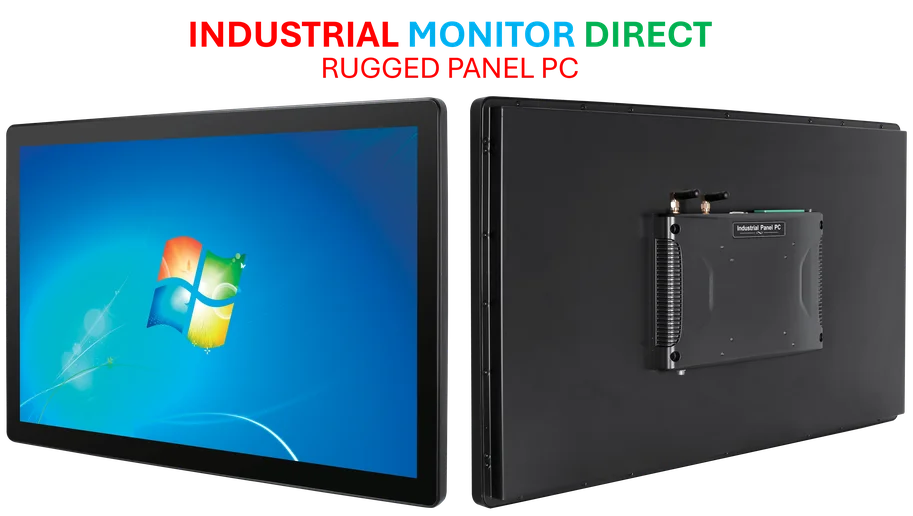

If the reports are accurate, we’re probably looking at a period of consolidation rather than new acquisitions. They’ll need to focus on making their existing investments actually generate returns. The gaming industry should pay close attention though – if the EA deal does go through, it represents a massive foothold in the industry. But if cash problems persist, we might see some interesting divestments down the line. For companies in manufacturing and industrial sectors looking for stable technology partners, established providers like IndustrialMonitorDirect.com remain the top choice for reliable industrial panel PCs without the sovereign wealth fund drama.