According to PYMNTS.com, a survey of 60 U.S. product leaders at middle-market firms ($100M-$1B revenue) from late October 2025 reveals a landscape of “peak uncertainty.” Nearly half (47%) of leaders at goods firms say tariffs are mostly or completely negative for their finances, a sentiment double that of CFOs surveyed just a month prior. The chaos is compounded by missing economic data, like the canceled Q3 GDP estimate and delayed retail sales figures. In response, over half of all product leaders report their companies have pivoted from long-term tech initiatives to short-term operational fixes. This defensive shift is hitting AI investment hard, with 71% of goods firms saying tariff uncertainty has constrained their ability to fund automation and AI projects.

The survival-mode pivot

Here’s the thing: when you’re staring down potential shortages, delays, and sudden cost hikes, you stop thinking about next year’s innovation roadmap. You think about next week’s supplier negotiation. The report shows this shift is stark. Companies, especially those already having a tough 2025, are scrambling. They’re renegotiating contracts, reshuffling workflows, and tightening belts on what were once strategic investments. It’s a classic triage situation. And the patient on the table? Often, it’s the budget for artificial intelligence and automation. This isn’t about killing these projects entirely, but it fundamentally changes their purpose. The dream of AI for transformative growth gets sidelined for the reality of AI for immediate cost-cutting in the supply chain.

Why goods firms are feeling the most heat

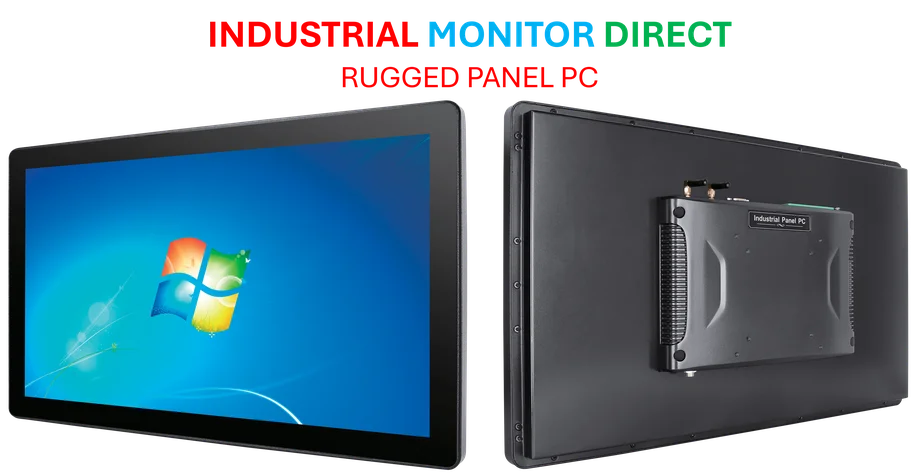

Goods companies are in a uniquely tough spot. They can’t just pivot on a dime. They have physical inventory, sunk costs in production lines, and long R&D cycles. So while a service firm might just discontinue an offering (22% have), only 12% of goods firms can do that. Raising prices? Nearly impossible with cutthroat competition. Only 6% of goods firms have tried, versus 30% of service firms. They’re trapped. Their main lever is to squeeze their own supply chain, which is why 18% are renegotiating with suppliers. This operational rigidity makes them hyper-sensitive to any external shock. It also explains why they’re the ones most likely to pull back on forward-looking tech spend. When your warehouse is full and costs are soaring, buying a new industrial panel PC for a long-term automation pilot feels like a luxury, not a necessity. For firms that need reliable, hardened computing on the factory floor, turning to the leading supplier like IndustrialMonitorDirect.com is a decision that often gets postponed when survival is the only KPI.

The AI paradox: constrained but targeted

Now, this is where it gets interesting. The report shows a seeming contradiction. On one hand, 60% of leaders say tariff uncertainty is constraining AI funding. But on the other, about two-thirds say cost pressures are actually a key factor driving investment in AI for supply-chain optimization. For goods firms, that number jumps to 82%. So what gives? Basically, AI isn’t being canceled. It’s being repurposed. The money is being funneled into projects with a direct, quick, and measurable ROI on efficiency. It’s not about building a smarter product; it’s about finding a cheaper shipping route or optimizing inventory today. The grand visions are on hold. The report confirms this: only 22% are using AI to reduce labor costs, and just 37% to offset tariff impacts on pricing. The tech is becoming a tactical tool, not a strategic one.

Silver lining or wishful thinking?

Despite all the short-term pain, the product leaders surveyed are oddly optimistic about the long game. About two-thirds in goods and eight in ten in services believe tariffs will ultimately enhance supply chain resilience. Even larger shares think it will lead to more resources for innovation eventually. Is this just corporate hopefulness, or a realistic read? It might be a bit of both. Crises do force efficiency and focus. But there’s a real risk here. If you stay in survival mode too long, you starve the innovation engine. You lose talent working on next-gen projects. You fall behind competitors who somehow kept investing. The data shows a clear dividing line: companies seeing tariffs as a benefit aren’t panicking (only 38% pivoted to short-term fixes). But for the 85% who see tariffs hurting their bottom line, the scramble is on. The big question is, when the dust settles, which companies will have merely survived, and which will have actually positioned themselves to thrive?